X (formerly Twitter) faced another turbulent quarter in 2025. While there were some signs of recovery, the platform continued to grapple with financial pressures, advertiser caution, and intensifying competition. MEF CEO Dario Betti discusses the social media platform’s search for a more sustainable role in the evolving digital ecosystem.

X has reported another turbulent quarter. There are positives but there are also dark trends for a business models that has been in constant reset since Elon Musk’ acquisition.

Revenue for the three months through June 2025 hit roughly $707 million – down 2.2% from the first quarter despite a 20% lift from the equivalent period in 2024. At first glance, that yearonyear growth looks like recovery. But beneath the surface, the numbers reveal a platform fighting for its commercial future, weighed down by debt, still tinged by a dose of advertiser scepticism, and facing fierce competition from rivals like Meta’s Threads.

The signal loss in X’s ad business

Advertising still makes up the lion’s share of X’s income. And here lies its problem: while political spending helped Q1 look promising, Q2 stripped that boost away. The underlying trend is fragile. Advertisers remain hesitant, citing concerns about brand safety and shrinking user numbers.

X’s financial accounts paint a picture of decline dressed as recovery.”

X closed out 2022 – Musk’s takeover year – with $4.4 billion in revenue. By 2024, that had shrunk to $2.6 billion. At today’s trajectory, X may bring in around $2.9 billion in 2025. That’s still far from Musk’s original projection of $26 billion by 2028. And with $1.2 billion in annual debt servicing costs, X is barely breaking even.

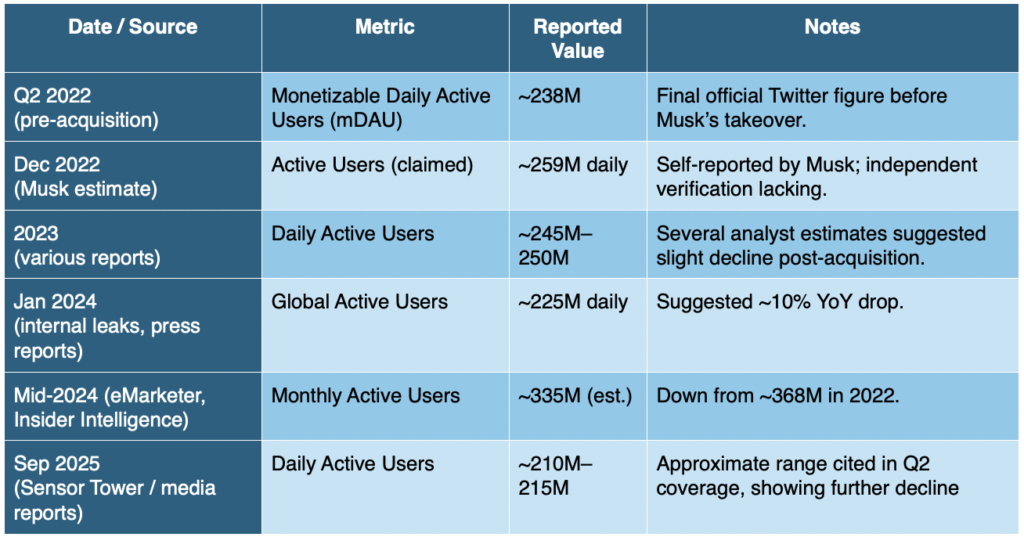

Since Elon Musk’s acquisition in 2022, X’s active user base has been on a clear downward trajectory, despite occasional claims of growth. The platform peaked at just under 260M daily actives in late 2022, but by mid‑2025 most analyst estimates place the figure at around 210–215M DAUs, a decline of nearly 20% in three years.

Subscriptions aren’t the safety net

Musk envisioned X Premium, the consumer subscription product, and new financial/payments tools as alternate revenue pillars to advertising. In practice, these are still establishing themsvels. “X Money” remains delayed by regulators. Premium subs account for about $200 million in annual revenue — helpful, but marginal.

Instead, the company has leaned heavily into AI. The X app has been merging the platform with xAI. Because X now serves as the data source for training the AI models of xAI (using social posts, realtime trends, and conversation streams), the former twitter services gets a cash injection as a payment for its data. This activity was described by Bloomberg to bring to X $500 million by yearend in 2025, rising to $2 billion in 2026. This figure is enough to prop X up in the short run. However, this is an internal payment, not a market value based by comparable services. The value of data in future is not certain. However, this might signal a pivot: X the app functioning more as an input engine (generating data for the xAI algorithms using post data) than as a standalone advertising powerhouse. This model would be an interesting turn in the finance and mission of X.

The competitive squeeze

Meta’s Threads continues to add momentum while X daily usage wanes. This highlights a market realignment: advertisers are not just shuffling budgets between platforms, they are recalibrating their risk tolerance. Platforms that cannot guarantee scale and brand safety seems to be deprioritized. For mobile advertisers, Threads coupled with TikTok and Instagram form a strong triad of growth in budgets. X, by contrast, feels increasingly niche. X is increasingly important in political and cultural debates ( and the relevant advertising markets) but weakened in commercial credibility ( the commercial markets).

What it means for the mobile ecosystem

X’s stumbles are less about one company and more about an industry pivot.

First, usage is not enough, engagement is driving advertisers’ decision. Raw usage isn’t enough; advertisers demand trusted environments with predictable outcomes and consistent activities with brands. Instagram and Tik Tok are good examples where brands create communities.

Buyers are diversifying spend across a growing number of platforms, no single player can dominate as Twitter once aspired to. The fragmentation of the social media, micro blogging side is now evident, and it hurst the once sole player more than anyone else.

xAI is propping up X financial. And this underscores a broader truth: the next competitive battles are being fought not over ad inventory, but over data for AI models. Social feeds are being reframed as training pipelines.

Why MEF members should care

For those in mobile, messaging, and digital services, the X story is a cautionary tale: diversification of both revenue base and audience trust is nonnegotiable. Reliance on one business model, in this case advertising, leaves companies exposed to user churn and brand perception volatility.

It also raises strategic questions: if X devolves into little more than an AI data engine, does that alter the landscape of digital communications? And if advertisers increasingly shift to “safer” ecosystems, what opportunities exist for mobile intermediaries and service providers to capture displaced spend?

X’s financial accounts paint a picture of decline dressed as recovery. The company can probably limp along, buoyed by xAI cash. But its position in the mobile ad economy is diminished, perhaps irreparably.