The digital music landscape is evolving rapidly, as streaming platforms reshape how audiences engage and how creators earn. With hybrid revenue models gaining ground and global markets driving the next wave of growth, the balance of power continues to shift. MEF CEO Dario Betti explores how YouTube and Spotify signal the next phase of music streaming maturity.

When YouTube announced it paid out $8 billion to the music industry in the 12 months between July 2024 and July 2025, my first reaction wasn’t surprise at the headline number.

It was recognition that we’re witnessing what people swore would never happen: people are paying for digital music services. If you like me, lived in the Napster era, you might remember the nay sayers were the large majority. Even more the maturation of ad-supported and subscription hybrid models as legitimate, scalable revenue engines for content creators and rights holders. The music industry is not getting squeezed by the digital platforms, but it brings home 18 billion from 2 players (Google and Spotify).

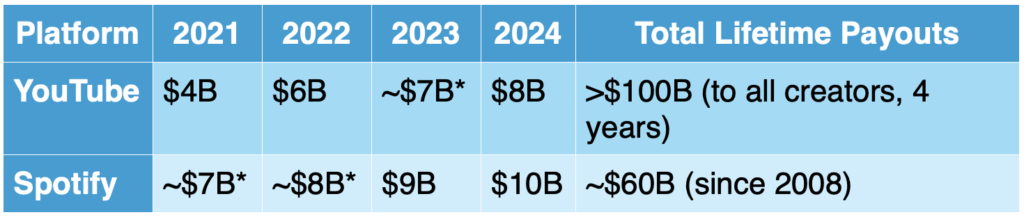

The Numbers Tell a Story of Consistent Growth

YouTube’s trajectory is instructive. The platform paid out $4 billion in 2021, $6 billion in 2022, and now $8 billion in the most recent 12-month period. That’s a compound annual growth rate of roughly 26% over three years—impressive by any standard, and particularly notable in a maturing market.

But context is everything. Spotify paid out $10 billion to the music industry in 2024 alone, up from $9 billion in 2023. Over the past decade, Spotify’s annual contributions have grown 10x. It went from around $1 billion in 2014 to $10 billion in 2024 and totalling nearly $60 billion since its founding.

Platform Payouts to Music Industry (Historical Comparison)

*Estimated based on growth trajectory

YouTube’s $8 billion payout to the music industry represents more than a financial milestone; it’s evidence that hybrid revenue models, mobile-first consumption, and global distribution platforms can create sustainable value for content creators, rights holders, and technology platforms alike.”

The “Twin Engine” Model: Ads Plus Subscriptions

What makes YouTube’s achievement particularly relevant to the mobile ecosystem is its dual-revenue approach. YouTube operates with over 125 million Music and Premium subscribers globally (as of March 2025, up from 100 million in February 2024), alongside 2 billion logged-in viewers who watch music videos each month. The ad-supported tier generates significant revenue while serving as a conversion funnel to premium subscriptions. This is a model that mobile operators and digital service providers have long understood but struggled to execute at scale.

Spotify, by contrast, has built its empire primarily on subscriptions, though it too operates a freemium model. With 252 million Premium subscribers as of Q3 2024 and 640 million monthly active users, the platform has demonstrated that more than 60% of Premium subscribers were once free-tier users.

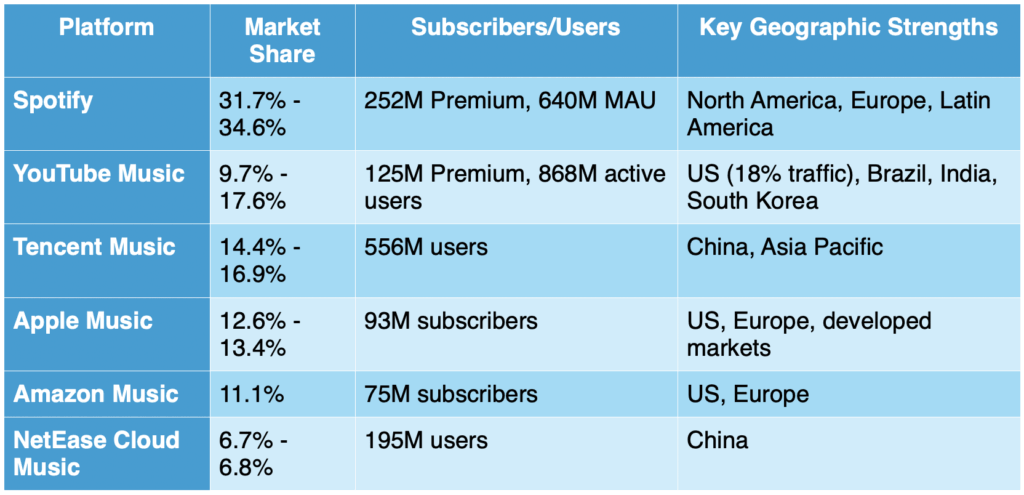

Market Share and Geographic Strengths

The global music streaming landscape is dominated by a handful of players, each with distinct geographic and demographic strengths.

Global Music Streaming Market Share (2024-2025)

Sources: MIDiA Research, Business of Apps, Statista

YouTube Music’s market position is complex. While it holds a relatively modest 9% global market share in pure music streaming, its integration with the broader YouTube ecosystem gives it unparalleled reach. The platform is available in over 100 countries and supports 80 languages.

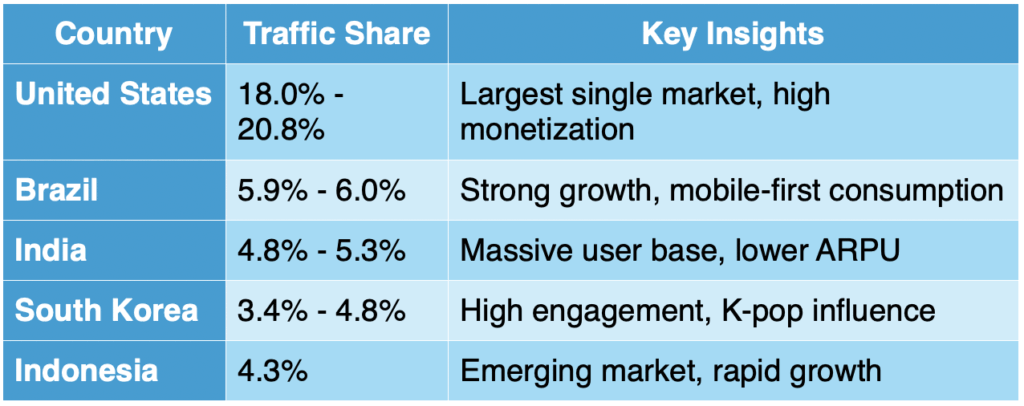

YouTube Music Traffic by Country (2025)

Source: SimilarWeb, What’s The Big Data

The geographic distribution reveals YouTube Music’s strength in mobile-first markets, precisely the territories where MEF members operate and where the future of digital consumption is being written. India, Brazil, Mexico, and Nigeria represent the next frontier for music streaming growth, and both YouTube and Spotify are investing heavily in these regions.

Benchmarking the Music Streaming Ecosystem

To understand YouTube’s $8 billion in context, we need to examine the broader music streaming market, which has become the dominant revenue source for the global music industry.

Global Music Streaming Market Size and Growth

The music streaming industry has experienced explosive growth over the past decade: 2024 Market Size: $46.7 billion to $47.1 billion and the 2025 Projected: $51.9 billion to $58.8 billion (Sources: Grand View Research, Research Nester, Coherent Market Insights).

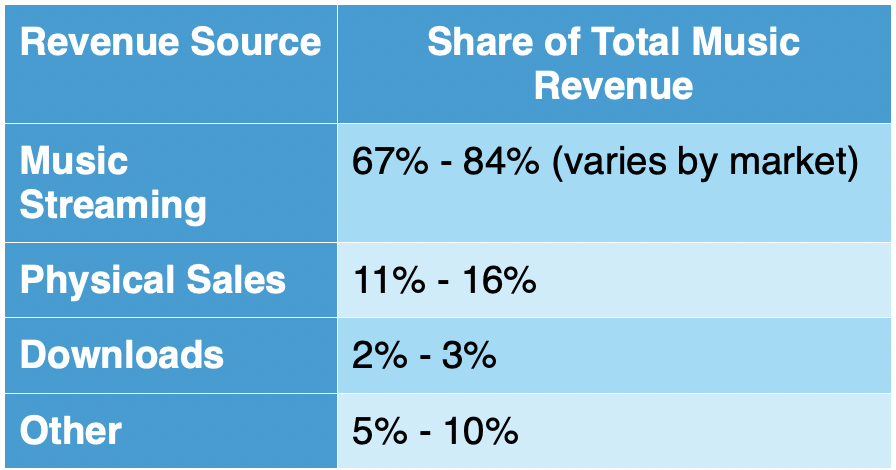

Music Streaming’s Share of Total Music Industry Revenue

In the United States, streaming accounts for a staggering 84% of music industry revenue, while globally the figure sits at 67%. This dominance represents a complete inversion from the CD era, when physical sales ruled and digital was an afterthought.

What This Means for the Mobile Ecosystem

At MEF, we’ve long argued that the mobile ecosystem thrives when multiple players can build sustainable businesses on shared infrastructure and open standards. The music streaming market exemplifies this principle: Spotify, YouTube Music, Apple Music, Amazon Music, and regional players like Tencent Music and JioSaavn all coexist, compete, and collectively grow the pie.

The Takeaway

YouTube’s $8 billion payout to the music industry represents more than a financial milestone; it’s evidence that hybrid revenue models, mobile-first consumption, and global distribution platforms can create sustainable value for content creators, rights holders, and technology platforms alike.