This month Indonesia’s communications regulator temporarily suspended TikTok’s licence for failing to fully share livestream data from August protests, citing alleged links to gambling. MEF CEO Dario Betti discusses the growing trend of states using platform registration rules to enforce compliance and governance, and the broader pressures on global social media platforms in managing data disclosure, costs, and political scrutiny in key markets.

In October 2025, The Indonesia regulator suspended TikTok’s licence over its failure to fully share livestream data from August 2025 protests, citing alleged gambling links. While TikTok remains accessible and is negotiating, this administrative action highlights growing state control over social media data, especially during unrest. It underscores a global trend of leveraging platform registration to compel compliance, content governance, and the mobile ecosystem’s operational costs in key growth markets.

A complex time for social media access regulation

From Jakarta to Cupertino to Kathmandu, OTT platforms are being squeezed by a new, harder edge of digital governance. Indonesia’s standoff with TikTok over protest livestream data signals a shift from reactive moderation to hard-coded compliance. On the same day as the Indonesia announcement Apple removed ICEBlock, an app for tracking immigration enforcement officers, from the App Store citing safety risks flagged by law enforcement. Fox News reported the USA Attorney General Pam Bondi requested the takedown. And in Nepal, 3 weeks earlier public pushback against tighter social media access reveals the political costs of blunt restrictions. Together, these flashpoints sketch a global rulebook in the making: states are asserting real-time leverage over high-velocity platforms, while tech firms race to engineer crisis governance into the product itself.

Key Takeaways

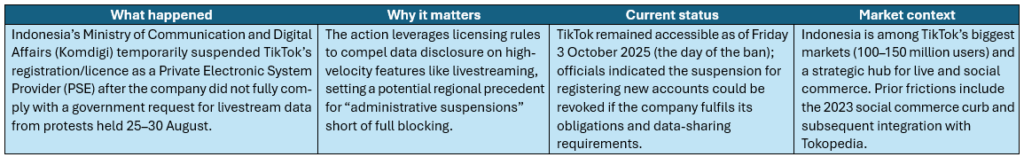

Indonesia’s temporary suspension of TikTok’s licence sits at the intersection of platform governance, public order, and the rapid monetisation of livestreaming. The decision, announced by the Ministry of Communication and Digital Affairs (Komdigi), followed a request for traffic, livestream, and monetisation data covering nationwide protests between 25 and 30 August. Officials said TikTok provided only partial information and argued that this fell short of obligations for registered electronic system providers. The ministry’s chosen instrument was not a blackout order but an administrative suspension of the platform’s registration, a lever that exerts pressure while keeping the service reachable. That nuance mattered immediately: despite official action, users were still able to access the app on Friday.

Indonesia’s temporary suspension of TikTok’s licence sits at the intersection of platform governance, public order, and the rapid monetisation of livestreaming. The decision, announced by the Ministry of Communication and Digital Affairs (Komdigi), followed a request for traffic, livestream, and monetisation data covering nationwide protests between 25 and 30 August. Officials said TikTok provided only partial information and argued that this fell short of obligations for registered electronic system providers. The ministry’s chosen instrument was not a blackout order but an administrative suspension of the platform’s registration, a lever that exerts pressure while keeping the service reachable. That nuance mattered immediately: despite official action, users were still able to access the app on Friday.

TikTok’s response sought to balance two imperatives that increasingly collide in major markets: the need to comply with lawful data requests and the company’s commitments to user privacy. The platform underlined respect for local law and confirmed it was engaging “constructively” with the ministry to find a resolution. During the protests themselves, TikTok had voluntarily paused its live feature for several days to maintain what it called a safe and civil environment. Officials in Jakarta framed their data request around a specific harm vector—alleged monetisation of livestreams by accounts tied to online gambling—suggesting the inquiry is not only about speech but also about payments and commerce that flow through live video.

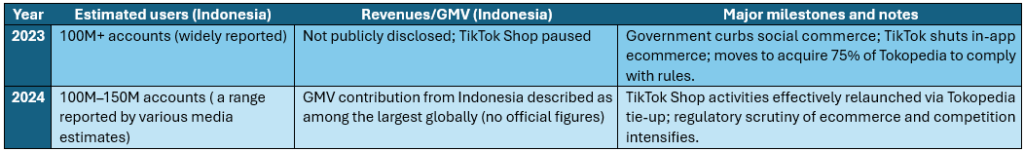

TikTok in Indonesia: second biggest market after the USA

The stakes are significant because Indonesia is arguably TikTok’s most important market outside the United States by audience (Tik Tok is not available in China). It is reported that the app has got 100 million accounts in Indonesia, and the market is central to user growth, creator communities, and advertiser reach. It is also pivotal to the company’s social commerce ambitions. Throughout 2024, Indonesia has been described in market reporting as one of the largest contributors to TikTok Shop’s global GMV, even as precise, country-level revenue disclosures remain unavailable.

The stakes are significant because Indonesia is arguably TikTok’s most important market outside the United States by audience (Tik Tok is not available in China). It is reported that the app has got 100 million accounts in Indonesia, and the market is central to user growth, creator communities, and advertiser reach. It is also pivotal to the company’s social commerce ambitions. Throughout 2024, Indonesia has been described in market reporting as one of the largest contributors to TikTok Shop’s global GMV, even as precise, country-level revenue disclosures remain unavailable.

TikTok regulatory friction in Indonesia

For the industry, the strategic response is clear. Compliance and crisis governance need to be engineered into the product, not bolted on after the fact, especially in the very markets driving the next wave of growth”

After the Indonesia government curtailed ‘social shopping’ in 2023, citing the need to protect small businesses, TikTok moved to acquire a 75% stake in Tokopedia the local e-commerce champion and route commerce through that domestic marketplace. Regulatory friction is therefore not a new story in Indonesia. What is new is the prominence of livestreaming as a governance flashpoint. Live formats merge expression, payments, and real-time audience dynamics in ways that stretch familiar content policies. As protests escalated in late August, livestreams became a conduit for documentation, mobilisation, and commerce. The government’s subsequent focus on monetisation data underscores how live video can blur the lines between speech and economic activity, making compliance a cross-functional challenge spanning trust and safety, payments, data retention, and legal policy.

The ecosystem shift: regulationg OTT solutions

For the broader mobile ecosystem, the Indonesian move echoes a pattern the Mobile Ecosystem Forum has tracked globally.

Until recently the communication sector was regulated by overseeing the national telecom licensed operators; today states increasingly intervene with over-the-top apps ( OTT’s). States prefer administrative levers: licensing regimes, app-store eligibility, data localisation, and expedited lawful access pathways, over blunt, nationwide bans. MEF’s earlier analysis of the spread of messaging and social app restrictions and the rise of state-aligned alternatives outlined how these tools are deployed most aggressively during periods of civil unrest. Indonesia’s action follows that playbook, using registration status as a compliance pressure point while retaining the option to escalate to technical blocking if talks fail. In practical terms, this approach can be more scalable for regulators and less socially disruptive than an outright shutdown, which is why it may propagate across the region.

Others took a more drastic approach: India banned TikTok in June 2020, citing national security and data privacy concerns after deadly border clashes with China. The ban targeted TikTok and 58 other Chinese apps, claiming they transferred user data without authorization, posing risks to India’s sovereignty and security. Although the ban remains in place, discussions about potential easing of tensions between India and China have raised speculation about the ban’s future.

The immediate implications radiate beyond a single app. Building privacy-preserving logging, configurable retention, and well-governed disclosure pathways is fast becoming table stakes for market access. Creators and brands that depend on live commerce must plan for platform volatility—maintaining multi-platform strategies and ensuring that fulfilment and payments can shift quickly. Mobile operators and app stores, for their part, will continue to face rapid-response requests from authorities and will need documented, repeatable due-process protocols to navigate competing obligations.

From Moderation to Mandates: Southeast Asia’s New Playbook

What happens next in Jakarta will be watched across Southeast Asia. If TikTok and Komdigi agree on a structured data-sharing framework for live events (and monetisation data) it could serve as a template for adjacent markets. If talks stall and authorities escalate toward network-level restrictions, risk premiums on social commerce and creator revenues would rise, and local competitors could gain ground. Either way, the trajectory reinforces a broader truth from MEF’s prior work: the governance of high-reach, high-velocity mobile services is moving from reactive moderation toward hard-coded compliance. For the industry, the strategic response is clear. Compliance and crisis governance need to be engineered into the product, not bolted on after the fact, especially in the very markets driving the next wave of growth.