Sign up for our weekly newsletter and get updates on MEF events and activities. We won’t share your email with anyone and you can opt out at anytime. Details of our privacy policy can be found here.

Latest News

MEF BUSINESS NEWS FRIDAY 17 OCT 2025 The International Monetary Fund is warning that renewed tensions between the US and China pose significant risks to global growth. After months of calm, Washington has expanded tech restrictions and proposed tariffs on Chinese ships — moves Beijing met with new export curbs on rare earths. The IMF says if these trade frictions deepen, global growth could shrink by 0.3 percentage points, hitting Asia hardest. The region’s economy is already expected to slow from 4.6% last year to 4.1% in 2026, even as strong exports and tech demand cushion the blow. A sharper split in global supply chains could ripple across everything from semiconductors to smartphones — testing the resilience of the world’s mobile economy. ———— Meanwhile, the Trump administration is set to hand US automakers a major break, with the Commerce Department expected to extend for five years an arrangement that lets carmakers cut what they pay on imported auto parts. The move — likely to be announced Friday — follows months of lobbying from Ford, GM, and Stellantis, who’ve struggled under Trump’s record-high tariffs on vehicles, steel, and aluminum. The relief, originally due to expire after two years, comes as the administration finalizes new tariffs on imported trucks. Automakers argue the change helps them stay competitive with foreign rivals like Toyota, which benefit from cheaper labor and lower trade barriers under the US-Japan deal. GM stock jumped nearly 4% on the news, while Ford and Stellantis also gained. For Detroit, it’s a rare win — and proof that even in Trump’s tariff world, persistence pays off. ——————— The European Central Bank says interest rates are “in a good place,” but behind that calm front, opinions are splitting. President Christine Lagarde told the IMF meetings in Washington the ECB is unlikely to cut rates this month — they’ve held steady at 2% since June. Still, some policymakers see inflation cooling and want cuts soon, while others fear price pressures could rebound. For now, the ECB says it’ll stay “data dependent,” adjusting policy meeting by meeting. That means Europe’s monetary GPS is set to cautious mode — steady hands on the wheel, eyes on every new signal. ——————- The EU has agreed on a €1.5 billion ($1.8 billion) defense plan aimed at strengthening Europe’s security and cutting reliance on US-made weapons. The deal, reached under Denmark’s EU presidency, will fund projects through 2027, with about 20% set aside for cooperation with Ukraine. It also caps non-European components at 35% of project costs — a compromise after months of debate led by France over “buy European” rules. The plan, part of a wider €131 billion defense and space budget proposed for 2028–2034, is designed to boost Europe’s fragmented defense industry and speed up procurement across the bloc. —————————- Three alleged cases of loan fraud have rattled US regional lenders, raising fears of deeper cracks in bank balance sheets. Zions Bancorp and Western Alliance both disclosed losses tied to investment funds linked to Andrew Stupin and Gerald Marcil — who deny wrongdoing — after loans meant for buying distressed mortgages allegedly went missing or were shifted to other entities. Zions’ California Bank & Trust wrote off $50 million, while Western Alliance also took losses. The fallout was swift: shares of 74 major US banks collectively lost over $100 billion in market value on Thursday. Analysts at JPMorgan said the rash of recent credit “one-offs” — from subprime lender Tricolor’s collapse to First Brands’ $10 billion default — suggests investors are getting jumpy. JPMorgan CEO Jamie Dimon warned earlier in the week that “when you see one cockroach, there are probably more.” Big banks can absorb the hits, but regional lenders — still recovering from the 2023 turmoil — are feeling the strain. For now, the industry’s bad-loan provisions suggest most see the damage as containable, but confidence is clearly under review. ————————— Spain’s BBVA says it’s moving on after its $19 billion bid for rival Banco Sabadell collapsed — and Chairman Carlos Torres insists he’s not going anywhere. Torres told Bloomberg TV he’ll stay on “as long as shareholders want,” after three-quarters of Sabadell investors rejected the offer, far below the 30 percent threshold needed to proceed. The failed merger ends 18 months of pursuit and frees BBVA to resume big shareholder payouts, including a new buyback once regulators approve it. For Spain’s banking sector — and its increasingly digital customer base — the setback delays further consolidation, but BBVA says the future is about boosting investor returns, not chasing deals. ——————— Ferrari has quietly throttled back the number of cars it sends to the UK, after new tax rules drove many of its wealthiest buyers to sunnier, lower-tax shores. The end of the non-dom regime and higher levies on the rich rattled demand and sent second-hand Ferrari prices sliding, so the company trimmed supply to stabilise values. Chief executive Benedetto Vigna says it’s not just about taxes — right-hand-drive cars can’t easily be resold elsewhere, adding to the dip. The move shows how fiscal policy now hits even the supercar ecosystem — where exclusivity is the engine of profit. In other words, fewer Ferraris in Mayfair, and maybe fewer revs outside Harrods. —— —— MEF MOBILE NEWS 17 0CT 2025 Samsung is unveiling its first trifold smartphone at the Asia-Pacific Economic Cooperation summit in South Korea later this month, a move aimed at reinforcing its position in the foldable segment. The device features two hinges, letting it function as a standard smartphone or a larger tablet when fully opened, showcasing innovation in mobile form factors. The APEC summit offers a global stage, though attendees will likely only see it under glass ahead of a wider commercial launch later this year. Samsung pioneered foldables in 2019, and competition is heating up with Huawei already offering trifolds and Apple preparing its first folding iPhone. The trifold could reshape how apps and content are consumed across the mobile ecosystem. Foldable tech, bigger screens, new experiences. ——————————— Turkey’s 5G spectrum auction has raised nearly $3 billion, surpassing government expectations and setting the stage for nationwide services next April. Turkcell led spending with over $1.2 billion, followed closely by Turk Telekom and Vodafone, acquiring blocks in both 700MHz and 3.5GHz bands. Eleven frequency packages totaling 400MHz were sold, including extended rights for existing next-gen bands through 2042. Analysts say the auction not only accelerates Turkey’s mobile ecosystem and 5G rollout but also signals robust telecom investment in the region, with widespread impact on mobile services, IoT, and enterprise connectivity. A major boost for Turkey’s digital future. ———————— Ericsson and HPE are launching a joint 5G validation lab in Sweden to test a cloud-native, AI-enabled dual-mode 5G core on multi-vendor infrastructure, aimed at helping telecom operators tackle network complexity and scale efficiently. The lab, operational by year-end, combines Ericsson’s dual-mode 5G core with HPE ProLiant servers, Juniper networking, and Red Hat OpenShift for cloud-native deployment. A step forward for Sweden’s mobile ecosystem and global 5G innovation. ———————— A New Jersey teenager is suing Telegram and the developers of the AI tool ClothOff after a classmate allegedly used it to create fake-nude images of her, raising alarm over AI-generated sexual content involving minors. The lawsuit, backed by Yale Law School faculty and students, targets the British Virgin Islands-based company and the claud based messaging app — Telegram, precisely — where the software could be accessed. Experts say AI deepfakes like these are increasingly classified as child sexual abuse material, and federal law now requires platforms to remove such content within 48 hours. Victims face ongoing fear and reputational harm, while lawmakers and tech platforms scramble to enforce accountability. A landmark case for digital safety. ———————- ———————— Italian news publishers are raising alarms over Google’s AI Overviews, claiming the tool is slashing traffic to original sites and threatening media diversity. The federation of newspaper publishers, FIEG, has lodged a formal complaint with the national communications regulator, Agcom, arguing AI-generated summaries cut advertising revenue and could undermine journalism’s economic sustainability. Research from the UK and US suggests users rarely click links under AI summaries, with traffic drops of up to 80%. Google disputes these findings. As Italy rolls out strict AI regulations protecting minors and limiting harmful uses, publishers warn the mobile ecosystem—where news consumption increasingly happens—is at stake. Digital audiences are reading less, and revenue models are feeling the pinch. ——————- Spotify is joining forces with Sony, Universal, and Warner to develop AI tools that respect artists’ rights and copyright. The streaming giant, with 276 million paying subscribers, says the new products will allow artists to opt in and ensure proper compensation and credit. The company has also launched a generative AI research lab to explore “breakthrough experiences” for fans and creators, while partnering with Merlin and Believe to include independent labels. The move comes amid lawsuits against AI music startups over copyright infringement, with the majors emphasizing that artist consent and licensing will be central to Spotify’s approach. —— —— MEF TECH NEWS 17 OCT 2025 This just in: Micron is exiting China’s data center market after Beijing’s 2023 ban on its server chips failed to lift, though it will continue supplying chips to select customers like Lenovo with operations outside China, as well as auto and mobile phone companies. The U.S. chipmaker, which generated $3.4 billion last year from mainland China, became the first U.S. semiconductor target amid escalating tech tensions between Washington and Beijing. The move underscores the growing impact of geopolitical friction on the global semiconductor supply chain and highlights the risks for companies navigating the mobile and cloud ecosystem in China. ————————— Apple is preparing to launch its first touch-screen MacBook Pro in late 2026 or early 2027, reversing decades of resistance to touch laptops. The new 14- and 16-inch models will use OLED displays, thinner and lighter frames, and Apple’s M6 chips, while retaining keyboards and trackpads to give users flexibility. The move comes as touch-screen PCs are standard across the industry and follows Apple’s experiments with the Touch Bar and iPad Magic Keyboard. Higher-end pricing is expected, creating an opportunity to push users upmarket and unify the Mac and iPad ecosystems. ————————- Investors are rushing into artificial intelligence, but the Financial Times warns it might be a bubble. Venture capitalists have poured more than 160 billion dollars into AI start-ups this year, pushing valuations of firms like OpenAI and Anthropic toward nearly one trillion dollars. The frenzy is driven by hopes that AI will unlock multitrillion-dollar markets, even though most companies are still operating at a loss. A Bank of America survey shows that over half of fund managers believe AI stocks are in a bubble, while experts from the Bank of England caution that investor excitement could trigger a market correction. Industry leaders are divided. Amazon’s Jeff Bezos says the hype fuels both good and bad investments, while OpenAI’s Sam Altman warns some investors could lose massive sums, even as others profit. Economists note the boom isn’t debt-fueled, so a correction would mostly affect shareholders. The Financial Times suggests only a handful of AI companies may ultimately survive — and the rush of money and hype could be creating a bubble in the sector. —————————— Meta is finalizing a nearly $30 billion private capital deal with Blue Owl Capital to co-own its Hyperion data center in rural Louisiana, with Meta keeping just 20%. The financing, structured through a special purpose vehicle, shields Meta’s balance sheet while giving investors access to a massive, asset-backed project. Hyperion spans 4 million square feet and, at full capacity, could draw 5 gigawatts of power — enough for roughly 4 million US homes. Completion is set for 2029, positioning the center to support Meta’s AI and cloud operations and setting a model for hyperscalers raising capital without risking credit ratings. ————————— Nigeria is seeing a nearly $1 billion surge in data center investment as AI adoption and mobile-first habits among its 240 million-strong, young population drive demand for local computing power. Global and regional players like Equinix, Microsoft, MTN, and Rack Centre are building next-generation facilities capable of handling AI workloads, supporting cloud and hybrid services, and linking to global networks. The country’s cloud market is projected to grow from $1 billion this year to $3.3 billion by 2030, while hubs like Lagos’ Itana Digital Zone aim to foster African AI and lower costs for startups. Power reliability remains a hurdle, pushing operators toward gas and renewable solutions. Local AI, global scale. ——————— Nintendo is ramping up production of the Switch 2, aiming for 25 million units by March 2026, betting on strong demand to drive record first-year sales. The move comes after early success with the console, with analysts expecting roughly 20 million units sold this fiscal year. The Japanese company has doubled marketing spend since its June launch and ensured compatibility with the full Switch game library, giving the device a ready-made software ecosystem. The strategy aims to avoid supply pitfalls that hampered rivals like Sony and Microsoft, keeping Nintendo ahead in mobile and hybrid gaming. Strong demand, deep ecosystem, big bets. ——

MEF BUSINESS NEWS FRIDAY 17 OCT 2025 The International Monetary Fund is warning that renewed tensions between the US and China pose significant risks to global growth. After months of calm, Washington has expanded tech restrictions and proposed tariffs on Chinese ships — moves Beijing met with new export curbs on rare earths. The IMF says if these trade frictions deepen, global growth could shrink by 0.3 percentage points, hitting Asia hardest. The region’s economy is already expected to slow from 4.6% last year to 4.1% in 2026, even as strong exports and tech demand cushion the blow. A sharper split in global supply chains could ripple across everything from semiconductors to smartphones — testing the resilience of the world’s mobile economy. ———— Meanwhile, the Trump administration is set to hand US automakers a major break, with the Commerce Department expected to extend for five years an arrangement that lets carmakers cut what they pay on imported auto parts. The move — likely to be announced Friday — follows months of lobbying from Ford, GM, and Stellantis, who’ve struggled under Trump’s record-high tariffs on vehicles, steel, and aluminum. The relief, originally due to expire after two years, comes as the administration finalizes new tariffs on imported trucks. Automakers argue the change helps them stay competitive with foreign rivals like Toyota, which benefit from cheaper labor and lower trade barriers under the US-Japan deal. GM stock jumped nearly 4% on the news, while Ford and Stellantis also gained. For Detroit, it’s a rare win — and proof that even in Trump’s tariff world, persistence pays off. ——————— The European Central Bank says interest rates are “in a good place,” but behind that calm front, opinions are splitting. President Christine Lagarde told the IMF meetings in Washington the ECB is unlikely to cut rates this month — they’ve held steady at 2% since June. Still, some policymakers see inflation cooling and want cuts soon, while others fear price pressures could rebound. For now, the ECB says it’ll stay “data dependent,” adjusting policy meeting by meeting. That means Europe’s monetary GPS is set to cautious mode — steady hands on the wheel, eyes on every new signal. ——————- The EU has agreed on a €1.5 billion ($1.8 billion) defense plan aimed at strengthening Europe’s security and cutting reliance on US-made weapons. The deal, reached under Denmark’s EU presidency, will fund projects through 2027, with about 20% set aside for cooperation with Ukraine. It also caps non-European components at 35% of project costs — a compromise after months of debate led by France over “buy European” rules. The plan, part of a wider €131 billion defense and space budget proposed for 2028–2034, is designed to boost Europe’s fragmented defense industry and speed up procurement across the bloc. —————————- Three alleged cases of loan fraud have rattled US regional lenders, raising fears of deeper cracks in bank balance sheets. Zions Bancorp and Western Alliance both disclosed losses tied to investment funds linked to Andrew Stupin and Gerald Marcil — who deny wrongdoing — after loans meant for buying distressed mortgages allegedly went missing or were shifted to other entities. Zions’ California Bank & Trust wrote off $50 million, while Western Alliance also took losses. The fallout was swift: shares of 74 major US banks collectively lost over $100 billion in market value on Thursday. Analysts at JPMorgan said the rash of recent credit “one-offs” — from subprime lender Tricolor’s collapse to First Brands’ $10 billion default — suggests investors are getting jumpy. JPMorgan CEO Jamie Dimon warned earlier in the week that “when you see one cockroach, there are probably more.” Big banks can absorb the hits, but regional lenders — still recovering from the 2023 turmoil — are feeling the strain. For now, the industry’s bad-loan provisions suggest most see the damage as containable, but confidence is clearly under review. ————————— Spain’s BBVA says it’s moving on after its $19 billion bid for rival Banco Sabadell collapsed — and Chairman Carlos Torres insists he’s not going anywhere. Torres told Bloomberg TV he’ll stay on “as long as shareholders want,” after three-quarters of Sabadell investors rejected the offer, far below the 30 percent threshold needed to proceed. The failed merger ends 18 months of pursuit and frees BBVA to resume big shareholder payouts, including a new buyback once regulators approve it. For Spain’s banking sector — and its increasingly digital customer base — the setback delays further consolidation, but BBVA says the future is about boosting investor returns, not chasing deals. ——————— Ferrari has quietly throttled back the number of cars it sends to the UK, after new tax rules drove many of its wealthiest buyers to sunnier, lower-tax shores. The end of the non-dom regime and higher levies on the rich rattled demand and sent second-hand Ferrari prices sliding, so the company trimmed supply to stabilise values. Chief executive Benedetto Vigna says it’s not just about taxes — right-hand-drive cars can’t easily be resold elsewhere, adding to the dip. The move shows how fiscal policy now hits even the supercar ecosystem — where exclusivity is the engine of profit. In other words, fewer Ferraris in Mayfair, and maybe fewer revs outside Harrods. —— —— MEF MOBILE NEWS 17 0CT 2025 Samsung is unveiling its first trifold smartphone at the Asia-Pacific Economic Cooperation summit in South Korea later this month, a move aimed at reinforcing its position in the foldable segment. The device features two hinges, letting it function as a standard smartphone or a larger tablet when fully opened, showcasing innovation in mobile form factors. The APEC summit offers a global stage, though attendees will likely only see it under glass ahead of a wider commercial launch later this year. Samsung pioneered foldables in 2019, and competition is heating up with Huawei already offering trifolds and Apple preparing its first folding iPhone. The trifold could reshape how apps and content are consumed across the mobile ecosystem. Foldable tech, bigger screens, new experiences. ——————————— Turkey’s 5G spectrum auction has raised nearly $3 billion, surpassing government expectations and setting the stage for nationwide services next April. Turkcell led spending with over $1.2 billion, followed closely by Turk Telekom and Vodafone, acquiring blocks in both 700MHz and 3.5GHz bands. Eleven frequency packages totaling 400MHz were sold, including extended rights for existing next-gen bands through 2042. Analysts say the auction not only accelerates Turkey’s mobile ecosystem and 5G rollout but also signals robust telecom investment in the region, with widespread impact on mobile services, IoT, and enterprise connectivity. A major boost for Turkey’s digital future. ———————— Ericsson and HPE are launching a joint 5G validation lab in Sweden to test a cloud-native, AI-enabled dual-mode 5G core on multi-vendor infrastructure, aimed at helping telecom operators tackle network complexity and scale efficiently. The lab, operational by year-end, combines Ericsson’s dual-mode 5G core with HPE ProLiant servers, Juniper networking, and Red Hat OpenShift for cloud-native deployment. A step forward for Sweden’s mobile ecosystem and global 5G innovation. ———————— A New Jersey teenager is suing Telegram and the developers of the AI tool ClothOff after a classmate allegedly used it to create fake-nude images of her, raising alarm over AI-generated sexual content involving minors. The lawsuit, backed by Yale Law School faculty and students, targets the British Virgin Islands-based company and the claud based messaging app — Telegram, precisely — where the software could be accessed. Experts say AI deepfakes like these are increasingly classified as child sexual abuse material, and federal law now requires platforms to remove such content within 48 hours. Victims face ongoing fear and reputational harm, while lawmakers and tech platforms scramble to enforce accountability. A landmark case for digital safety. ———————- ———————— Italian news publishers are raising alarms over Google’s AI Overviews, claiming the tool is slashing traffic to original sites and threatening media diversity. The federation of newspaper publishers, FIEG, has lodged a formal complaint with the national communications regulator, Agcom, arguing AI-generated summaries cut advertising revenue and could undermine journalism’s economic sustainability. Research from the UK and US suggests users rarely click links under AI summaries, with traffic drops of up to 80%. Google disputes these findings. As Italy rolls out strict AI regulations protecting minors and limiting harmful uses, publishers warn the mobile ecosystem—where news consumption increasingly happens—is at stake. Digital audiences are reading less, and revenue models are feeling the pinch. ——————- Spotify is joining forces with Sony, Universal, and Warner to develop AI tools that respect artists’ rights and copyright. The streaming giant, with 276 million paying subscribers, says the new products will allow artists to opt in and ensure proper compensation and credit. The company has also launched a generative AI research lab to explore “breakthrough experiences” for fans and creators, while partnering with Merlin and Believe to include independent labels. The move comes amid lawsuits against AI music startups over copyright infringement, with the majors emphasizing that artist consent and licensing will be central to Spotify’s approach. —— —— MEF TECH NEWS 17 OCT 2025 This just in: Micron is exiting China’s data center market after Beijing’s 2023 ban on its server chips failed to lift, though it will continue supplying chips to select customers like Lenovo with operations outside China, as well as auto and mobile phone companies. The U.S. chipmaker, which generated $3.4 billion last year from mainland China, became the first U.S. semiconductor target amid escalating tech tensions between Washington and Beijing. The move underscores the growing impact of geopolitical friction on the global semiconductor supply chain and highlights the risks for companies navigating the mobile and cloud ecosystem in China. ————————— Apple is preparing to launch its first touch-screen MacBook Pro in late 2026 or early 2027, reversing decades of resistance to touch laptops. The new 14- and 16-inch models will use OLED displays, thinner and lighter frames, and Apple’s M6 chips, while retaining keyboards and trackpads to give users flexibility. The move comes as touch-screen PCs are standard across the industry and follows Apple’s experiments with the Touch Bar and iPad Magic Keyboard. Higher-end pricing is expected, creating an opportunity to push users upmarket and unify the Mac and iPad ecosystems. ————————- Investors are rushing into artificial intelligence, but the Financial Times warns it might be a bubble. Venture capitalists have poured more than 160 billion dollars into AI start-ups this year, pushing valuations of firms like OpenAI and Anthropic toward nearly one trillion dollars. The frenzy is driven by hopes that AI will unlock multitrillion-dollar markets, even though most companies are still operating at a loss. A Bank of America survey shows that over half of fund managers believe AI stocks are in a bubble, while experts from the Bank of England caution that investor excitement could trigger a market correction. Industry leaders are divided. Amazon’s Jeff Bezos says the hype fuels both good and bad investments, while OpenAI’s Sam Altman warns some investors could lose massive sums, even as others profit. Economists note the boom isn’t debt-fueled, so a correction would mostly affect shareholders. The Financial Times suggests only a handful of AI companies may ultimately survive — and the rush of money and hype could be creating a bubble in the sector. —————————— Meta is finalizing a nearly $30 billion private capital deal with Blue Owl Capital to co-own its Hyperion data center in rural Louisiana, with Meta keeping just 20%. The financing, structured through a special purpose vehicle, shields Meta’s balance sheet while giving investors access to a massive, asset-backed project. Hyperion spans 4 million square feet and, at full capacity, could draw 5 gigawatts of power — enough for roughly 4 million US homes. Completion is set for 2029, positioning the center to support Meta’s AI and cloud operations and setting a model for hyperscalers raising capital without risking credit ratings. ————————— Nigeria is seeing a nearly $1 billion surge in data center investment as AI adoption and mobile-first habits among its 240 million-strong, young population drive demand for local computing power. Global and regional players like Equinix, Microsoft, MTN, and Rack Centre are building next-generation facilities capable of handling AI workloads, supporting cloud and hybrid services, and linking to global networks. The country’s cloud market is projected to grow from $1 billion this year to $3.3 billion by 2030, while hubs like Lagos’ Itana Digital Zone aim to foster African AI and lower costs for startups. Power reliability remains a hurdle, pushing operators toward gas and renewable solutions. Local AI, global scale. ——————— Nintendo is ramping up production of the Switch 2, aiming for 25 million units by March 2026, betting on strong demand to drive record first-year sales. The move comes after early success with the console, with analysts expecting roughly 20 million units sold this fiscal year. The Japanese company has doubled marketing spend since its June launch and ensured compatibility with the full Switch game library, giving the device a ready-made software ecosystem. The strategy aims to avoid supply pitfalls that hampered rivals like Sony and Microsoft, keeping Nintendo ahead in mobile and hybrid gaming. Strong demand, deep ecosystem, big bets. ——

MEFTV Live

Subscribe Now

- MEF Webinars & Workshops

- Podcasts

- Interviews

- Personal Data

- Anti - Fraud

- Connectivity & Wholesale

- 5 Minutes With

- Opinion

MEF’s Nick Millward is joined by Inderpal Singh Mumick, CEO of Dotgo, Abhinav Jha, Head of Business Development at Communications Partnerships at Google, and Sethumadhav Bendi, Wireless Solutions Architect at Verizon Wireless, to explore how the telecom industry is responding to shifting messaging dynamics. The session examines emerging strategies, technologies…

MEF Members and friends came together in Las Vegas ahead of MEF Future of Mobile USA for an unforgettable afternoon of pickleball, laughter, and community spirit at our pre-event charity social. Designed as a lighthearted ice-breaker all for a good cause before the busy week’s schedule, the charity event gave…

MEF was in Las Vegas last week for The Future of Mobile USA 2025 – where we brought together the most influential voices in mobile from across the Americas and beyond to discuss the state of the US ecosystem and its global influence. The event featured a stellar lineup of…

In a recent MEF Webinar, Oksana Mikhnova, Products & Services Team Leader at LANCK Telecom Joined MEF’s Nick Millward to outline the shift reshaping enterprise messaging. Her point was clear: the move away from SMS has already begun, marking a real transformation in enterprise communication. For decades, SMS was unmatched.…

Juniper Research sees rapid growth fueled by enterprise demand, roaming interoperability, and modular network strategies, as industry players pivot to API access, usage-based pricing, and cross-sector integration.

Sinch urges brands to adopt RCS and AI now to boost engagement and stay competitive, highlighting higher click rates, real-time personalization, and the importance of multichannel strategies, transparency, and ESG commitments. “Don’t hesitate — get started.” That’s the message from Sinch to business leaders still weighing the move to Rich…

Vox executives unveil how real-time, on-device AI, semantic traffic analysis, and flexible anti-fraud infrastructure are driving a global shift in telecom security — from monetizing A2P in high-risk markets to preparing for threats like voice cloning and quantum disruption. “When you start stopping the fraudsters, they adapt — so you…

Listen to the latest Perspectives in Mobile podcast as MEF’s Riccardo Amati speaks with CCS Insight’s Chief Analyst Ben Wood about security, trust, and the impact of emerging technologies on encryption standards. A recent mistake where a journalist was accidentally added to a private Signal chat has raised fresh concerns…

Why has Content for Mobile teamed up with mega brands such as NBA and PFL to create mobile VAS products? And how can MNOs use DCB to monetise them? In this exclusive MEF TV interview, Gaby Bosch, CEO of CFM, explains… Mobile VAS started the mobile content revolution 25 years…

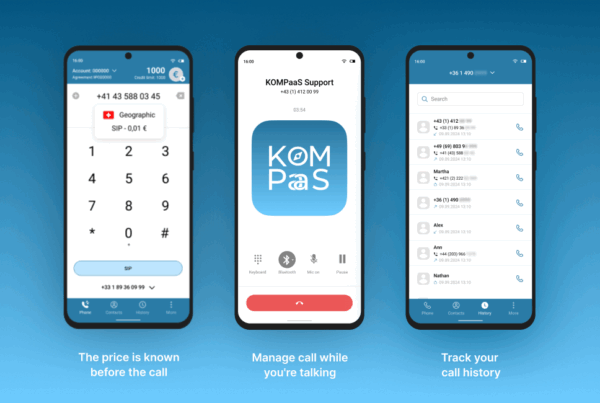

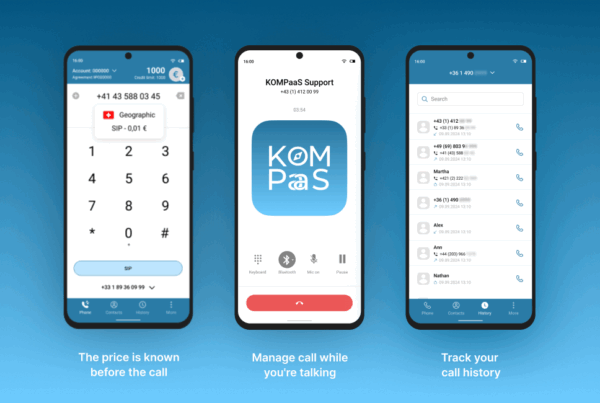

In our 5 minutes with profiles, MEF members talk about their business, their aspirations for the future and the wider mobile industry. This week Business Development & Marketing Director Liubov Martynova and Founder Alexander Melnikov introduce telephony services and cloud solutions provider, KOMPaaS.tech. KOMPaaS.tech provides telephony services and cloud solutions…

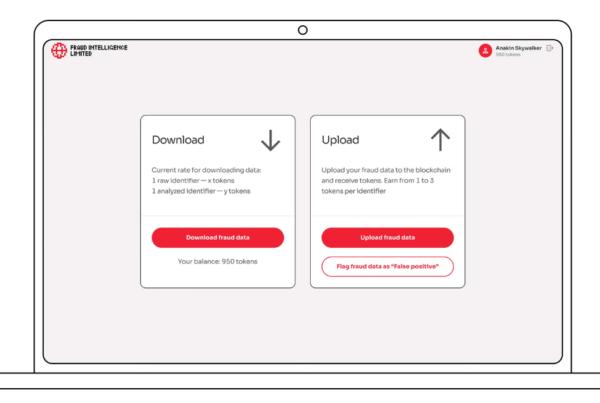

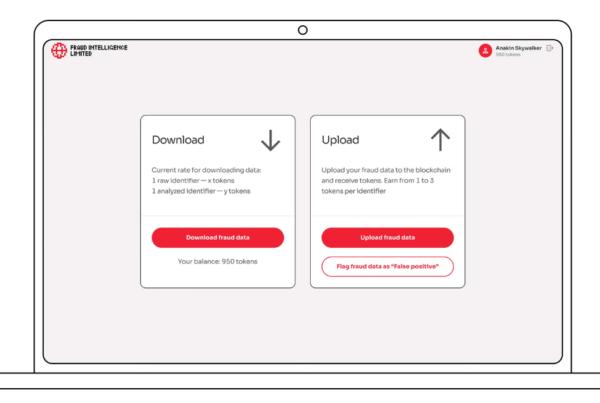

In our 5 minutes with profiles, MEF members talk about their business, their aspirations for the future and the wider mobile industry. This week, Fraud Intelligence Limited, Board members: Andrew Wong and Anthony Sani, introduce the Fraud Intelligence Blockchain Platform. Fraud Intelligence Limited operates the Fraud Intelligence Blockchain (FIB), which…

In our 5 minutes with profiles, MEF members talk about their business, their aspirations for the future and the wider mobile industry. This week, Co-Founder Vincentas Grinius introduces all-in-one Internet Protocol platform IPXO. We operate the world’s largest fully automated platform for IPv4 (and IPv6) address leasing and monetization, connecting…

New stats from the FIDO Alliance reveal the passkey to be a fast-growing and safe alternative to the password. Tim Green, programme director for MEF ID and Data, took a look behind the data. Just days ago, the FIDO Alliance confirmed that more than 3 billion passkeys are currently securing consumer…

WhatsApp is preparing a major update that could reshape how people and businesses connect on the platform. Early developments suggest changes to identity, privacy, and brand presentation, with implications across the wider messaging ecosystem. MEF CEO Dario Betti explains why the development deserves attention and how it may influence future…

A new proof of concept wants to remove the OTP, the password and even voice detection from the call centre experience. In its place? A simple click inside a wallet app. Tim Green, MEF's ID and Data programme director, explains.

Gavin Patterson, MEF’s Director of Data, explores the rapid evolution of mobile connectivity as 5G adoption accelerates worldwide. From high-growth Asian markets to global trends in device uptake and network expansion, the rollout of next-generation networks is reshaping the mobile landscape. While opportunities abound, economic, technical, and regulatory challenges continue…

The UAE’s recent regulatory move to phase out SMS and email-based One-Time Passwords (OTPs) marks a turning point in global digital security. This decisive shift signals the beginning of a new era for authentication, trust, and mobile ecosystem innovation. MEF Director of Programmes, Nicholas Rossman highlights what this means for…

Stefano Nicoletti, Head of MEF’s Sender ID Registry in the UK, explains the latest shift in the UK messaging market, as Ofcom revises its approach to A2P SMS regulation. Following new industry commitments and evolving market dynamics, the regulator is taking a lighter touch. This development highlights changes in pricing,…

Mobile fraud continues to challenge networks worldwide, highlighting the need for stronger cooperation between industry, regulators, and law enforcement. As threats grow increasingly sophisticated and borderless, coordinated solutions are becoming essential. Emerging initiatives show how collaboration and harmonisation can strengthen defences. MEF Director of Programmes, Nicholas Rossman, explains how these…

The Mobile Ecosystem Forum (MEF) has issued a detailed analysis of the recent Ofcom consultation, "Combatting Mobile Messaging Scams," which proposes mandatory new rules and guidance for Mobile Network Operators (MNOs) and business messaging aggregators operating in the UK. The consultation, published on 29 October 2025, aims to protect UK…

More non-Europeans than Europeans have a positive view of businesses using their mobile phone numbers to verify their identities. Over half of non-European respondents to MEF’s 11th Annual Consumer Survey, or 51%, said they viewed mobile number intelligence as a positive development, compared to 42% of Europeans. This is likely…

MEF’s Riccardo Amati highlights Telefónica’s latest move marks a turning point for one of Europe’s telecom giants as it refocuses on fundamentals, tightens its structure and prioritises infrastructure strength. The company’s shift hints at a broader rethink across the mobile ecosystem about leadership, partnership and what real execution will mean…

MEF’s Nick Millward is joined by Inderpal Singh Mumick, CEO of Dotgo, Abhinav Jha, Head of Business Development at Communications Partnerships at Google, and Sethumadhav Bendi, Wireless Solutions Architect at Verizon Wireless, to explore how the telecom industry is responding to shifting messaging dynamics. The session examines emerging strategies, technologies…

In our 5 minutes with profiles, MEF members talk about their business, their aspirations for the future and the wider mobile industry. This week Business Development & Marketing Director Liubov Martynova and Founder Alexander Melnikov introduce telephony services and cloud solutions provider, KOMPaaS.tech. KOMPaaS.tech provides telephony services and cloud solutions…

In our 5 minutes with profiles, MEF members talk about their business, their aspirations for the future and the wider mobile industry. This week, Fraud Intelligence Limited, Board members: Andrew Wong and Anthony Sani, introduce the Fraud Intelligence Blockchain Platform. Fraud Intelligence Limited operates the Fraud Intelligence Blockchain (FIB), which…

In our 5 minutes with profiles, MEF members talk about their business, their aspirations for the future and the wider mobile industry. This week, Co-Founder Vincentas Grinius introduces all-in-one Internet Protocol platform IPXO. We operate the world’s largest fully automated platform for IPv4 (and IPv6) address leasing and monetization, connecting…

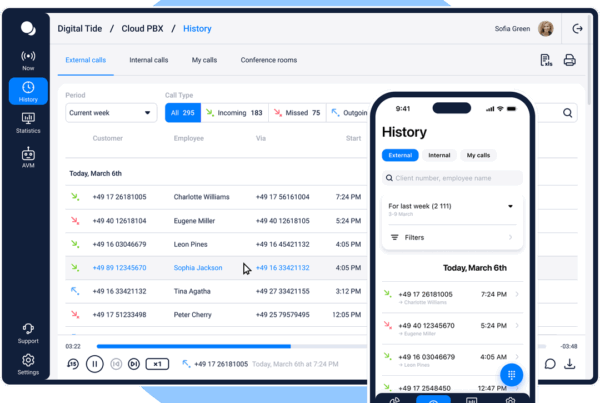

In our 5 minutes with profiles, MEF members talk about their business, their aspirations for the future and the wider mobile industry. This week, Marketing Team Lead Anna Gonzales introduces pioneering communications software provider Digital Tide. Digital Tide provides advanced communications software for telecom operators. We specialize in white-label voice…

The ACC 2025 Team shares insights from the Asian Carriers Conference, where industry leaders came together to explore the evolving landscape of telecommunications and digital innovation. Over five days, delegates exchanged ideas, discovered emerging trends, and connected with peers, offering a glimpse into the opportunities, challenges, and future possibilities that…

Andrew Parkin White, Co Founder of TecFutures, shares insights from the firm’s latest Enterprise IoT Growth Roadmap report, exploring how communication service providers can navigate a rapidly evolving market. The study highlights shifting enterprise needs, emerging technologies, and new commercial strategies that will shape where and how CSPs capture sustainable…

Rahima Ouadfel, Vice President of Growth of Smadex, explains how programmatic advertising is shaping user acquisition and media transparency at the Global Carrier Billing & Mobile Payments Summit in Amsterdam. The event gathered operators, merchants, aggregators, and ad platforms to explore the future of mobile payments, with Smadex highlighting data-driven…

The global MVNO market is projected to grow from $85.24 billion in 2023 to $173.10 billion by 2032. To stay competitive, MVNOs are boosting revenue through streamlined onboarding, proactive communication, self-service tools, personalization, and continuous feedback. Anna Gonzales, Marketing Team Lead of Digital Tide, explains their strategy. Five key best…

MEFTV Interview: Cellusys, Charles Bernard

MEF Members – more interviews and videos MEFTV Spoke with panelists and experts at IOT Solutions World Congress to explore the current state of the IoT ecosystem, and how cellular IoT is developing and evolving. Members – Log in now >

MEFNovember 3, 2019

Global Mobile News round-up, November 1st

Find out the week’s top mobile stories from around the world. This week.. China rolls out ‘one of the world’s largest’ 5G networks, smartphone market shows signs of life, Australia says Google misled consumers over location data and much more. China’s mobile operators have made 5G services available to consumers,…

MEFNovember 1, 2019

10 things you need to know about… Direct Carrier Billing

Diego Conforti, CCO of Digital Virgo, shares 10 tips and facts about the opportunity presented by Direct Carrier Billing. Digital Virgo is unique in the telecom payment ecosystem since the Group is one of the rare players to have a 360° worldwide experience on payment, monetization and marketing; the three…

MEFOctober 31, 2019

Final shortlist for the 5th AppsAfrica Innovation Awards Announced

The final shortlist for the 5th AppsAfrica.com Innovation Awards have been announced. The Awards celebrate the best in mobile and tech from across Africa with winners announced in Cape Town on November 11th, 2019. The annual Awards attracted over 400 submissions from 52 countries, with solutions launched in African markets…

MEFOctober 30, 2019

MEF Member News Round-up, October 28th

Get the latest announcements from MEF Members across the mobile ecosystem globally in this weekly review of member news… IMImobile, a global communications software provider has partnered with Mavenir, a US-based network software provider, as part of its RCS Business Messaging Ecosystem to accelerate market adoption of this richer, more…

MEFOctober 28, 2019

Global Mobile News Round-up, October 25th

This week.. Facebook Dig In for Long Haul on Cryptocurrency, AT&T, Verizon, Sprint, and T-Mobile agree to replace SMS with a new RCS standard, Apple Pay Overtakes Starbucks as top payment app and much more. Facebook CEO Mark Zuckerberg vowed to move ahead with plans to create a cryptocurrency-based payments…

MEFOctober 25, 2019

Understanding the value of RCS Business Messaging

MEF Member GMS’ Chief Product Officer Virginie Debris discusses what they see as the real value of RCS business messaging (RBM), for both operators and enterprises, and what this means for the future of the channel and of the telecoms ecosystem. When it comes to talking about RCS, the same…

MEFOctober 23, 2019

MEF Member news round-up, October 21st

Get the latest announcements from MEF Members across the mobile ecosystem globally in this weekly review of member news… Direct carrier billing company Boku has entered into a partnership with Indonesia-based GoPay, the digital payments platform of Gojek. Through the partnership, Boku’s merchant customers in Indonesia will be able to…

MEFOctober 21, 2019

Global Mobile News Round-up, October 18th

This week.. Google Pixel 4’s face unlock security concerns, Kaspersky honeypots find 105 million attacks on IoT devices, Snapchat goes after retailers and brands with new Dynamic Ads and much more. Don’t let someone get a hold of your Google Pixel 4. It has been confirmed that the Face Unlock…

MEFOctober 18, 2019