LINK Mobility’s$145M acquisition of SMSPortal marks its first major move into Africa’s A2P messaging market. The deal, announced on June 2025, signals renewed CPaaS M&A activity and a shift in global strategy. With a 4.6x EBITDA multiple, LINK aims to diversify revenue and introduce advanced messaging solutions to South Africa’s fast-growing market. MEF CEO Dario Betti takes a deep dive into the move and what it means for the industry.

On June 24, 2025, the European cloud communications company LINK Mobility announced the latest of its long list of deals: the acquisition of SMSPortal, South Africa’s application-to-person (A2P) messaging provider, for up to$145 million.

This is not another move for scale though: it marks LINK’s first major foray outside Europe and signals a new phase in the evolution of the global Communications Platform as a Service (CPaaS) market. It also shows the trend in valuation in a market that some would describe as challenging.

A Strategic Leap into Africa

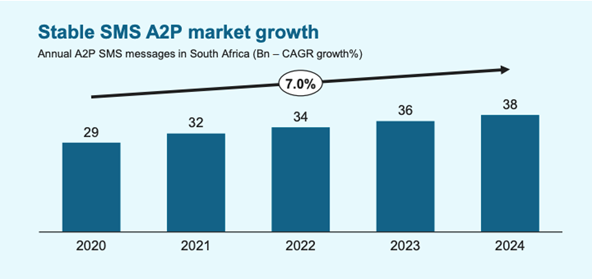

For LINK Mobility, headquartered in Oslo, a member of MEF, and listed on the Oslo Stock Exchange, the acquisition is more than just a geographic expansion. It’s a calculated step into a region where mobile messaging remains the dominant channel for business-to-consumer communication. South Africa, with its young, mobile-first population and a market that has seen SMS volumes grow at a 7% compound annual rate, offers fertile ground for innovation and growth.

Thomas Berge, CEO of LINK Mobility, described the acquisition as a perfect fit for the company’s long-standing M&A playbook. “We are pleased to announce the acquisition of SMSPortal, the number one player in an attractive market with further growth opportunities within the A2P market and high growth potential from introducing LINK’s more advanced CPaaS solutions,” he said. The deal, expected to close in the third quarter of 2025, will see SMSPortal continue to operate independently from its Cape Town headquarters, retaining its brand and leadership while gaining access to LINK’s broader suite of products.

The acquisition is an important health check for the industry: it comes at a time when the CPaaS sector show signs of renewed M&A activity, following a period of reduced deal flow in 2022–23. The dynamics in the industry are different: the CPaaS sector is showing signs of pressure on margins, higher MNO charges for SMS delivery”

The companies: European Serial Acquirer, South African Grower

LINK Mobility has built its reputation as one of Europe’s largest CPaaS provider, serving over 50,000 enterprise and SME customers across 30 countries and delivering more than 21 billion messages annually. The company’s growth has been fuelled by a disciplined acquisition strategy, with more than 35 deals in the past decade, always seeking strong local market positions, positive cash flow, and the potential for cross-selling higher-margin services.

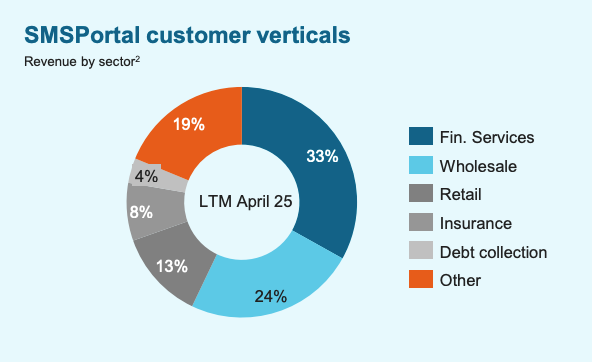

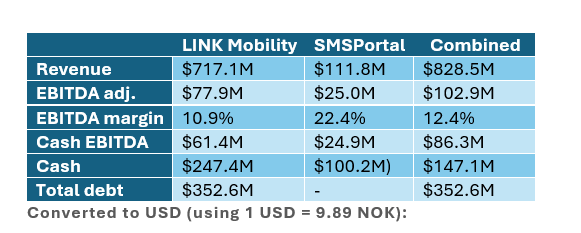

SMSPortal, founded in 2002, has been led since January 2024 by André Ittmann (previously at MNOs: Cell C, and Vodacom). It has become a strong player of South Africa’s messaging landscape. The company claims a stable base of over 5,100 customers, including major banks, retailers, and a long tail of SMEs. In the twelve months leading up to April 2025, SMSPortal reported $112 million in revenue and $25 million in EBITDA, with a robust 22% margin. Its growth trajectory has been impressive, with revenues climbing from $65 million to $112 million in just three years, driven by strong customer retention and a focus on enterprise clients.

Source: LINK Mobility

Source: LINK Mobility

For Ittmann, the deal represents an opportunity to accelerate SMSPortal’s evolution. “Being a part of a European industry leader like LINK enables us to enhance our product offering,” he said. “By leveraging LINK’s established expertise, resources and products, we can deliver better communications services to an even broader and more diverse local and international customer base, driving accelerated profitable growth with sustained high margins.”

The Rationale Behind the Deal

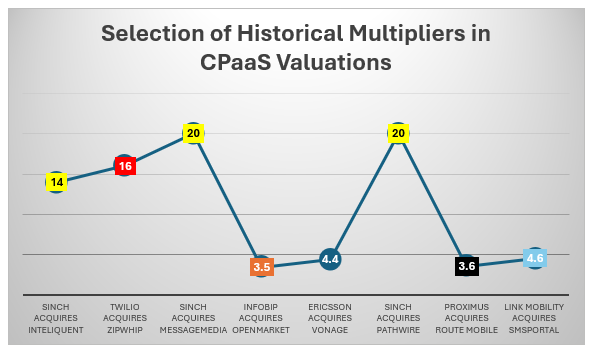

The acquisition is structured with an upfront cash payment of$100 million, a $15 million equity component, and a potential earn-out of up to$30 million, contingent on performance targets. The headline valuation—4.6 times cash EBITDA, rising to 5.8 times if all targets are met—is notably lower than LINK’s historical average for acquisitions, reflecting both the attractiveness of the deal and the normalization of valuations in the sector.

Market analysts have responded positively. Pareto Securities, for example, reiterated its buy rating on LINK and raised its target price, calling the deal “highly EPS-accretive and a logical first step in LINK’s non-European expansion.” DNB Markets highlighted the strategic hedge the deal provides against slower growth in Europe

The strategic rationale is clear. By acquiring SMSPortal, LINK not only diversifies its revenue base geographically but also gains a platform for cross-selling its higher-margin, more comprehensive CPaaS products. SMSPortal’s customer base, which has so far relied almost exclusively on SMS, now becomes a channel for LINK’s broader portfolio, including conversational messaging, payments, and chatbots. The deal also brings cost synergies, as the two companies can share global routing, billing, and compliance platforms. This new assignment now also provides SMSPortal’s customers with access to a world of LINK’s richer OTT messaging channels that stretch far beyond the humble SMS, to those such as RCS and WhatsApp which also boast impressive engagement rates with audiences.

LINK Mobility Previous Acquisition: FireText

Before its acquisition of SMSPortal, LINK Mobility expanded its presence in the UK market through the purchase of FireText Communications Limited. Announced and completed in April 2025, the transaction saw LINK Mobility acquire FireText for £9.7 million, or roughly 12 million US dollars at the time. This move has further strengthened LINK’s market share in the region.

FireText, based in the United Kingdom, is a provider of SMS messaging services with a focus on enterprise and SME clients. The company has built a reputation for reliable messaging solutions tailored to the needs of businesses across various sectors. By bringing FireText into its portfolio, LINK Mobility aimed to strengthen its position in the competitive UK messaging landscape, broaden its customer base, and enhance its local product offerings.

The industry is ready for consolidation (again..)

The acquisition is an important health check for the industry: it comes at a time when the CPaaS sector show signs of renewed M&A activity, following a period of reduced deal flow in 2022–23. The dynamics in the industry are different: the CPaaS sector is showing signs of pressure on margins, higher MNO charges for SMS delivery, increased fraud, higher investment on multiple channels (e.g. RCS, WhatsApp, Telco APIs). While the growth and outlook for the sector remains very positive: there are multiple factors that might change the fortunes of some players. LINK’s move into Africa is the first significant north–south CPaaS deal, suggesting that strategic buyers are once again willing to pursue growth through acquisition as valuations stabilize.

This trend is driven in part by the ongoing compression of margins in the A2P SMS business. As global blended margins have fallen, scale has become increasingly important. Larger players can negotiate better termination rates, spread compliance costs over greater volumes, and offer a broader portfolio of services to enterprise clients. At the same time, the need for product breadth is growing, as businesses seek unified APIs for SMS, RCS, OTT messaging, email, and voice.

Valuation: at 4.6x EBITDA historically low but rising

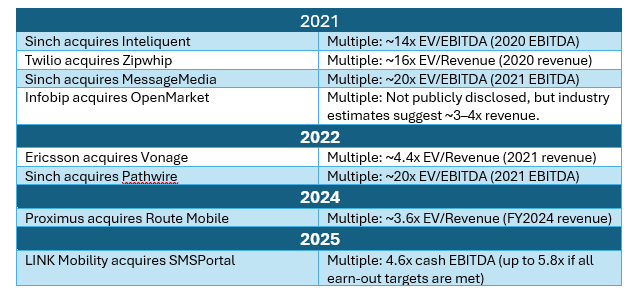

The golden era for CPaaS acquisitions and multipliers (acquisition multiples) have been the 2021-22 years, the post COVID appreciation for the digital transformation. Multipliers are typically referred to as a multiple of EBITDA or revenue, and they have ranged from about 3.5x to 16x, depending on growth and strategic value. The latest acquisition from LINK Mobility might point at an

Below you will find a table a summary of reported or estimated multiples for major CPaaS acquisitions from 2021 to 2025. The double digital

What Does This Mean for the Mobile Ecosystem?

For enterprises in the African region, the deal promises a more comprehensive suite of messaging and engagement tools, delivered through a single provider. Mobile operators may benefit from increased traffic volumes and more efficient billing, though they could also see their negotiating leverage diminish as the aggregator landscape consolidates. Developers and local innovators stand to gain from the introduction of richer API functionality, while regulators may welcome the entry of a well-capitalized, compliance-focused player.

The SMSPortal acquisition reduces the number of independent Tier-1 aggregators in South Africa from four to three, hinting at a gradual contraction of the global supplier base. Yet with thousands of local ISVs and niche providers still active—and with the monetization of rich messaging and CPaaS services only just beginning in many emerging markets—the ecosystem remains vibrant and full of opportunity.

Next at MEF

LINK Mobility’s acquisition of SMSPortal is more than a headline deal; it’s a signal that the CPaaS industry is entering a new phase of global integration and innovation. As the sector matures, the need for scale, product breadth, and geographic diversification will only grow. If LINK can successfully integrate SMSPortal and unlock the promised synergies, it will set a precedent for further consolidation—and for the continued evolution of the mobile messaging ecosystem.

To stay informed, prepared and connect with your peers, join the MEF Enterprise Communications Insight Groups.