WhatsApp is piloting new limits on messages sent to users who haven’t replied, signalling a shift in how the platform manages engagement and spam. MEF CEO Dario Betti discusses what these changes could mean for users, brands, and the broader messaging ecosystem.

WhatsApp is piloting a monthly cap on how many messages individuals and businesses can send to people who haven’t replied in October 2025. The company hasn’t disclosed exact thresholds and is A/B testing limits across multiple countries.

Users approaching the cap will see a warning pop-up, and once the cap is hit, further sends to non-responders are temporarily blocked until a response arrives. WhatsApp says typical users won’t notice changes; the aim is to curb spammy “blast” behaviour, especially prevalent as the app has expanded from personal chats to groups, communities and business messaging.

The policy extends a broader shift that began in 2024 with limits on business marketing sends, a native unsubscribes for business promotions, and broadcast caps that have been expanding, particularly in India, one of WhatsApp’s largest markets. See coverage and context at TechCrunch: the new test announcement, earlier business message caps, unsubscribe control, and broadcast limits.

For the Mobile Ecosystem Forum, this is an opportunity to formalise engagement-gated best practices. MEF could convene a working group to standardize reply-rate KPIs, opt-in and cadence frameworks, and cross-channel integrity guidelines…”

From a market perspective, the timing is significant. WhatsApp’s footprint reached roughly 3.0 billion monthly active users (MAU) by March 2025, with more than 100 million in the U.S. and hundreds of millions concentrated in high-usage markets like India and Brazil. Daily usage at global scale translates into more than 100 billion messages every day (some estimate around 150 billion), and roughly 7 billion voice notes sent daily. When a platform of this size pivots from volume to engagement, the ripple effects touch brand CRM playbooks, CPaaS routing and compliance logic, and even channel mix decisions across RCS, SMS, email, and in-app push.

The practical mechanics are straightforward: every outbound message to someone who hasn’t replied counts toward a monthly ceiling; a single response exempts that conversation from further counting. Because thresholds are currently undisclosed, planning requires conservative “safety budgets” and an operational bias toward eliciting replies quickly. That in turn favours messages that deliver immediate value and provide low-friction reply paths (for example, clear question prompts or quick-reply choices).

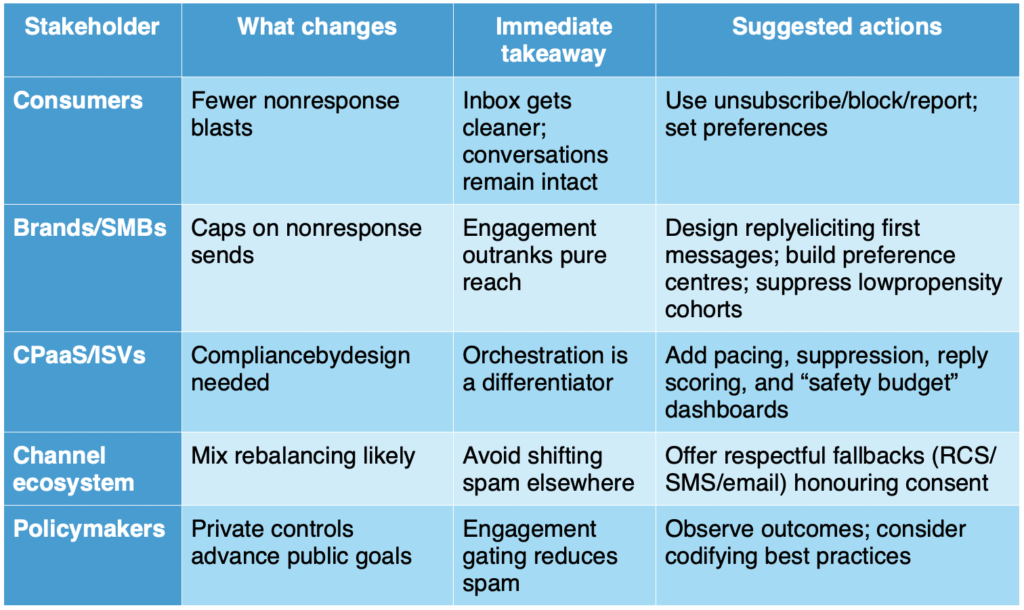

For consumers, the likely outcome is a cleaner inbox with fewer unsolicited blasts, without disrupting two-way conversations they choose to continue. For brands and SMBs, campaign design will shift toward explicit opt-ins, preference centres, double opt-in flows, and sequencing that privileges engagement overreach. For CPaaS and ISVs, orchestration and compliance-by-design become differentiators: pacing, deduplication, suppression, and predictive reply scoring will be needed to keep programs within caps while preserving outcomes.

This change comes with open questions. Without transparent caps, modelling will rely on observed hit rates and warnings, which can vary by market. Engagement gating may inadvertently suppress outreach to quiet but interested users, pushing teams to use gentler re-engagement prompts and clearer value exchange.

Regional norms matter: in India, where WhatsApp doubles as a commerce and community rail, the constraints could feel tighter and may accelerate the adoption of preference-led journeys. Still, the direction aligns with global anti-spam norms. Rather than adjudicating content, WhatsApp is using a measurable signal—recipient response—as the primary control.

For the Mobile Ecosystem Forum, this is an opportunity to formalise engagement-gated best practices. MEF could convene a working group to standardize reply-rate KPIs, opt-in and cadence frameworks, and cross-channel integrity guidelines that prevent “policy arbitrage” (simply shifting blasts to other channels). It can also advocate for platform transparency around thresholds and definitions, along with diagnostics and appeals to reduce false positives. Toolkits tailored to SMEs—templates for preference centres, double opt-ins, and first-message designs—would speed adoption. And aligning these practices with regulatory expectations would give the ecosystem a shared, outcome-based baseline for consentful messaging.

For brands and CPaaS providers, the near-term to-do list is clear: audit unreciprocated send volumes; redesign first messages to deliver immediate utility and prompt a simple reply; expose preference controls early; implement market-level safety budgets with automatic pacing and channel fallbacks that respect consent; and elevate reply-rate, time-to-first-reply, and opt-in recency as north-star metrics. Those who master engagement will find caps less of a constraint and more of a forcing function toward higher-quality conversations.