Telecom employment has fallen sharply from 1.8 million employees in 2015 to 1.3 million in 2024 as automation, AI and managed services reshape the industry. MEF CEO Dario Betti explores how the sector can strike a balance between operational efficiency and workforce growth to remain competitive in the AI era.

A job in a telecom operator was once a coveted lifelong employment. Not anymore. The telecom workforce has continuously shrunk in the last 10 years, according to research by Light Reading for the top 20 telecom groups.

We moved from 1.8 million employees in 2015 to 1.3 million in 2024. CFOs could claim this as the result of efficiency programmes but some of the CEOs and Chief Humar Resource Officers, might be asking the question: “Is the industry losing a talent war?”

The Acceleration of Job Reductions

Over the past two decades, telecom employment has entered a period of steady decline. Automation, digital self-service, managed services and network virtualization have all played a role. According to Light Reading, the combined workforce of the world’s 20 largest operators shrank by 52,000 jobs (4%) in just the last year. British Telecom (BT) alone plans to cut 10,000 jobs over the next seven years, much of it attributed to AI and automation SEO.AI.

This is part of a long-term trend: since the early 2000s, major operators in Europe and North America have reduced headcount by 30–50% or more, even as network traffic and service complexity have soared.

The challenge for the industry is to balance efficiency with innovation and workforce development. Upskilling, reskilling, and investing in new talent pipelines will be critical if telecoms are to remain competitive and relevant in the age of AI.”

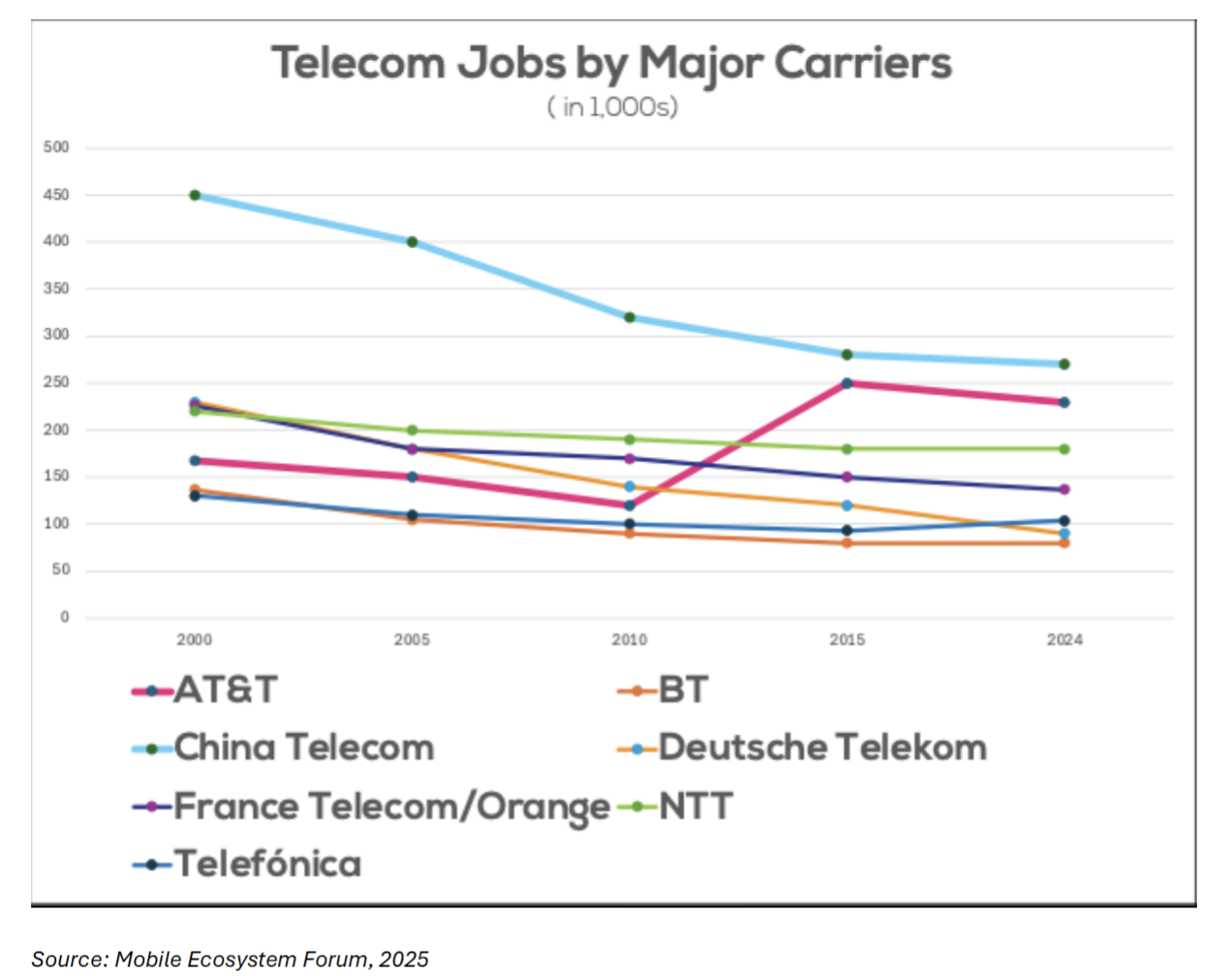

The following chart shows how all telcos saw a contraction in the workforce in the last 25 years, with the sole exception of two telecom groups. AT&T acquired multiple businesses including non-telecom assets such as Direct TV satellite business (in 2015) and Time Warner media group (in 2018) each adding about 25,000 employees to the headcount. Telefonica headcount increased only in the last 5 years: a slight increase in 2024 (104,000) compared to 2020 (93,000). Telefónica has participated in mergers that increased its headcount (while reducing its Latin America footprint), as well as an increased in the employees of its Technology division, a counter trend.

A Historical Perspective: From Expansion to Contraction

The question of telecom talent is not just an HR topic anymore; it is a strategic choice. The telecommunications industry has always been a bellwether for technological and economic change. Of late it has been a case for optimisation, rather than new skills.

From the days of switchboard operators and field engineers building new networks in the last two decades telecom are not talking about less human centric AI-driven, software-defined network. In the early and mid-20th century, telecoms were among the largest employers in many countries. National operators employed armies of technicians, engineers, customer service agents, and administrative staff. The rise of digital switching in the 1970s and 1980s began to automate many manual roles, but the sector continued to grow as new services (mobile, broadband, pay TV) proliferated. The 1990s and early 2000s saw a wave of privatization, deregulation, and global expansion. Telecoms invested heavily in infrastructure and customer acquisition, and employment remained robust. However, as markets matured and competition intensified, the focus shifted to efficiency and cost control.

Today, the development of the services and the infrastructure is moving outside of the traditional telecom companies -involving more and more global technology giants.

The Role of Managed Services

A less visible but equally significant factor in telecom job reductions has been the rise of managed services. Starting in the 2000s, many operators began outsourcing network operations, IT, and even customer service to specialist vendors—often global giants like Ericsson, Nokia, Huawei, IBM, and Accenture. Telecom players have looked for outsourcing technical know-how to companies that could offer economies of scale and offshoring.

Managed services contracts allowed telcos to convert fixed labour costs into variable expenses, access specialized expertise, and focus on core business functions. Telcoms became great acquirers of standard based solutions. However, this also meant that thousands of jobs were transferred off the telco payroll—sometimes to lower-cost regions, sometimes to third-party employers with different working conditions.

While managed services can drive efficiency and flexibility, critics argue that they have contributed to a loss of institutional knowledge, reduced career opportunities within telcos, and weakened the direct relationship between operators and their technical workforce.

AI and Automation: Efficiency or Just Cost-Cutting?

Today, the impact of AI and automation is unmistakable. According to Veritis, 70% of telecom companies report improved operational efficiency from AI, and robotic process automation (RPA) is slashing costs in areas like billing, compliance, and customer support Vodworks. AI-driven chatbots and self-healing networks are now standard, reducing the need for large call centers and field teams.

But is this relentless drive for efficiency making the industry better—or just smaller? While some job losses are offset by new roles in data science, cybersecurity, and digital services, the net effect is a leaner workforce. The McKinsey report notes that only 1% of telecom companies feel “mature” in their AI deployment, suggesting that many are still navigating the transition and may not be fully prepared for the workforce implications.

The Double-Edged Sword

The telecom industry’s transformation is a double-edged sword. On one hand, efficiency gains are real and necessary—networks are more reliable, services are more diverse, and customers benefit from faster, smarter support. On the other, the relentless focus on cost reduction—through both automation and managed services—risks hollowing out the industry’s talent base.

The challenge for the industry is to balance efficiency with innovation and workforce development. Upskilling, reskilling, and investing in new talent pipelines will be critical if telecoms are to remain competitive and relevant in the age of AI.

For more information or to join the Insight Group, please contact the MEF team at info@mobileecosystemforum.com.