Meta has introduced new scam protection tools on WhatsApp and Messenger, focusing on safeguarding older adults from rising online fraud. The move reflects growing concern over digital crime targeting seniors and the need for stronger cross-platform defences. MEF CEO Dario Betti explains why these measures signal progress but highlight wider industry challenges.

Meta has announced new scam detection and warning features for WhatsApp and Messenger, targeted at fraud aimed at older adults.

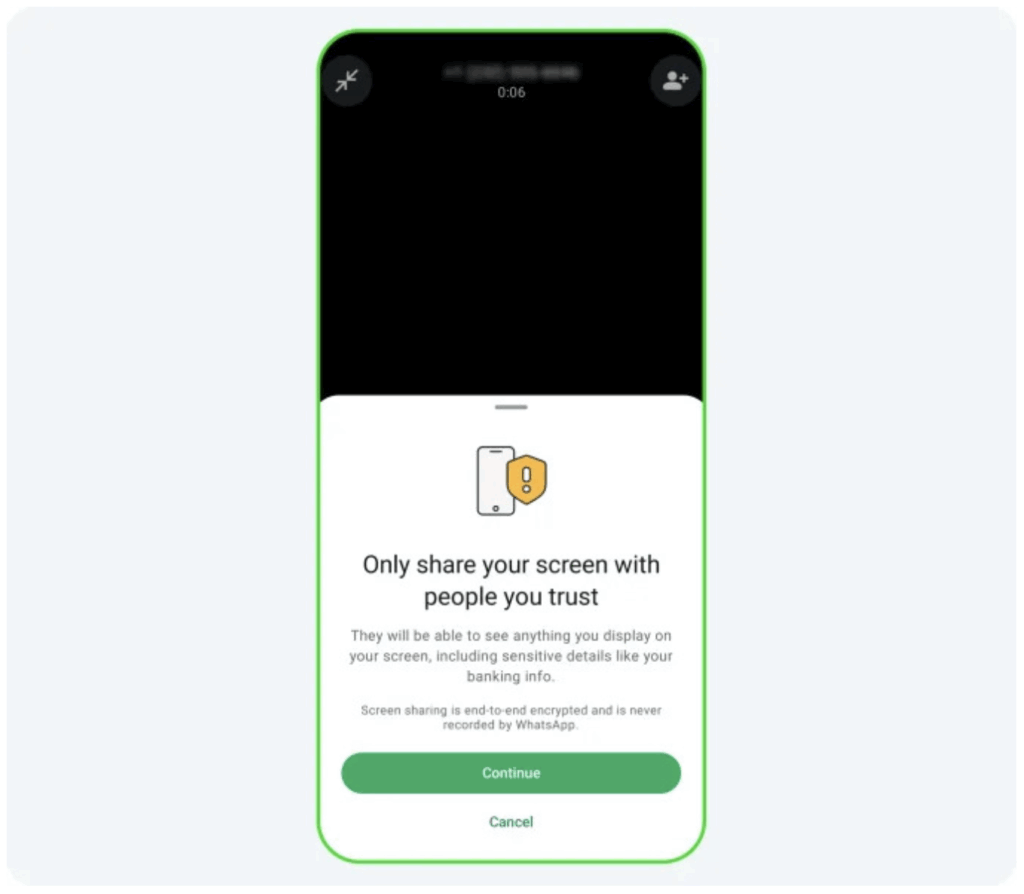

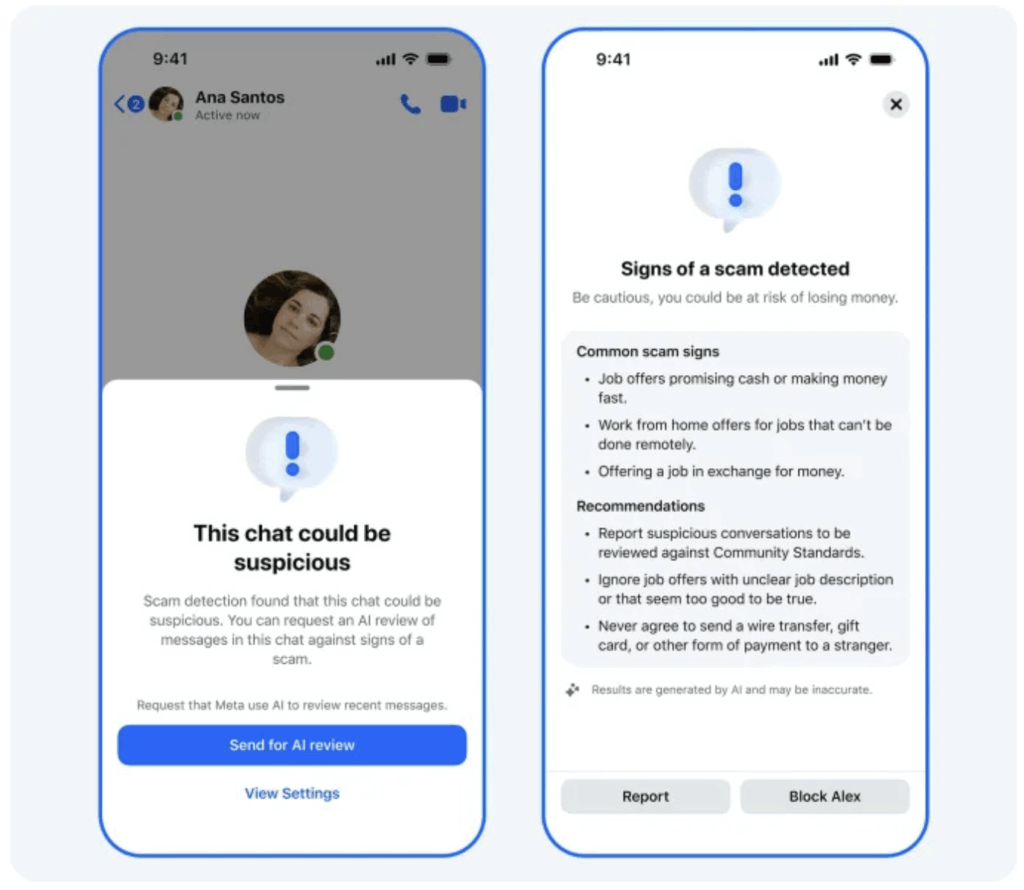

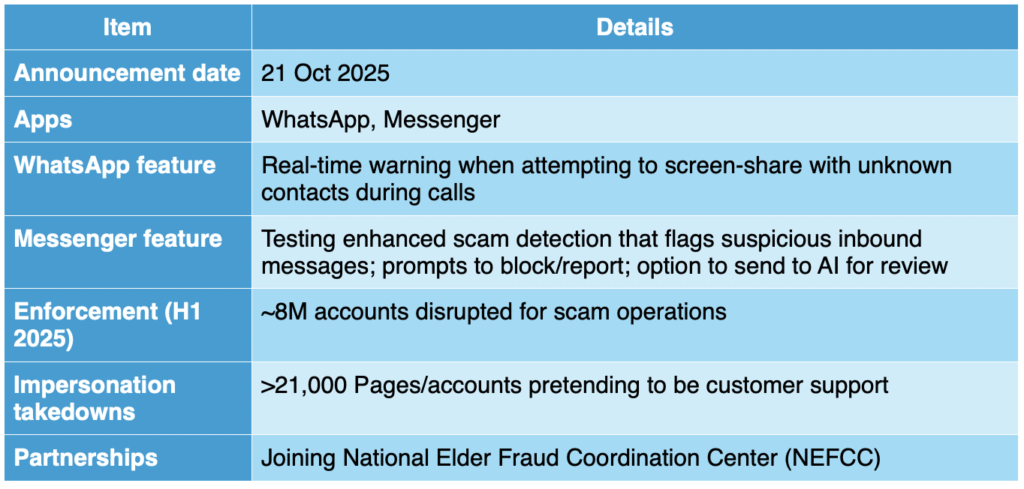

The update was disclosed on October 21, 2025, and forms part of Meta’s activities to address online scams on its platforms. According to the announcement, WhatsApp will now warn users when they attempt to share their screen with unknown contacts during calls, a common tactic used to capture sensitive information such as banking details and one-time passcodes. Messenger is also testing enhanced scam detection, flagging suspicious messages and prompting users to block or report, with an option to route content to AI for review. Meta says it disrupted about 8 million accounts engaged in scam operations in the first half of 2025 and took action on over 21,000 Pages and accounts impersonating customer support operations. Meta also noted it is joining the National Elder Fraud Coordination Center (NEFCC) to strengthen cross-industry efforts against elder fraud.

Meta’s newsroom has previously highlighted a series of contextual safety cards, reminders around common scam vectors (e.g., shipping, instant payments, and romance scams), and a WhatsApp Safety Center as part of ongoing safety work, though most were not specifically aimed at older adults.

In short, Meta’s updates are a meaningful step and a positive signal to the industry, but the bar for protecting older users should be end-to-end: from initial contact through to funds movement.”

The scale of fraud targeting seniors

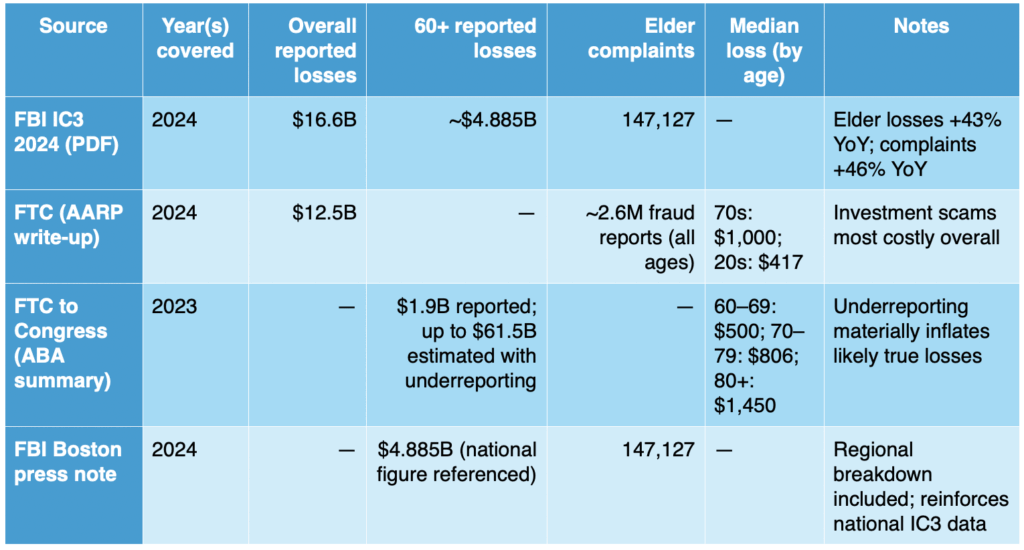

Independent data underscores why platform-level protections tailored to seniors matter:

- The FBI’s Internet Crime Complaint Center (IC3) reports that total internet crime losses hit a record $16.6 billion in 2024. Losses among victims aged 60+ rose sharply, with FBI citing $4.885 billion lost from 147,127 elder complaints in 2024—up 43% in losses and 46% in complaints year over year.

- The FTC’s 2024 data shows a record $12.5 billion reported lost to fraud overall, up 25% from 2023. Median losses increase with age: victims in their 70s reported a median $1,000 loss versus $417 for those in their 20s. Investment scams were the most financially damaging, and older adults bore outsized harm.

- Adjusting for underreporting, older Americans could have lost as much as $61.5 billion to fraud in 2023 alone, per the FTC’s report to Congress summarized by the American Bankers Association.

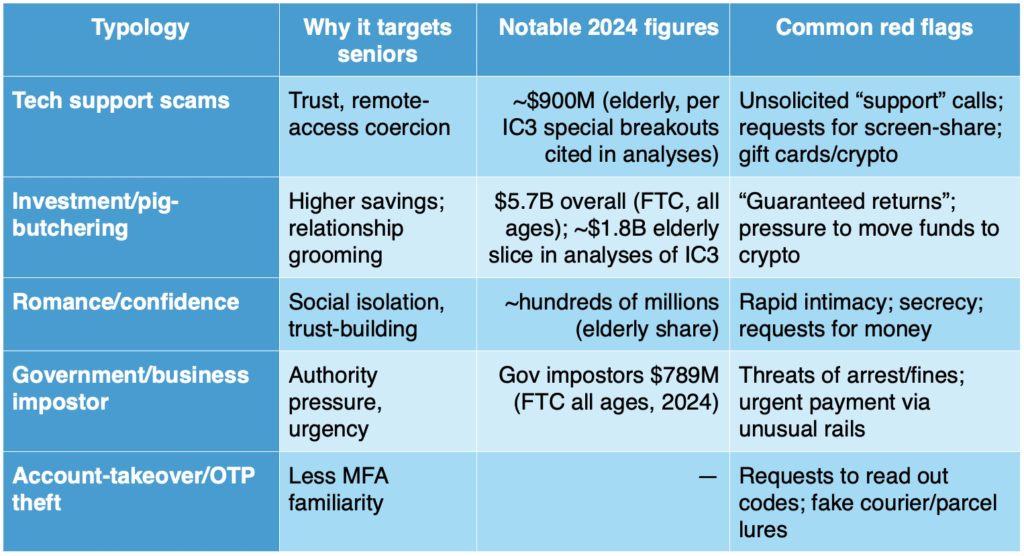

Beyond headlines, several dynamics drive elevated risk for seniors: targeted social engineering (including romance and tech support scams), higher accumulated savings, potential cognitive decline, and lower reporting rates due to shame or awareness gaps. The FBI notes that tech support, investment, and romance scams are particularly costly for older victims, with crypto and wire transfers common exit channels for funds.

Scam typologies most affecting seniors (indicative)

What Meta has announced and when

On WhatsApp, the company introduced a real-time warning system that activates when a user tries to share their screen with an unfamiliar contact during a video call. Screen-sharing is a common technique exploited by scammers to harvest personal and financial information, such as bank details, one-time verification codes, or passwords. Meta says the feature aims to disrupt these account-takeover and data-extraction attempts at the source, by encouraging users to pause and reconsider before exposing sensitive information.

Image: META

Meanwhile, on Messenger, Meta has begun testing advanced scam detection mechanisms designed to identify suspicious inbound messages in real time. When a message triggers warning signals—like offers of “easy cash” or work-from-home schemes—the system will issue a clear, in-app alert advising users to be cautious, with direct options to block or report the potentially fraudulent sender. Users can also choose to forward such messages to Meta’s AI review system for further analysis, allowing rapid improvement of detection accuracy and response speed across the broader platform.

Image: META

Implications for the wider mobile ecosystem

Assessment: progress, but gaps remain

Meta’s new safety features are a good start. They focus on the moments when scams are most likely to succeed, and Messenger’s AI can help catch problems faster than manual review. The scale of enforcement—8 million scam accounts disrupted, and 21,000 fake support pages removed—shows real momentum. Still, stronger protection for older users will require going beyond warnings. Meta should work with banks and wallets to pause risky payments, especially for international wires, until users can confirm they’re legitimate. It also needs clearer signals of identity and authenticity, with more verified business messaging, visible sender reputation, and default safeguards that slow down cold outreach and first-contact screen-sharing.

Because seniors use many channels SMS, calls, email, messaging apps, and social media—protections must feel consistent across all of them; fragmented defences create gaps scammers exploit. Finally, we would welcome Meta reporting the outcomes and metrics of these defences, show impact for people 60 and over, sand a potential best practice fort the entire industry. Sharing results will help the whole ecosystem learn what works and improve over time.

The Bottom line

Warnings, while valuable, might not be sufficient. Scammers adapt quickly, and informational prompts can habituate users unless paired with dynamic, risk-based controls and coordinated downstream protections. Given known high-loss typologies for seniors, platforms should move from “advise and alert” to “predict and prevent,” integrating:

- Transaction-aware safeguards via data-sharing with financial institutions and wallets to interrupt high-risk payments in real time.

- Stronger friction for first-contact scenarios, including cooling-off periods and guided verification flows when sensitive actions (screen-share, app installs, device control, or funds movement) follow a cold inbound communication.

- Greater use of verified sender frameworks and reputation scoring across messaging channels to reduce the reach of impostors.

- Continuous, independent evaluation of efficacy with public reporting by age cohort.

In short, Meta’s updates are a meaningful step and a positive signal to the industry, but the bar for protecting older users should be end-to-end: from initial contact through to funds movement. Coordinated, standards-driven action across the mobile ecosystem is the most credible path to materially reducing losses among seniors.