In these unprecedented times MEF is working to gather and share opinions and reactions from across the Mobile ecosystem to the current health crisis and discover how the industry is harnessing innovative mobile technologies to help aid the fight against the global pandemic.

Industry views: Latest MEF Member Covid-19 responses

As the global COVID-19 pandemic continues, with countries at differing stages of response and recovery, we share further learnings and actions from MEF members working to support businesses and consumers as well as innovative solutions for fighting back against the virus.

Rajdip Gupta, MD & Group CEO, Routemobile

As the outbreak of COVID-19 continues to escalate, there is uncertainty in every industry and will also have long-lasting repercussions. The crisis reinforces the enterprise for the adoption of omnichannel communications. With increasing consumer uncertainty, we have seen a surge in the application-to-person (A2P) and person-to-person (P2P) messaging.

Many brands are trying to ensure business continuity and ensure seamless communications with their customers by sending notifications, updates, critical information, alerts etc. We can see many SMEs are early adopters of WhatsApp Business Solution to communicate with their users and the trend will follow with RCS adoption as well. Globally the government bodies have been communicating through Apps, A2P messaging and WhatsApp Business Solution for sending emergency notifications. The Healthcare sector is the frontline of using cloud communication channels, the modern technology of telemedicine has enabled doctors to consult patients using voice and messaging apps.

We estimate an acceleration in cloud communications channels and the imminent restructuring of the global economy. The digital transformation in enterprises will increase more customer engagement and better user experience. All I can say is that the world needs a speedy recovery from this unprecedented disruption and be prepared for the future digital transformation.

Vincent Schaeken, Technical Product Manager, AdaptiveMobile Security

While most of the world comes about in unison to fight any adversary, there is always a small minority that takes it as an opportunity for profiteering. The Covid19 pandemic has been no different. As countries and businesses around the world unite in their approach to keep their citizens and employees safe, criminals are also finding new avenues to exploit the fear and uncertainty surrounding the globe.

With the Telecoms ecosystem being critical to not just communication but numerous other verticals, it is not surprising that a spike in Covid19 related fraudulent activity was also observed across almost all operators. There is prior history here too, other previous ‘news-worthy’ disease outbreaks in the past, such as H1N1/swine flu , MERS and Ebola have also witnessed similar ’spam outbreaks’.

However we are seeing an evolution in the way that Governments, Health Authorities and a broad range of businesses are reaching out to citizens and customers to provide information about the support and assistance programs available, using mobile messaging in ways never previously done to such scale and interaction. This has created an opportunity for scammers to capitalise upon the urgency and importance of these new campaigns and interactions, by emulating them with a range of maliciously crafted attacks that look plausible copies of legitimate traffic.

People are particularly vulnerable at this time and thus more prone to disclosing sensitive information and falling prey to scams and misinformation, so protecting them against these malicious campaigns is even more critical. The messages range from financial grants, updates to untested and potentially dangerous cures which can develop a false sense of security in the society and cause even greater harm. Our COVID-19 SMS Spam Dashboard shows the frequency and geography of some of these attacks in North America and Canada, as well as showing some examples of the types of Spam out there.

AdaptiveMobile Security with its worldwide deployments of Network Protection Platforms protecting over 1/5th of the world’s mobile users are protecting against many of these attacks, and are participating in a range of industry initiatives to ensure that legitimate emergency messages get through, while harmful traffic is controlled.

Robert Rose, Chief Strategy Officer - GMS Worldwide

Like many international messaging companies, GMS has seen a fluctuation in traffic due to the quarantine. Though not all of it negative: we have actually seen international traffic grow in two key categories.

Business support use cases have increased – for example, we have seen an increase in 2FA/OTP messages as the move to remote working has required additional verification of connections to productivity suites.

Specific segments of the entertainment sector have also increased their traffic. Social media brands, in particular, have seen an increase in signups, with a corresponding rise in authentication messages.

Meanwhile, traffic from local/domestic businesses has experienced more volatility. Less shopping and fewer payments have led to a drop in banking notifications. Stores themselves are obviously putting promotional messaging on hold, although delivery notifications are seeing an understandable uptick.

Clearly, this means that local aggregators are more vulnerable than those with an international footprint. However, even these latter won’t be immune to the knock-on effects if their clients start to see problems. Hubs and providers that get a lot of traffic from ride-sharing apps or brick-and-mortar stores will be more vulnerable than those that, for example, focus more on serving the operators.

In turn, providers like GMS can help operators that are seeing falling roaming revenues by securing and monetizing international messaging. Managed services are designed to separate and optimize messaging routes, which in the present circumstances goes a long way in allowing an operator to weather the storm of uncertainty.

William Dudley, Head of Mobile Innovations and Evangelism, SAP Digital Interconnect

SAP Digital Interconnect recognizes that the COVID-19 pandemic and crisis means that people are increasingly turning to mobile communications – including mobile messaging. One of our products called People Connect 365 is designed help enterprises boost their resilience to various types of events such as the current pandemic. As part of our efforts to help customers dealing with the risks and impacts of the COVID-19 pandemic, we began running a 30-day free trial of our People Connect 365 product from April 1st – June 30th 2020.

During the trial period, customers can use the full features and capabilities of the product to remain in touch with their employees as needed through SMS and other channels. Our trial also includes free SMS messages for each employee loaded into the system (up to a maximum of 30,000 free messages). We also pre-provisioned messaging for a number of countries so that customers could launch very quickly in order to begin production.

Additionally, we have noted that our global messaging traffic has shown considerable elevations above normal levels since the middle of March – both for P2P and A2P. Consequently, we put our messaging operations on high alert to make sure our networks are operating at their peak efficiency and that our business customers are using high-quality routes.

We, as SAP Digital Interconnect, recognize that now more than ever businesses need to connect with their customer. Social distancing means physical distancing and therefore requires even more virtual touch points. SAP Digital Interconnect with our CPaaS portfolio of channels and solutions continue to intelligently interconnect everyone, everything, everywhere.

Eduardo Brazao Director, Business Development, Somos

As a leading data solutions and registry management provider, Somos has a long history of providing the neutral, reliable and unwavering services needed to ensure trusted connections between brands, consumers and communities. We have a commitment to be a leading provider of solutions that drive innovation, inspire confidence and most importantly, support our communities and customers.

One solution that best supports these guiding principles is TFN Identity, a centralized database that allows Responsible Organizations (Resp Orgs) to provision and store Caller ID information which in turn allows the Caller Name to be displayed when a call is received from the Toll-Free Number.

Unfortunately, as fears around the coronavirus pandemic occupy our attention, phone scams and hoaxes that prey on these fears are making consumers hesitant to answer calls from unknown numbers. When it was recently reported that this was happening to calls from a Department of Health and Human Services (HHS) Toll-Free Number set-up to provide patients with COVID-19 test results, providers turned to TFN Identity to deliver the critical Caller ID information needed to alert consumers that this was a call that they wanted to answer.

If you would like to contribute a comment to this article contact us at editorial@mefmobile.org or leave your thoughts in the replies below.

Without a trace: the risks and rewards of privacy post-covid

In this guest post, fintech and digital finance specialists Mondato assess the impact and long term effect of the COVID-19 pandemic on privacy and personal data globally.

As financial services have gone digital over the years, each step forward has required three things: affordability, access, and trust. Of these, trust is perhaps the least well-understood; how do users know when to trust an app to handle their money, pay their bills, or steward their personal data? Trust in digital services is intensely personal, but it’s also acutely attuned to its particular cultural and political context.

What engenders trust in the citizens of a given part of the world is not necessarily effective elsewhere, and institutions play by different rules depending on their role in a given society. For this reason, the ramifications of the COVID-19 crisis on data and privacy are unfolding in divergent ways at the regional level, with long-standing attitudes toward authority underpinning the various strategies emerging across the world.

Prior to the COVID-19 pandemic, countries could be broadly classified into three types with respect to who was ultimately trusted with user data. In collectivist Asia, for example, it was government; in capitalist America, it was the private sector; and in the European Union, the newly implemented General Data Protections Regulation (GDPR), which standardized data privacy law across the EU, sought to return control of data from companies back to users themselves.

But now, all over the world, social responsibility is balanced against individual liberties as a global pandemic renders fellow citizens the potential threat.

In the past, privacy law was about your rights as a citizen vs the government. Then, 20 years ago, we started thinking about your rights with your employer and companies you deal with. Now, not necessarily for the first time, it is integrating those three things — you in relation to companies, the government, and people.”

Kirk Nahra, U.S. privacy and data security lawyer

Emergency measures implemented during the crisis have waived certain privacy laws and created massive surveillance programs. But the data measures put in place (though extraordinary in their implementation and novel in many senses) are in fact continuations of pervading attitudes, pre-existing industry practices, and, in autocratic countries, deepening social control. The data collection operations underway to combat COVID-19 are arguably not transformative, but rather serve as a defining example of life in the digital age.

Contact Tracing: The New O2O

The sudden demand for mass surveillance comes at a fraught moment in the privacy debate. To justify mass data collection practices, adtech firms champion aggregation and anonymization practices that claim to protect the identities of individuals while gathering sufficient data to create sophisticated consumer portfolios. Critics, however, question the claim that any data set of user information can be both precise and anonymous. Without sufficient safeguards, anonymized data can be de-anonymized by matching it with other data sets in order to identify individuals. In December, The New York Times opinion section published a series on location tracking in which it reviewed anonymized metadata from one of dozens of location data companies in the United States. They found, as one expert explained, that “really precise, longitudinal geolocation information is absolutely impossible to anonymize.” With the help of publicly available information, like home addresses, the Times was able to identify and track the movements of notable figures using supposedly anonymized data. Telcos have been selling such location data to third party data brokers for years. Although aggregated results are more easily anonymized, there remains the issue of who possesses the original data set, which can be hacked or abused.

Despite growing concerns surrounding the ability to keep such data anonymized, anonymization is a key component to nearly all data collecting measures employed against COVID-19’s spread. The CDC and governments in the U.S. are receiving metadata from the mobile advertising industry to better map out the movement of people during the crisis. In the UK, tech firms are processing large volumes of confidential UK patient information and creating outbreak models from it. As long as daily new infections and deaths keep climbing, and every citizen is deemed both suspect and potential victim, maintaining data anonymity may prove a secondary concern.

Apps Of All Stripes

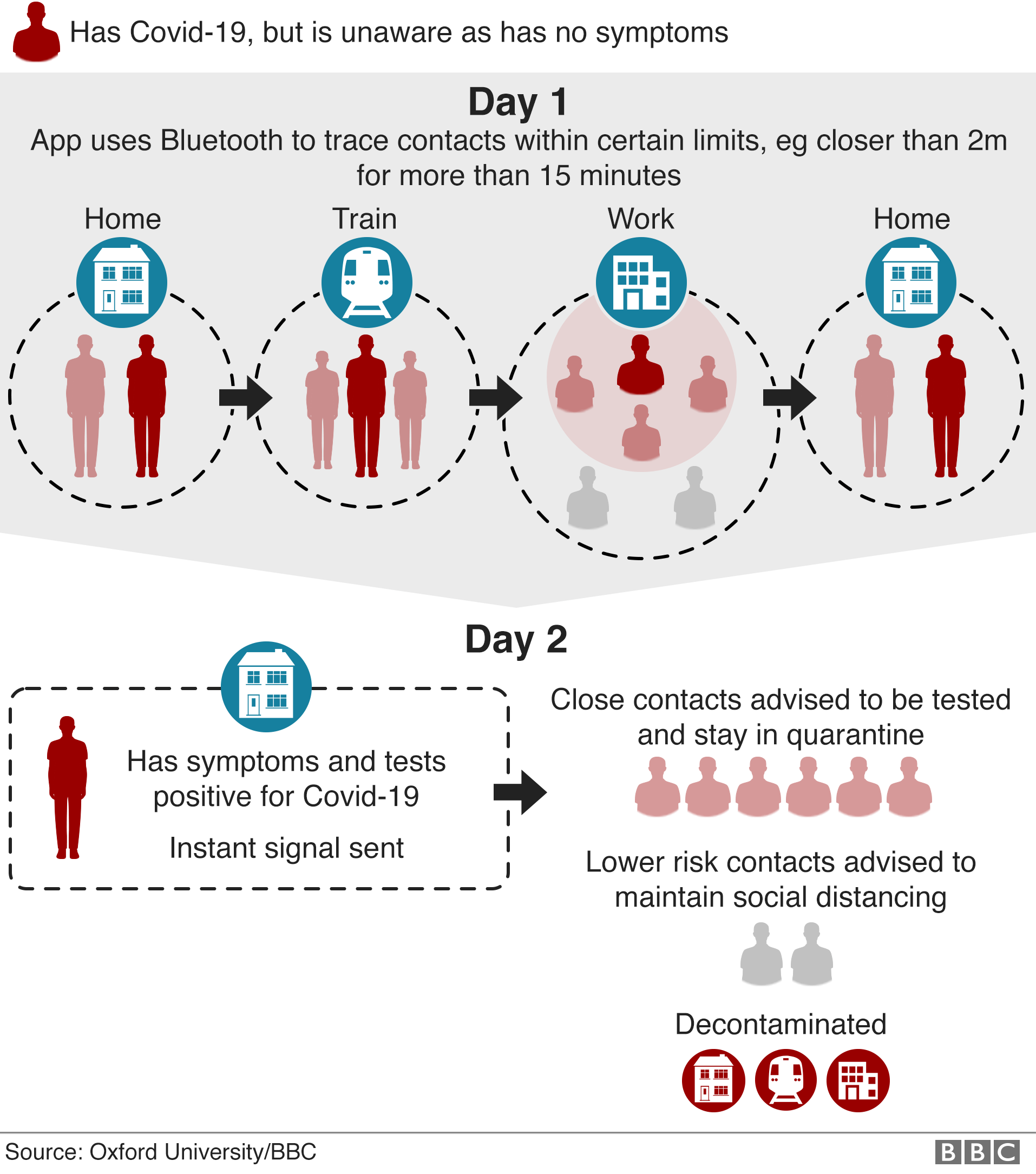

As countries seek to end lockdowns and slowly reopen their economies, the most prevalent use of digital data will be contact tracing apps. According to digital rights group Top10VPN, there are now 43 contact tracing apps available around the world to monitor and stop the spread of COVID-19, with more in the pipeline. How regimes reconcile the tension between individual privacy and public exposure is what differentiates these respective apps from each other, and approaches to contact tracing diverge along several dimensions:

Which data will be collected?

GPS tracking can help governments form maps of citizens’ movements to better understand the effectiveness of confinement measures (and in certain cases, to better enforce them). GPS is indeed an appropriate tool for understanding social movement on a macro level. But when it comes to contact tracing, GPS is an imperfect oculus; in theory, GPS can be accurate within one meter, but more typically 5 to 20 meters — obviously an unsuitable range to determine whether someone has been within two meters of an infected person.

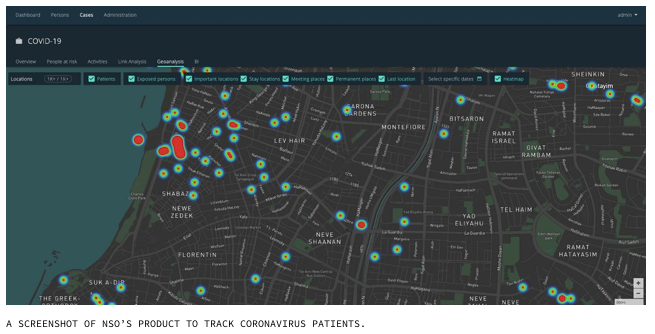

Generally, GPS is regarded as a more invasive, less effective approach, but it’s used by 64% of extant contact tracing apps as reported by Top10VPN. Israel, for example, has employed a GPS tracking system that surveils all citizens, pinging cellphones, cross-referencing data, and alerting them if they have been potentially exposed to someone with COVID-19. The use of such imprecise information has predictably led to cases in which individuals are erroneously forced to quarantine despite maintaining proper social distancing.

While GPS measures location, Bluetooth simply measures proximity between devices, which improves precision and protects privacy. Perhaps to protect user privacy, Apple and Google are using Bluetooth for their upcoming tracking app. In this app, each device is granted an anonymous key that cycles every 15 minutes to preserve privacy. The signals of nearby phones are picked up at 5-minute intervals, and connections between devices are stored in a database. Once a person has been infected, the app will only share keys from the specific period in which they were infected.

Bluetooth technology still faces considerable, however; currently, the app and Bluetooth must be kept on at all times, and it can’t tell if a wall or barrier stands between people. Most crucially, such technology requires a critical mass of the population to voluntarily download and use the app at all times to be effective. An Oxford study suggested that at least 60% of the population would need to use such an app to effectively track and control the virus. Singapore had been lauded for its Bluetooth-enabled TraceTogether app, used in tandem with its manual tracing regime and high testing rates to control the disease. However, even with high smartphone penetration, a small, cooperative populace and centralized authority, only about one in five Singapore residents had downloaded the app. In recent weeks, infections started to spike after an outbreak among migrant workers — rendering such tracing efforts pointless, as it would be nearly impossible to keep up with community spread.

Where is data stored?

A centralized database is far easier to manage and sort during a crisis, but it also makes sensitive information prone to hacking or abuse by the collecting body. Of the 27 contact tracing apps with known database set ups (others have yet to be publicly disclosed), only 8 employ decentralized databases, whereas 19 have centralized databases — many of which are government-run.

In the case of the Apple/Google app, it is the mobile devices themselves which perform the cryptographic calculations; central servers only maintain the database of shared keys, rather than the interactions between said keys. The drawback to this privacy-conscious model is the lack of information it provides to epidemiologists. Only by linking different sightings of a device with different users would authorities be able to use it effectively on a society-wide scale — which would compromise privacy.

What to do with the information?

According to Top10VPN, 28% of contact tracing apps so far have no privacy policy enumerated, meaning that there have been no clear boundaries set for how the stored data could actually be used. While it’s too early to know what risks are associated with this data, in the most egregious case to date, Iran launched an app that claimed to diagnose coronavirus through a series of yes-or-no questions. But rather than offering a proper diagnosis, the app enabled the Iranian regime to gather large swaths of citizen data and track their movements in real time.

Collectivism, Culture, Virus, Virtue

In Asia, laws and social norms alike leave a grey area for the use of data. South Korea, for instance, actually had a digital contact tracing regime prepared before COVID-19. After the 2015 MERS outbreak, South Korea passed regulations which required districts to publish information pertaining to infected people, including: travel routes; which public transit they took; which hospitals treated them; whether they wore masks; and even their age and gender. South Koreans are routinely informed if there has been an infected case within 100 meters of their location. Such detailed mapping, combined with extensive manual contact tracing efforts and high levels of testing, have helped South Korea prevent full-blown community outbreaks. As The New Yorker described recently, despite the invasion of privacy inherent in such a process, the South Korean citizenry decided after the 2015 MERS outbreak that radically transparent “virtuous surveillance” was the best option. The South Korean surveillance apparatus also makes use of credit-card payment information, travel and medical records, and health information to track the travel history of every resident.

Elsewhere in Asia, anti-COVID measures have sometimes ignored individual liberties for the social good. Hong Kong gives a wristband to anyone entering the country that they must calibrate with the country’s StayHomeSafe app, geofencing quarantined residents. Taiwan has utilized what it calls an “electronic fence” which tracks mobile phone data and alerts authorities if someone who is quarantined leaves their home. Some parts of India are stamping the hands of airport arrivees and monitoring reservation data from airlines and trains to ensure that those people don’t travel.

Not surprisingly, China was the first to employ digital tracking to battle COVID-19, and it also employed some of the most invasive measures in their design. Software installed in citizens’ phones tracks their movements and classifies individuals with a color code indicating their contagion risk, even regulating their ability to enter public spaces. The government has avoided disclosing exactly what information determines the individual health status for over 1 billion citizens, but reports have suggested that digital payment data from AliPay and WeChat Pay were used by authorities to ascertain if someone was buying fever medicine, for example. Though unsurprising, this would certainly signify a creep in the Chinese surveillance apparatus. Reportedly, Alibaba and Tencent — with speculated ties to the Chinese government — have resisted efforts by authorities to obtain consumer data during the pandemic, but this may be due to a view that privacy protections are vital for a future expansion into Western markets. If surveillance entreaties by Chinese authorities ultimately prove successful, there is precedent in events like the Beijing Olympics and Tibetan protests that “emergency” surveillance measures could become permanent.

Democracy, Data, Pandemic, Privacy

In the U.S., on the other hand, authorities are collecting data from the advertising industry to get an idea of where people are gathering. The U.S. relief bill also included $500 million for the CDC to build a “surveillance and data collection system” using advertising metadata. The ad companies, which are sometimes criticized for their lack of transparency, are not actually changing any of their collection practices in response to the crisis — rather, their existing operations are being further legitimized by the U.S. government. And this isn’t particular to the U.S.; companies with dubious records such as U.S. big data firm Palantir, Israeli spyware maker NSO and Italian surveillance company Cy4gate are offering their services to countries across the world. But the fact remains that this emergency comes at a critical time for data privacy in the U.S., where a national data privacy law limiting the actions of private companies is conspicuously absent.

Through the GDPR, the European Union has reined in data collection endeavors, but COVID-19 comes just after the new regulations have begun to take root. The GDPR, the EU’s sweeping new data privacy law implemented in 2018, says companies can collect personal data only for a specific reason, and must obtain individuals’ consent for how it will be used, prohibiting “coerced” or “hidden” consent practices common in other regions. Telcos are still collecting metadata, but it has to be properly anonymized or deleted.

(Proposed contact tracing app, Germany and U.K.)

(Proposed contact tracing app, Germany and U.K.)

In the COVID context, the GDPR contains emergency provisions which allow flexibility on responsible data collection during an outbreak. Although all member countries are bound to GDPR regulations, several states have taken somewhat divergent views on observing its guidelines. With the exception of Poland’s digitally monitored enforcement of quarantines, invasive measures have so far been relatively minor, with explicit expiration dates for collection efforts (though it is still early in the pandemic for countries like Hungary, where Prime Minister Orban can now rule by emergency decree during the crisis).

The EU must now reconcile its focus on personal control of user data with the public health demands of the crisis. As the EU’s data protection watchdog calls for a single coronavirus app, the European Commission has leaned on telcos to provide fuzzy metadata for coronavirus modelling, akin to the United States.

While the EU’s privacy regime is bending (though not yet breaking), the privacy-conscious citizenry of Europe will make it even more difficult to approach the critical mass needed for such tracing apps to be effective. In Austria, the Bluetooth-enabled app is voluntary, can be deleted, and no central database exists. Though privacy experts have expressed approval of the app’s design, the country’s wary citizenry have been slow to adopt the app nonetheless. Will the GDPR’s privacy regime be diminished or fractured to strengthen digital tracking measures, or does it endure at the cost of foregone contact tracing opportunities, and potentially a faster recovery?

The Unknown & The Unknowable

There may ultimately be no need for a zero-sum tradeoff between useful data collection and effective data protection. Emerging privacy enhancing technologies (PETs) offer a solution to the centralized hoarding of consumer data. PETs use different computational and mathematical approaches to extract data without jeopardizing the privacy and security of this information. One method already in use is “differential privacy”, wherein statistical noise is added to the inputs to prevent the unmasking of information through overlapping data sets; Google is reportedly employing this technique for its coronavirus mobility maps. Another emerging but pertinent method is called “zero-knowledge proofs”. It comprises a series of cryptographic algorithms that can “test” to “verify” that a computational statement is correct, without revealing any data behind it. Blockchain security company Hacera, in partnership with IBM, Oracle, and Microsoft, has already adopted this technique to create a distributed and verifiable data hub, MiPasa, to collect, validate, and leverage COVID-19 data in Honduras, with the possibility of expanding the blockchain-powered app to facilitate segmented shopping schedules for locked-down populations. National health institutions in the U.S., Canada, Europe, and China have contributed to the project.

Such methods are complex, often developmental, and undeniably less useful to information-hungry companies and governments. It is unlikely privacy rights will emerge from this pandemic unaffected. For data-reliant industries like digital financial services (which are increasingly embracing PETs for their own data collection purposes) the ramifications are uncertain. On the one hand, as pressures mount on Chinese companies like Tencent to adhere to Western privacy standards even during the crisis, the interconnected nature of digital realms ties each region’s fates a little closer to each other. But without global coordination during the crisis, it is likely that data privacy across regions will increasingly gravitate towards the predilections of their respective political and cultural situations — in most cases to the detriment of privacy for individuals, with lasting risk to the post-COVID world.

This post originally appeared on Mondato Insight and is republished with kind permission

Mondato is a consulting firm specializing in fintech & digital finance – visit them on LinkedIn or get in touch directly.

India under COVID19: The telecom networks are holding up, barely

Shiv Putcha, Principal Analyst at emerging tech specialists Mandala Insights, shares insight into how the covid19 pandemic is affecting the mobile ecosystem in India, and how the telcos are coping with keeping the country connected.

There are multiple trends to review from the emerging market response to the COVID19 virus. As a telecoms analyst, I would be remiss not to begin with the impact on and the performance of the telecom sector at large as well as in India, where I reside.

The degrees have varied as well as the strategies applied for implementation but the net effect of all the lockdown has been to force people indoors, with little to do and a lot of time on their hands. Predictably, most people have gone online, in work from home (WFH) mode, in online classroom mode, or for casual browsing on steroids.

There are several “Covid motivators” out there who have discovered hidden or latent baking, musical and other skills…you know who you are! The resulting Internet traffic spikes have been significant across the board, irrespective of region, country or even at a city level.

What has the experience been like in India? So far so good. The biggest concern was that India’s telecom networks, straining to maintain a modicum of quality at the best of times, have largely held up, either on their own merits or with luck, duct tape, and Superglue. India’s mobile operators, cable providers, and ISPs have been forced to trim customer care and other operations down to the bare minimum.

Overall, they have managed, in conjunction with their network vendor partners, to keep the lights on. Payments have largely switched to online payment methods, either through net banking or through services like Paytm, PhonePe, and Mobikwik. Prepaid balance validity periods have been extended, as well as free incoming calling and a host of other benefits.

One of the biggest learnings from the lockdown is that all assumptions about traffic patterns and network planning go out the window. People are no longer mobile so their traffic will tend to skew towards “hotspots” and become more consistent throughout the day“

Shiv Putcha, Principal Analyst

One of the biggest learnings from the lockdown is that all assumptions about traffic patterns and network planning go out the window. People are no longer mobile so their traffic will tend to skew towards “hotspots” and become more consistent throughout the day. That is, traffic becomes more “localized” and there are potentially several mobile cell sites that have seen dramatic increases in terms of capacity load and several that have seen decreases. Moreover, there is no “peak hour” traffic anymore…people are on all the time.

Where possible, capacity has been increased at traffic hotspots to handle the surge in traffic. But without fresh (and even temporary) allocations of spectrum, it would not be possible to add capacity, especially in crowded urban areas. As a result, the telcos are certainly under strain and the impact can already be felt with reduced speeds and faint signals.

My primary number is with Airtel and I can only get mobile data when standing at the balcony window in my apartment in Mumbai. Under the circumstances, the only viable strategy in the short term is to offload traffic.

A good case in point is Reliance Jio employing WiFi Calling. I have a secondary SIM card with Jio, taken to mitigate the previously mentioned coverage issues with Airtel. While there is no problem with coverage, Jio’s speeds have slowed to a fraction of previously available and advertised speeds. A clear issue for a company that promised its subscribers free voice calling for life and loads of free mobile data bundled into its plans. Moreover, virtually all my voice calls now go out over WiFi, a clear indication of the strain placed on Jio’s LTE networks.

Is 5G the answer? Sadly, not in the short term

So how do these telcos get more capacity in the short term? Ideally, there would be a lot more fixed broadband to the home, enterprise and small business locations. However, fixed broadband penetration in India is pitifully low, despite recent momentum following the launch of Jio Fiber, One Broadband, and other services.

The answer lies with the allocation of more spectrum. More spectrum and new use cases like Fixed Wireless Access (FWA). In India, the 5G spectrum auction has been on the cards for some time. Will we have a 5G auction soon? Absolutely not. While the impact of Covid19 has brokered an uneasy truce between the Indian government and the telcos over license fee demands, there is a looming problem with capital scarcity. If they are barely able to pay their past dues in license fees, where is the capital left over to pay for exorbitantly priced spectrum in an environment where there is bound to be a squeeze on lending and credit? Telcos around the world are currently re-evaluating CAPEX plans. My prediction is that any 5G auctions that have not already happened will get delayed to 2021 at the earliest and follow up auctions in other countries will also get pushed back.

Despite my reservations on the potential delays for 5G auctions, I am hopeful that India’s telcos take matters into their hands and look at new technologies like Dynamic Spectrum Sharing (DSS) and older technologies like carrier aggregation (CA) to help them pool existing resources and boost bandwidth. DSS has been primarily mooted for combination scenarios where operators can combine 5G and 4G spectrum, dynamically, in order to boost capacity. However, this can also be done with 4G and older 3G/2G networks. The recent announcement of 3 Indonesia with Nokia for applying DSS to their 4G and legacy networks is a very interesting case in point for India’s operators to follow.

One silver lining coming out of all this. If we assume that the lockdown continues in the short term and we slowly limp back to a semblance of normalcy, we are still looking at a fundamentally different world coming out on the other side. I for one hope and pray that people, many if not all, reboot and begin to place more value on the truly essential things in life.

For one thing, I believe that people’s appreciation of connectivity and the premium they are willing to pay for this will be renewed. Building and operating a telecom network is tough, gritty and at the best of times, a thankless business, no more or less so than the plumbing networks that take our refuse to dark, dank corners. Both are vital, essential but also taken for granted!

This post originally appeared on the author’s website Mandala Insights and is reused here with kind permission

MMD Smart Interview: Covid19’s impact on small to medium enterprises

As part of MEF’s COVID19 IMPACT series, Dario Betti asks Ira Cohen from MMD Smart how small and medium enterprises can maintain their business and grow customer relations.

While the health emergency is now largely understood for COVID19 the impact on business is also becoming clearer. In particular, small and medium companies are suffering due to the lockdown. How can these companies use digital channels to stay in touch, and even create new business opportunities. Ira goes through a list of use cases that can help small businesses and give them the edge. Today digital transformation is more important than ever.

Watch the full video below.

Subscribe to MEFTV

For more unique interviews, opinions, panels and webinars, subscribe to the MEFTV YouTube channel, and stay up to date with MEF Members and the global mobile ecosystem.

Scammers seek financial help during Covid-19 pandemic

In this guest post, Stuart McBride, Head of Threat Intelligence at AdaptiveMobile Security shares their assessment of the recent rash of Covid-19-themed SMS spam campaigns, and offer practical steps for how consumers can spot such scams.

We recently documented the “outbreak” of Covid-19-themed SMS spam campaigns; spammers exploiting the fear around the pandemic to sell fake preventions and cures, push false offers and sell payday loans.

As the public adapts to the pandemic as part of daily life and grows accustomed to unusual restrictions, rules and public announcements, scammers are continuing to vary their tactics to take maximum advantage of the current reality and capitalise on continuously evolving news cycles.

Many Governments across the English-speaking world are announcing various reliefs and benefits to individuals and businesses financially affected by the Covid-19 pandemic. Such programmes are an attractive new vector for scammers.

AdaptiveMobile Security’s Threat Intelligence analysts have observed similar SMS Spam being sent to subscribers in the US, Canada and the UK.

As an illustrative example, on March 18th, Canada announced it would be making one-time special payments by May 2020 for qualifying individuals. This week, we have observed messages like the example below being sent to some Canadian mobile phone subscribers:

To an ordinary recipient, growing accustomed to unexpected announcements, this may seem like a genuine public service message in extraordinary times.

The message isn’t entirely implausible. It’s fairly clearly laid out, and other than the incongruous French abbreviation of “Gouvernment,” is spelled correctly and signed as if from the real Canada Revenue Agency.

Let’s see what happens to the unsuspecting subscriber who clicks the link.

The first thing the subscriber will see on their handset is an authentic-looking website with the real Government of Canada logo, and in both official languages:

Choosing English, the subscriber is now asked for their name and social security number. The subscriber may enter their real details at this point, but regardless of the input, another convincing “Searching…” message is animated for a few seconds, before presenting the good news. The subscriber is eligible for a random amount of Canadian dollars:

Proceeding with the application, we now reach the key and indeed only intention of the scam – to steal the subscriber’s credit/debit card details. The subscriber is invited to choose their bank from a list of real Canadian banks. Choosing BMO (Bank of Montreal) leads to a login page with genuine logos and convincing looking links to register, change language and reset password:

In fact, as an entirely fake mock-up of BMO’s login page, the site has no way to authenticate the login, and will accept any correctly formatted card number and password.

The follow-up page asks for the remaining card details and even the security questions and answers – providing the attacker with enough information to potentially hijack the subscriber’s bank account.

Assuming the subscriber entered their details correctly, they can now expect unauthorised purchases, payments or transactions on their account.

Spotting a scam

How could a regular subscriber have avoided falling victim to this SMS Spam?

1. The message

From the initial message, there were some tell-tale signs that this a scam. First of all, there’s the awkward language in the initial line of the message, with an unnecessary capitalization, and the French spelling of “Gouv.” However, this might not be immediately obvious to a non-native speaker of English.

The next and bigger red flag is the link offered. All Canadian government websites use the top-level domain for Canada, “.ca”, for example https://www.canada.ca/ and https://www.gc.ca. As anyone in the world can register any .com domain name, the random format of the web address should give pause to an astute subscriber.

2. The website

It would be unusual, if not entirely impossible, that in 2020 an official website would be unencrypted. The “Not Secure” warning in the phone’s web browser should be an immediate red flag. If any doubt still remains whether this site is a scam, it should be removed on seeing the online banking login page.

It would be unusual, if not entirely impossible, that in 2020 an official website would be unencrypted. The “Not Secure” warning in the phone’s web browser should be an immediate red flag. If any doubt still remains whether this site is a scam, it should be removed on seeing the online banking login page.

Under no circumstances will an online banking login ever show (1) a “Not Secure” message in the browser or (2) a domain name in the address bar that does not belong to the bank.

Three steps to protect yourself

1. Stop and think: does this organization or agency usually contact me this way? Was I expecting this message? Do I recognize this website? If in doubt, ignore the message and visit the real website of the agency in question to determine genuine entitlements and procedures to follow.

2. Look for red flags: does this website really belong to the organization in question? Don’t trust the name – check the organization’s real website using another source. If there’s any doubt, make a call to the organization or agency in question.

3. NEVER disclose online banking details: There are no circumstances under which you will need to provide your online banking details, security questions or security codes to a website, other than when you are logging in to your own bank on your own volition. An organization transferring funds to your account will need only your account number and sort code. Any time you need to use online banking, go directly to your bank’s website or app.

This blog post originally appeared on the Adaptive Mobile Security Website and is re-used here with kind permission

Industries unite to tackle SMS fraudsters exploiting COVID-19 text alerts

The UK mobile, banking and finance industries along with the National Cyber Security Centre (NCSC) have joined forces to prevent fraudsters sending scam text messages that seek to exploit the Covid-19 crisis.

Industries unite to tackle SMS fraudsters exploiting COVID-19 text alerts

The UK mobile, banking and finance industries along with the National Cyber Security Centre (NCSC) have joined forces to prevent fraudsters sending scam text messages that seek to exploit the Covid-19 crisis.

The collaboration is part of an ongoing industry initiative by Mobile Ecosystem Forum, Mobile UK and UK Finance, supported by the NCSC, to help identify and block fraudulent SMS texts and protect messages from legitimate businesses and organisations.

Text messaging scams which trick consumers into sending money or sharing their account details with fraudsters are known as ‘Smishing’ (or phishing by SMS). Criminals send bogus texts which appear to come from a trusted sender, for example, in the case of the Government’s mass-text campaign UK_Gov.

These messages often contain links to fake websites or phone numbers using sophisticated social engineering techniques to trick the victim into revealing their personal and financial information or sending money. Criminals will also often use a technique called “spoofing”, which can make a message appear in a chain of texts alongside previous genuine messages from that organisation.

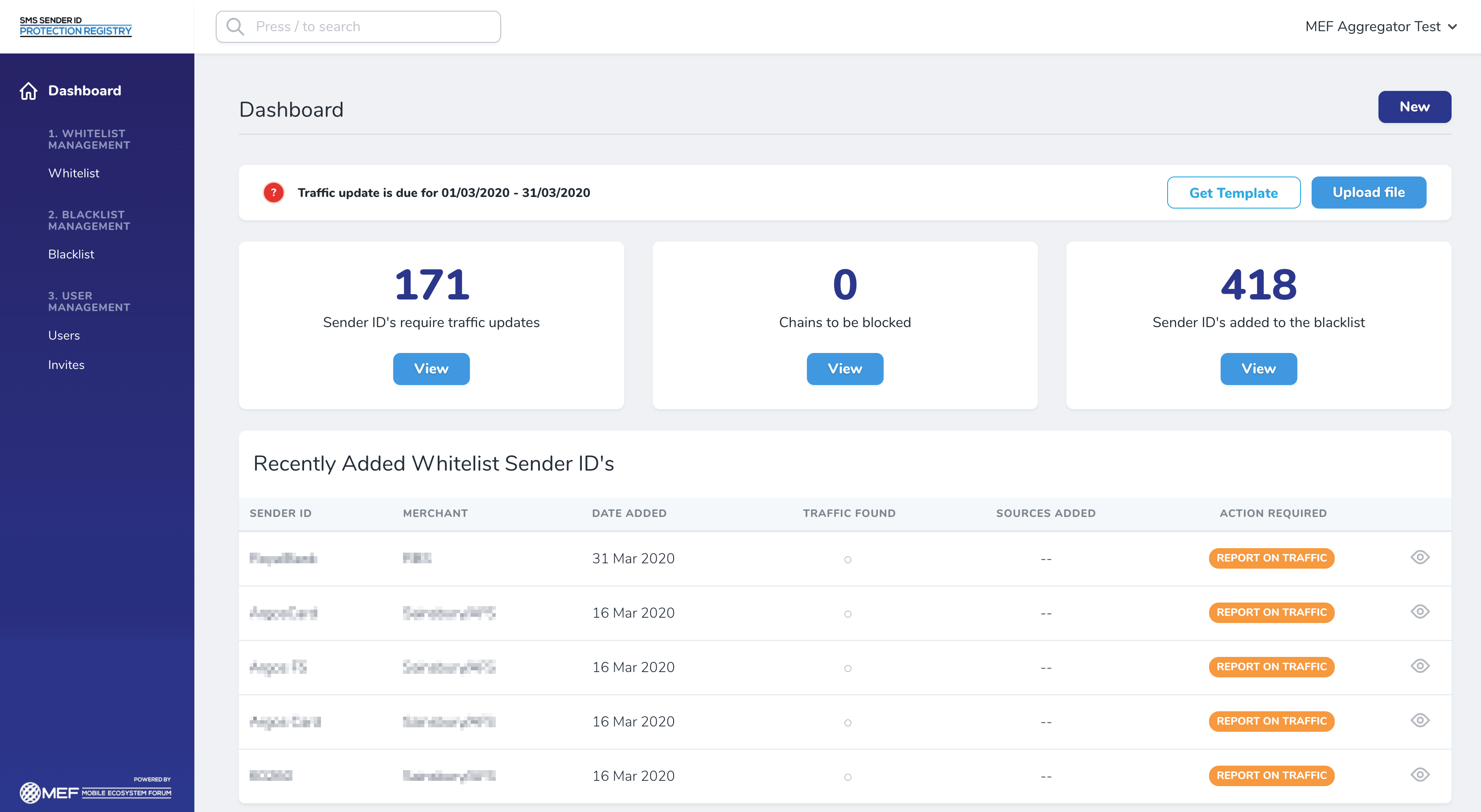

As part of the cross-stakeholder trial, MEF has developed the SMS SenderID Protection Registry which allows organisations to register and protect the message headers used when sending text messages to their customers. The Registry limits the ability of fraudsters to send messages impersonating a brand by checking whether the sender is the genuine registered party.

70 bank and Government brands are currently being protected through the trial with 352 trusted SenderIDs registered to date. Over 1500 unauthorised variants are being blocked on an ever-growing blacklist, including 300 senderIDs relating to the Government’s Coronavirus campaign.

24 banks and Government agencies including HMRC and DVLA are participating in the ongoing trial which is supported by BT/EE, O2, Three and Vodafone.

The trial also has the support of the UK’s leading messaging providers including BT’s Smart Messaging Business, Commify, Dynamic Mobile Billing, Firetext, Fonix Mobile, IMImobile, Infobip/OpenMarket, mGage, Reach-Interactive, SAP Digital Interconnect a division of SAP, Sinch, TeleSign, Twilio and Vonage.

The cross-stakeholder working group has seen a significant drop in fraudulent messages being sent to the UK consumers of the participating merchants.

Example text message sent using senderID ‘coronavirus’

Dr Ian Levy, Technical Director at the NCSC, said: “We are pleased to be supporting this experiment which is yielding promising results. The UK Government’s recent mass-text campaign on Covid-19 has demonstrated the need for such industry collaboration in order to protect consumers from these kind of scams.”

We are pleased to be supporting this experiment which is yielding promising results. The UK Government’s recent mass-text campaign on Covid-19 has demonstrated the need for such industry collaboration in order to protect consumers from these kind of scams.” Dr Ian Levy, Technical Director at the NCSC

Mobile UK’s Head of Policy & Communications, Gareth Elliott added that “Mobile companies work hard to protect their customers from fraud and the contribution from the industry to the Registry will help reduce the number of scam texts pretending to be from trusted brands. This gives much-needed protection against fraud, including for the most vulnerable customers.”

As part of the Coronavirus campaign, consumers have also been reminded to follow the advice of the Take Five to Stop Fraud campaign and remember that criminals are experts at impersonating people, organisations and the police. Customers can report suspected spam text texts to their mobile network provider by forwarding them to 7726.

Katy Worobec, Managing Director of Economic Crime at UK Finance, said: “This initiative shows how by working together with the government, law enforcement and other sectors, we are protecting the public from these cruel scams. We would urge consumers to remain vigilant of criminals exploiting the Covid-19 outbreak to commit fraud and report suspicious texts by forwarding the original message to 7726, which spells SPAM on your keypad. Always follow the advice of the Take Five to Stop Fraud campaign and avoid clicking on links in any unsolicited text messages in case it’s a scam.”

Mike Fell, Head of Cyber Operations HM Revenue and Customs, who were one of the first Government agencies to report Covid-19 text scams said: “This trial builds on the success of an HMRC pilot, conducted with telecoms providers, which resulted in a 90% reduction in reports of the most convincing HMRC-branded SMS scams. We are happy to collaborate with MEF and partners to take forward our work to safeguard the UK public from such SMS-related scams.”

MEF’s COO, Joanne Lacey summarised: “All stakeholders involved in business messaging have a responsibility to follow industry best practice and proactively work together to be one step ahead of the fraudsters. The SMS SenderID Protection Registry is a tactical solution to mitigate smishing and spoofing, backed by MEF’s A2P SMS Code of Conduct. Through the Registry, the industry has been able to support the UK Government’s campaign and demonstrate the vital role of messaging not least in times of emergency and crisis.”

The UK trial of the SMS SenderID Protection is part of MEF’s Trust in Messaging Service developed by MEF’s Future of Messaging Programme Fraud Working Group.

Webinar: COVID19 & Personal data

An expert panel discuss the use of mobile in countering the coronavirus pandemic, looking at the new use cases and exploring the balance between effectiveness and privacy concerns.

- Riccardo Amati, Broadcast Media Professional

- Julian Ranger, Chairman & Founder – Digi.me

- Daniele Mensi, Blockchain Advisor – MEF

- Andrew Bud, CEO, iProov

Blockchain Podcast: Blockchain against COVID19: digital identity and secure tracking

Continuing the series of Podcasts to discuss the role of Blockchain in the mobile world Daniele Mensi, MEF Advisor on Blockchain talks to Dario Betti, MEF CEO about the difference between hype and the real potential of this new technology in the mobile and wireless world.

In Episode 3 Daniele and Dario chat about the potential applications of blockchain to support the fight against COVID19 – how governments and industry are working on potential ways to scale up virus testing by using blockchain for secure digital identities and information sharing.

Subscribe to more MEF Podcasts on your favourite audio platforms >

Industry views: COVID19 responses from the mobile ecosystem

The rapid spread of the COVID-19 virus has caught many by surprise and the pandemic is devastating lives across the world. The social and economic impact of the resulting lockdown is becoming evident: it will require a massive effort to bring normality back to the world.

The mobile ecosystem has been central to many of the innovations and creative solutions that have emerged in the last few weeks: not just in communications in keeping us connected but also in the essential sharing of information, entertainment, education, business and finance all now commonly managed at home from mobile devices.

The virus might have exposed the vulnerability of the human, however, the reactions from people worldwide have also showed resilience, ingenuity and astuteness. Below we share learnings and actions from MEF members that have worked in supporting businesses and consumers as well as innovations and new solutions for fighting back against the virus.

William Dudley, Head of Mobile Innovations and Evangelism, SAP Digital Interconnect

SAP Digital Interconnect recognizes that the COVID-19 pandemic and crisis means that people are increasingly turning to mobile communications – including mobile messaging. One of our products called People Connect 365 is designed help enterprises boost their resilience to various types of events such as the current pandemic. As part of our efforts to help customers dealing with the risks and impacts of the COVID-19 pandemic, we began running a 30-day free trial of our People Connect 365 product from April 1st – June 30th 2020. During the trial period, customers can use the full features and capabilities of the product to remain in touch with their employees as needed through SMS and other channels. Our trial also includes free SMS messages for each employee loaded into the system (up to a maximum of 30,000 free messages). We also pre-provisioned messaging for a number of countries so that customers could launch very quickly in order to begin production.

Additionally, we have noted that our global messaging traffic has shown considerable elevations above normal levels since the middle of March – both for P2P and A2P. Consequently, we put our messaging operations on high alert to make sure our networks are operating at their peak efficiency and that our business customers are using high-quality routes.

We, as SAP Digital Interconnect, recognize that now more than ever businesses need to connect with their customer. Social distancing means physical distancing and therefore requires even more virtual touch points. SAP Digital Interconnect with our CPaaS portfolio of channels and solutions continue to intelligently interconnect everyone, everything, everywhere.

Karl Kilb, CEO - Boloro Global Limited

The Internet was never designed for secure transactions and other risky activity, and Operating Systems are often subjected to malware. The coronavirus is highlighting these problems. SIM Swaps, email hacks, malware, man-in-the-middle attacks and other forms of fraud are rising dramatically. In addition, touching a public Point of Sale device, ATM keypad, or finger scanner could spread the coronavirus.

Boloro Authentication is working with MNOs in India, Africa and soon other markets to leverage the secure signalling channel of the mobile network operator, push USSD or network initiated USSD, to separate the authentication from the activity itself. With Boloro, all activities are conducted safely and securely on the personal mobile handset, eliminating sole reliance on the Internet and eliminating physical contact with a public device or screen.

Boloro is compatible with all mobile phones, including smartphones and feature phones, and easily deployed via APIs for local hosting and / or cloud-based hosting. Use cases include: online banking, digital payments and eCommerce, as well as the avoidance of touching public Point of Sale machines, ATM keypads, finger scanners and other public devices by putting all activities safely and securely on the personal mobile handset.

Julian Ranger, Exec Chairman & founder, digi.me

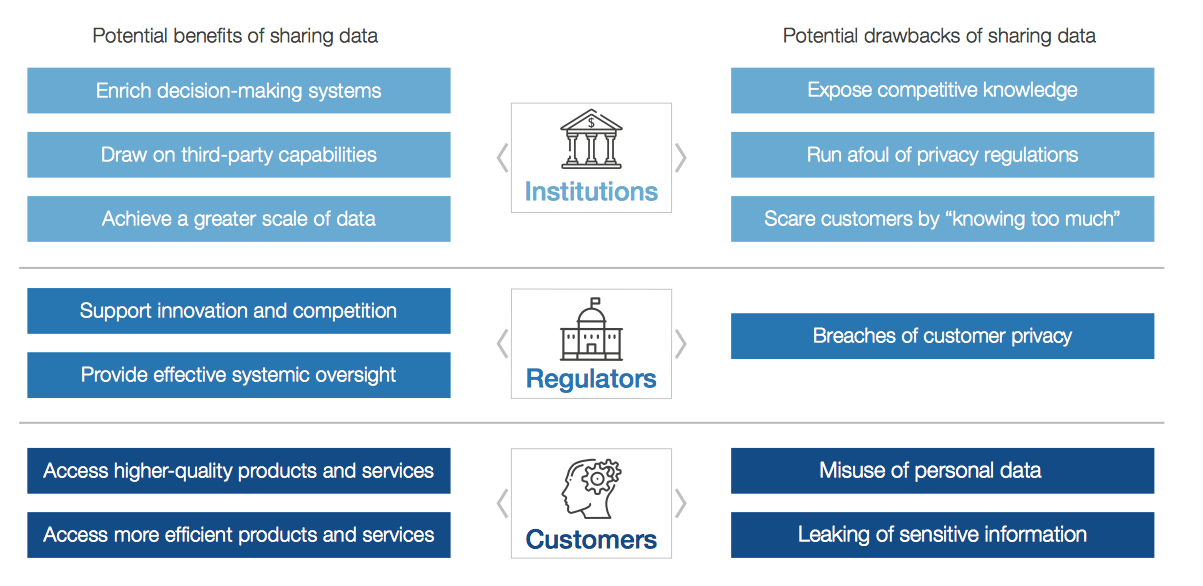

World events such as Covid-19 create an unprecedented challenge for Governments when it comes to situational awareness, tracking and understanding what is happening. We need solutions which empower individuals and Governments to help tackle and overcome this horrendous pandemic with greater access to data without infringing on citizen’s privacy and freedoms.

Governments need data from individuals to have the national picture to help direct solutions and mitigations. But how can the Government get that data, privately and with consent, quickly and efficiently, and catering for data they may not know they need yet?

The solution to these issues that was recently extensively referred to in the new European Data Strategy with reference to MyData, enables more and better data to be shared amongst all participants with full privacy, security and consent. The aggregation of data occurs at the individual, and then enable them to share that data with 3rd parties through a straightforward consent process.

This is what digi.me provides, and we have proposals that we are making to the UK, Netherlands and Australia for this to be rapidly rolled out in weeks to provide a framework for the many other apps, services and data exchanges that the Government needs between it and its citizens.

Imagine if on Day 1 of this emergency the Government could have asked and received data immediately – privately and with consent. How much quicker we would have got on top of the crisis – and how much more quickly can we implement effective measures as we come out of lock-down. And how simple it will be to share other data during the recovery phase if we need to, such as financial data for grants/other eligibility criteria.

Solutions like this exist today and can be implemented within weeks with Government backing and support. We can and should solve this data crisis now to help with solving the Covid crisis, and to provide resilience for whatever future crises occur as data will always be needed, data which is immediate, complete, private and consented.

Silvio Kutić, CEO, Infobip

Infobip understands that communicating during a crisis is essential for maintaining public confidence – especially when it entails information important to protecting public health. Infobip is in the business of delivering quality digital connected communication and we feel duty bound to assist organizations tasked with delivering critical communications at times like these.

If authorities are to engage in dialogue with the population during a crisis, they must have access to sufficiently large communications technology that has the capacity to handle potentially massive volumes of calls and contacts. So, we have decided to make some of our technology available for this purpose and have been helping with public health information initiatives around the globe with projects in development in Africa, APAC, India, Europe and Latin American regions.

To make sure public health and government institutions’ critical messages reach people on time, we’ve decided to offer them our messaging services for free – find out more here.

Frank Joshi, Managing Director, Mvine Limited

I am seeing how the Covid-19 pandemic has deeply challenged the levels of readiness and connectedness in many organisations large and small. Equally it has put security postures to the test as companies struggle to adapt to a different way of working quickly enough.

From Mvine’s point of view, our management policy and infrastructure already enables business continuity even when all staff might be required to work remotely or from home. It has meant that we could assure customers that Mvine is prepared whatever adverse contingency may arise as a result of COVID-19. The entirety of Mvine’s technology and platform will continue to be fully operational as usual. This means our customers can continue to rely on a full service. But I am very mindful that is not the case with many organisations.

Jeff Bak, VP Product Management, Cloud Messaging Services, Syniverse

COVID-19 has resulted in a fluctuation in application-to-person (A2P) messaging traffic that we’re seeing across the board. Most notably, we have seen a large spike in government and local agency emergency notifications, an increase in mobile promotion and delivery alerts in grocery, and an increase in one-time passwords and customer service alerts from social media companies. These industries have ramped up their outbound communications rapidly from February to March 2020 as a result of the pandemic’s continued widespread activity.

Just as swiftly, Syniverse has joined its mobile network operator customers, plus the broader mobile ecosystem, in the relief efforts with rapid implementation of best-in-class public warning systems and communications services, combined with global best practices and proven industry experience in managing these types of crises, to assist carriers in quickly disseminating critical information aimed at ensuring the safety and well-being of citizens in numerous large metropolitan areas across the world.

Dario Tumiati, Chief Development Officer, Agile Telecom

“The lower traffic in messaging has been exclusively on Retail marketing, linked to offline shops – and as these were closed they cancelled their campaigns.

However, notifications, transactions and alerts have shown a traffic uplift, that in part has compensated. For now, we can only sustain this situation.

The real challenge will be to understand the future of SMS messaging channel, after the markets will experience .”

Surash Patel, GM Messaging & VP, RealNetworks

“With the advanced analytics capabilities of our Kontxt platform we had the opportunity to observe the effect of the Covid-19 emergency on our partners’ networks and on the mobile messaging industry in general during the last few weeks in the USA.

There has been a clear increase in total volumes with, in some instances, up to 40% increase in various cases throughout March and we observed some interesting trends in terms of the composition of this traffic:

- We have seen the traffic mix shifting from marketing and promotional campaigns toward public health messages and notifications from companies, and health providers to their employees and customers.

- Health providers, religious organisations and companies have boosted their usage of A2P SMS to inform the public about changes in their services.

- Unfortunately, bad actors have been trying to use Covid-19 as a pretext for Fraud and Smishing: Kontxt detected and blocked a growing number of fraud messages promising free devices or subscriptions in order to cope with the Covid-19 lockdowns

Looking forward, we anticipate the potential for further abuse as fraudsters and scammers take advantage of governmental financial aid and deferred tax filings notifications in order to construct new campaigns to exploit the vulnerable and worried population.”

Sonia Sifo, Marketing & Communication Solutions Manager, Sparkle

“Sparkle is committed to play its part in fighting the current healthcare crisis: in this context, A2P SMS is also a means to share a wishful “Everything will be alright” with all our partners, customers and suppliers worldwide.

We recommend to use this tool for being closer to all the stakeholders, including employees, remembering that the SMS is able to reach anyone, anywhere.”

Dario Calogero, Chief Executive Officer, Kaleyra

“As a trusted multi-channel CPaaS (Communication Platform as a Service), Kaleyra has always been particularly focused on transactional notifications via APIs. Even if Europe remains an important part of our revenues, thanks to a combined effect of the business verticals of our customers (online banking, healthcare and government more than marketing, retail and transportation) and the kind of services that our platform provides, we didn’t experience a substantial negative effect on our overall business, even if it is a bit early to evaluate all the potential impacts.

In the interim, we foresee an acceleration in the digital transformation of many industries, resulting in a positive impact on CPaaS volumes. Our heart goes out to all the companies and families around the world that are suffering in these difficult times. We are willing to help every institution that can benefit from our services, for free, as we recently did for Croce Rossa Italiana (Italian Red Cross) by enabling an SMS number for doctors and nurses to apply for help.” – Find out more about our COVID-19 reponse here.

Anurag Aggarwal, Director - Messaging Services, Tata Communications Limited

“From an Indian perspective, we’ve started seeing sporadic cases of “struggle for bandwidth” i.e. with families staying indoor mostly, there is a tremendous consumption of existing internet bandwidth. This is leading to slower internet speeds across the country… I’m personally experiencing this and I’m sure it’s a similar situation across other countries as well, especially the developing ones.

Given the lockdown situation in most places, there are cases whereby internet-access has actually got restricted for some, because no service staff from the service-provider is available to fix the optical fibre disruptions etc. in every case that’s occurring.

Given the above two points, services such as SMS which are not data-dependant, at least for last-mile delivery, come into play and are a great support in delivering time-critical traffic to the end recipients. For brands using the MO (P2A) services as well, it’s another low-data-dependency technique to hear back from their customers for critical feedback.”

If you would like to contribute a comment to this article contact us at editorial@mefmobile.org or leave your thoughts in the replies below.

COVID19: Fake news hits mobile masts, real news shows mobile value

- Un-founded conspiracy theories have gone global on the web claiming 5G communication causes COVID19

- In the UK up to 20 incidents saw arsonists setting fire to 5G towers based on this claim

- Mobile services are helping people in this hard time: mobile payments, advertising, games, business communications are in strong demand

“Talk sense to a fool and he calls you foolish.” That was what Euripides said in the ‘The Bacchae’ tragedy about in 405 BC. Not much seems to have changed in the last 25 centuries.

The possibility that 5G microwave bandwidth might have caused COVID19, have been discredited – if not even laughed at in some instances – by the World Health Organisation (WHO) and national health institutes. Health authorities all categorically denied any link between the two. Nevertheless, misguided folks are preferring to vent their own foolishness and fears, rather than engaging in rational discussions. It is a real pity, the mobile industry is proving its value to support society in these difficult times, it does not deserve to have its infrastructure set on fire.

At MEF we pride ourselves of the fact that we give no advice on the COVID19 virus – we follow the guidance set from health authorities and learn from the debate of their experts. Our community trust the value of real knowledge and experience: it includes the top experts in the fields of mobile technologies, computing, finance, entertainment. Our members are practiced professionals that share their valuable experiences; we do no host social media natters. We have no epidemiologist in our community, so we are pleased to point you instead to these other trusted and proper sources:

- in 2014 the World Health Organisation stated that “no adverse health effects have been established as being caused by mobile phone use”.

- England’s National Medical Director Stephen Powis is reported saying: “The 5G story is complete and utter rubbish, it’s nonsense, it’s the worst kind of fake news.”

However, there is one area where MEF can speak authoritatively in the debate: the support of the mobile industry to the new challenges posed to society during the pandemic. The industry is working for the benefit of users across the globe, real facts supports that people have embraced mobile services during lock-down more than ever. The mobile ecosystem is helping the world in these difficult times.

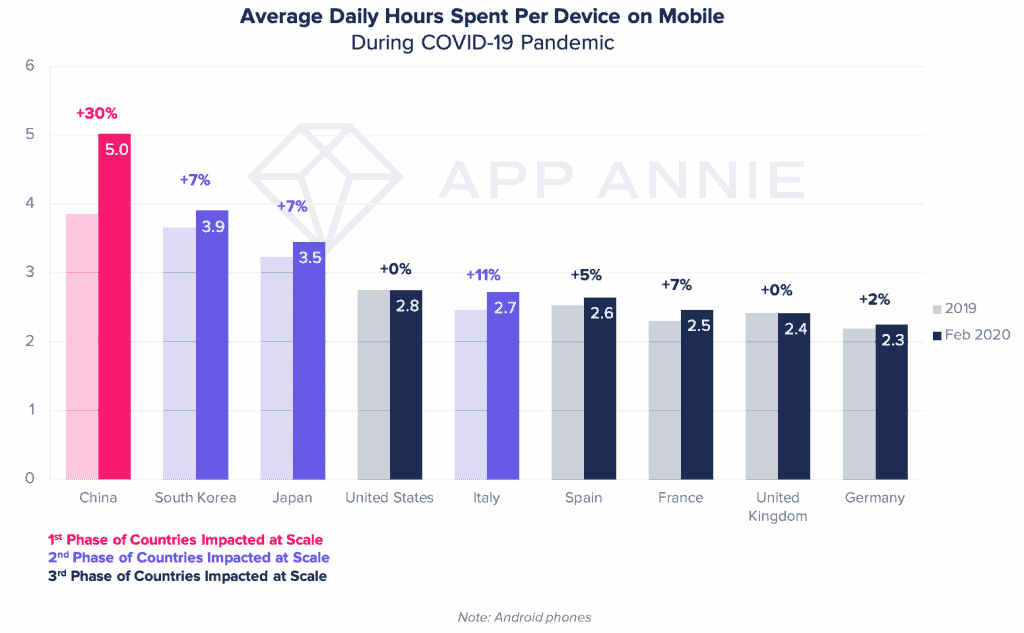

Half of the world’s population is reported to be in semi-quarantine, but they can connect, communicate, educate, work, manage their money via mobile services. Time spent on mobile has increased significantly according to AppAnnie, in both China and Italy. In China, the city lockdown began in January 2020, by the following month we could see daily time spent on mobile jump to 5 hours per day, an increase of 30% compared to the average for 2019. Italy, in the equivalent week of March 15, saw the second highest jump at 11%.

The industry is working for the benefit of users across the globe, real facts support that people have embraced mobile services during lock-down more than ever”

Mobile users are engaging in many ways. Financial services are probably one of the biggest growth areas monitored by MEF. The deVere Group reported an increase in usage of Fintech Apps of 72%. In Japan, weekly time spent on Android phones for the fintech app ‘au PAY’ grew by 20% from the previous week in the first week of March. During the same time period, the South Korean Fintech app ‘PASS by SK TELECOM’ also grew 20% in weekly time spent. In USA, the fintech app, ‘RobinHood’ saw a 50% growth in downloads in both Apple and Google App stores.

The success in downloads of mobile games is supported by hyper-casual games such as ‘Scrabble’, ‘SpiralRoll’, ‘DrawClimber’, and ‘Fishdom’ reaching the top ranks in downloads. Mobile games downloads have seen big growth in affected markets. In China, the average number of weekly game downloads in February 2020 went up 80% compared to 2019 figure (63 Million on iOS App Store alone). South Korea saw a 35% increase in late February 2020 (15 million downloads).

Online advertising has followed – PockeGamer.biz reports an increase in Real Time Bidding ads in the affected areas of China (173%), South Korea (56%); in Japan (30%) and Italy (16%).

At the same time, smartphone users are working and participating in lessons via Skype, Faceboook, RIngcentral, Zoom and Houseparty or company-secure messaging apps. The number of weekly hours spent on Mobile Business applications in China during lock-down has more than doubled (from 11 hours per week to 22). AppAnnie also reports that during the first week of March, 761,000 downloads of Business apps took place across iOS and Google Play in Italy — marking the biggest week ever for the category.

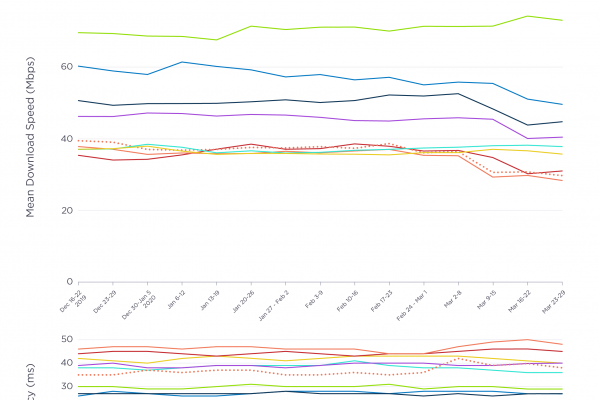

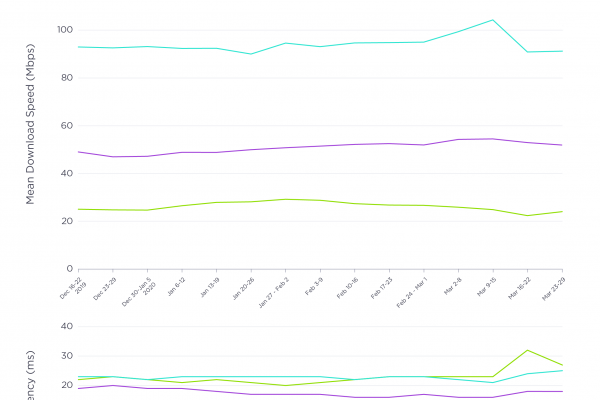

It is also worth reporting that overall despite the growth of traffic mobile networks are still faring well in connecting people. Reports from Ookla show that the networks broadband speeds have been impacted by the greater traffic, but they still maintain broadband speeds. The mobile industry infrastructure is working, but it will need additional capacity to keep up with the trends. People should welcome the positive impact of 5G networking expansions.