Governments worldwide are increasingly banning or restricting messaging apps like WhatsApp, Telegram, and Viber over security, compliance, and sovereignty concerns. In June 2025 Russia is launching a state-run alternative and the U.S.is banning WhatsApp from official devices, MEF CEO Dario Betti explores the global impact on messaging platforms and the implications for providers navigating a fragmented, regulation-driven communications landscape

In mid‑2025, significant developments have reignited the ongoing trend toward restrictions, bans, and even state-run messaging alternatives worldwide. From Washington, D.C. to Moscow, public authorities are increasingly scrutinising peer-to-peer (P2P) messaging apps due to concerns around data security, digital sovereignty, and trust.

Russia’s State Messaging App: Digital Sovereignty in Focus

On June 24, 2025, President Vladimir Putin signed legislation authorising the development of a new state-owned messaging app, designed to replace Western platforms such as WhatsApp and Telegram. The state-owned app should allow access to government services as well: it will integrate identity verification and document signing, reinforcing the Kremlin’s pursuit of “digital sovereignty.”

While pitched as a tool for national resilience, critics warn it could become a lever for surveillance and content control. Mikhail Klimarev, of the Internet Protection Society, flagged concerns that Russia might throttle competitors—especially Meta’s WhatsApp and the widely used Telegram—to coerce user migration. Russia has already banned some international platforms including LinkedIn and Viber.

Governments around the world are growing increasingly cautious of encrypted and un-auditable platforms, particularly in sensitive sectors or regions where monitoring dissent or criminal activity is a priority.”

WhatsApp Ban in U.S. House: Trusted App Now Viewed as a Risk

Meanwhile, in Washington, the U.S. House of Representatives has banned WhatsApp from staff devices, citing security vulnerabilities. The Office of Cybersecurity labelled WhatsApp as high-risk, pointing to unclear data management practices and weaknesses in encrypted data storage. Staff are encouraged to use alternatives like Microsoft Teams, Signal, or Wickr.

This action follows previous bans on TikTok, Microsoft Copilot, and other apps, reflecting a trend of tightening scrutiny over foreign platforms across government IT infrastructures.

Telegram: A Repeated Target of Restrictions

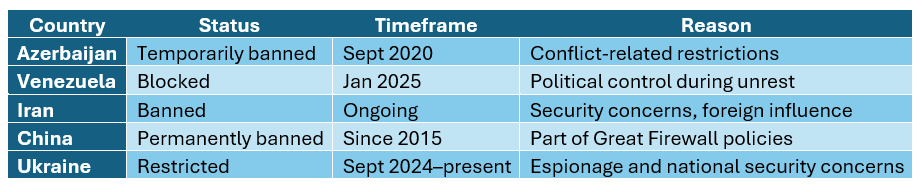

Though once hailed as a champion of privacy and freedom of speech, Telegram has become a frequent target for censors. Governments cite national security, hate speech, and coordination of protests as reasons for bans:

A 2023 analysis found 31 countries had restricted Telegram at some point. While some bans are temporary, many reflect enduring concerns over its role in unmoderated content dissemination or foreign influence operations.

A 2023 analysis found 31 countries had restricted Telegram at some point. While some bans are temporary, many reflect enduring concerns over its role in unmoderated content dissemination or foreign influence operations.

Viber: Caught in the Crossfire

While less prominently featured in headlines, Viber—an app particularly popular in Eastern and Southern Europe, the Balkans, and parts of Asia, including the Philippines, Greece — has also faced government blocks:

- Russia: In December 2024, Russia’s Roskomnadzor blocked Viber over legal non-compliance and content takedown refusals. Prior fines in 2023 had signalled tightening scrutiny.

- Saudi Arabia: As early as 2013, Saudi Arabia banned Viber, citing surveillance limitations and pressure from licensed telecom providers.

- Pakistan (Sindh Province): Viber was blocked for 3 months in October 2013, alongside Skype and WhatsApp, in response to security threats.

- Occupied Donetsk and Luhansk: In June 2022, Viber was reportedly restricted by pro-Russian authorities due to military concerns.

- Other Countries: Reports indicate intermittent blocks or VoIP restrictions in UAE, Egypt, and Qatar, affecting Viber’s usability.

Other OTT Platforms: LinkedIn, TikTok, Zoom

While P2P messaging apps are in the spotlight, broader OTT platforms—including LinkedIn, TikTok, and Zoom—have also faced bans or severe restrictions. LinkedIn was blocked in Russia in 2016 for failing to comply with data localisation laws, marking one of the earliest major Western platforms excluded on sovereignty grounds. Following that it was banned in Kazakhstan in 2021, and China in 2023.

TikTok has faced bans or restrictions in India (2020), parts of the U.S. government (2022–2025), and recently in the EU, citing concerns over privacy, data access by foreign governments, and influence over public discourse. Even enterprise platforms like Zoom have been barred from certain government use cases. Countries that have restricted or banned the use of Zoom include:

- Taiwan banned Zoom for government agencies,

- Germany restricted its use in the foreign ministry.

- Cuba, Iran, North Korea, Syria, and parts of Ukraine (Crimea, Luhansk, and Donetsk regions) have restricted access to Zoom due to regulatory reasons

Why Are Messaging Apps Being Banned?

Governments around the world are growing increasingly cautious of encrypted and un-auditable platforms, particularly in sensitive sectors or regions where monitoring dissent or criminal activity is a priority.

This concern is fuelling a broader movement toward digital sovereignty, as seen in countries like Russia and India, where there is a concerted effort to build self-sufficient digital ecosystems and reduce reliance on USA-based technology firms, thereby maintaining tighter control over national communications. At the same time, regulatory compliance is becoming a central requirement, with institutions such as governments and banks demanding applications that can log communications, enforce retention policies, and provide audit trails—capabilities that many consumer apps are not designed to offer.

Platform accountability remains inconsistent, as content moderation and legal compliance vary widely across services, often prompting enforcement actions when governments believe platforms are hosting harmful, false, or extremist content.

Implications for MEF Members

As this trend continues, it creates new challenges—and opportunities—for MEF member organisations:

Compliance-Ready Products

There is growing demand for enterprise-grade messaging platforms that can provide secure messaging alongside audit trails, retention policies, and administrative controls. Some of the public messaging app will not be adapt for internal messaging usage. Private or secure app messaging platforms are going to increase in market relevance.

Navigating Fragmented Markets

A bifurcation of the global messaging ecosystem is unfolding. And that is true for business messaging as well. Members such as CPaaS platforms that are operating across regions may need to adapt to varying regulatory regimes and even develop regional variants of their apps.

Interoperability and Standards – good news for RCS?

With RCS emerging as the de facto replacement for SMS on both Android and Apple devices, its position as a universal messaging standard is set to strengthen from this fragmentation. However, Google’s central role in operating RCS peer-to-peer services may eventually draw increased scrutiny from certain governments. In short, while RCS currently enjoys a significant advantage, this may not be permanent.

Looking Ahead: The Messaging Balancing Act

With P2P messaging platforms caught between privacy ideals and national priorities, the future likely lies in a hybrid approach—combining strong encryption with transparent data management, regional compliance options, and verifiable moderation protocols.

The momentum toward state-managed apps and state bans poses fundamental questions: can interoperability survive political borders? Will user trust shift toward local or independent providers? And how will the industry adapt to the rising tide of digital sovereignty? How should the mobile ecosystem respond?

Let’s continue the conversation—this issue touches on the very core of our connected digital future.

Responsible adoption, clear compliance frameworks, and ongoing regulatory clarity will determine whether fantasy sports apps become a lasting pillar of mobile content—or face the fate of many early VAS products disrupted by regulation or market distrust.

The MEF ‘Content, DCB & Advertising’ Insight Group will continue to monitor and explore this important trend. We invite MEF members to contribute to our working group discussions on:

- The classification of fantasy sports and real-money apps in mobile ecosystems

- Operator and app store policy development

- The balance between monetisation and consumer protection

For more information or to join the Insight Group, please contact the MEF team at info@mobileecosystemforum.com.

View the Global Messaging Bans: Summary Table