Google Play’s move into third-party digital gift cards marks a subtle but meaningful expansion of how mobile platforms enable everyday value exchange. The shift hints at new dynamics in payments, brand reach, and the wider mobile ecosystem as stored-value options evolve. MEF CEO Dario Betti explains how this development may shape opportunities and challenges for industry stakeholders.

Google is piloting a feature inside Google Play that lets users buy third‑party digital gift cards directly in the Play Store, expanding the platform from app and in‑app purchases into broader “stored‑value” retail.

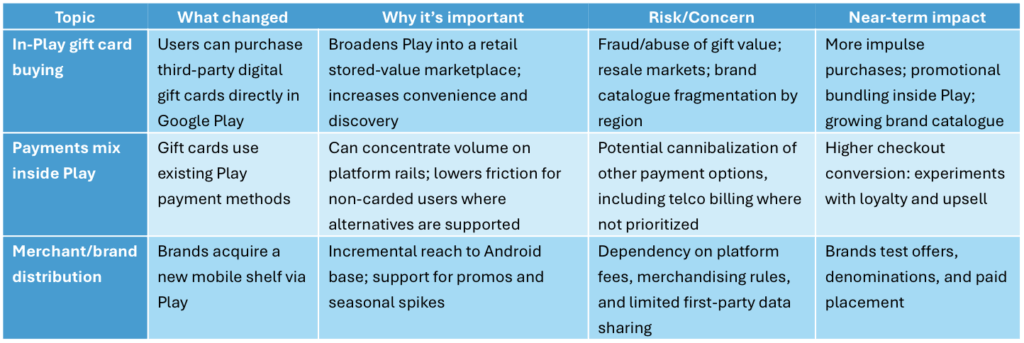

The cards would include non-digital services such as food stores and retailers, a divergence from the typical digital apps sales of the app stores. Fulfilled instantly and reportedly powered by partners like Blackhawk Network, the flow uses existing Play payment methods and could integrate with loyalty (e.g., Play Points), making it a convenient, high‑intent mobile shelf for brands. For the mobile ecosystem, this concentrates more consumers’ spend inside platform‑controlled funnels. It is a reminder that MNOs could leverage privacy‑preserving network signals to help harden fraud controls and co‑market gift‑card bundles tied to plans. Direct Carrier Billing has a new, high‑frequency use case to consider for monetisation as well as new fraud challenges, and promotional strategies to compete. The move is strategically sound for Google, but watch for regional catalogue fragmentation, platform fee dependencies for merchants, and elevated fraud risks typical of liquid stored value.

Key takeaways

Google Play’s in‑app gift card purchasing is a logical extension of the store into mainstream digital value.”

Implications for MEF members

Google Play added a new “Gift cards” entry in the profile/account menu that lets users buy and send third‑party brand e‑gift cards (retail, dining, travel, entertainment), in addition to Google Play credit. Cards are delivered by email or SMS with a redemption link/code. Users can also find it by searching “gift cards” in Play. Rollout began in early October 2025 and is live in at least the US, UK, and Mexico, with value ranges that vary by brand and daily limits in some regions. The marketplace is powered by Blackhawk Network (BHN), a large branded-payments distributor. Google says brands will get placement across search, in‑app promos, and curated deals. Reported “Top brands” include Starbucks, Disney, Target, AMC, Adidas, DoorDash, Bass Pro Shops, Delta Airlines, and of course Google Play. Denominations commonly range from $10–$500 depending on the merchant. Coverage indicates the feature is rolling out regionally; Android Authority notes availability in the US, UK, and Mexico at launch, with examples like a $250/day purchase cap in the US. The Play Store is “quietly” becoming a digital gift‑card marketplace or “mall,” positioning it to compete with Amazon/PayPal gift card hubs and to drive more commerce through Google’s payments stack.

Implementation details

Here is how the service will work for users:

- Discovery: Profile icon → Gift cards, or search “gift cards.” There is a carousel of “Top brands” and category filters (Retail, Fashion, Beauty, Dining, Entertainment, Home, Travel, Electronics)

- Flow: Choose brand and amount, select a card design, enter recipient email or phone, optional message; delivery via secure link by email/SMS with redemption instructions.

Analytical review: Google expands app stores to non-app values

Google’s pilot plays to its strengths: by tapping Google Play’s massive distribution, account identity, and built‑in payment rails, it can capture meaningful share of the gift‑card market without launching a separate wallet, reinforcing its broader consumer‑commerce story on Android. The user experience is designed for low friction, familiar checkout, instant digital delivery, centralized receipts, and likely tie‑ins with Play Points. Still, the rollout will face practical constraints: brand catalogues and timing will differ by country based on licensing and partner deals; merchants gain reach but accept platform fees and limited first‑party data; and, as with any liquid stored value, early fraud patterns. Issues such as promo abuse, and resale arbitrage are likely until market‑specific limits, velocity controls, and risk thresholds are fully calibrated.

Bottom line

Google Play’s in‑app gift card purchasing is a logical extension of the store into mainstream digital value. For MNOs and DCB providers, the upside lies in considering this use case or becoming an aggregator of pre-paid value digital store cards. The near‑term play is to secure rail placement, align fraud/reporting standards, and test bundles that tie carrier value to branded stored value.

Join MEF’s Interest Group on Mobile Payments to discuss what are the impacts on the mobile ecosystem.