Snap Inc.’s Q2 2025 delivered 8.7% revenue growth to $1.34B and an 8.6% DAU increase to 469M, yet net losses widened to $262.6M amid escalating infrastructure and R&D costs. North American growth slowed, offset by stronger international gains. Monetization remains constrained. MEF CEO Dario Betti explains the company is strategically balancing near-term performance with long-term AI and AR investments.

Snap Inc. the messaging platform, delivered mixed results in its second quarter of 2025, demonstrating resilience in user growth and revenue expansion while grappling with rising operational costs and regional market challenges.

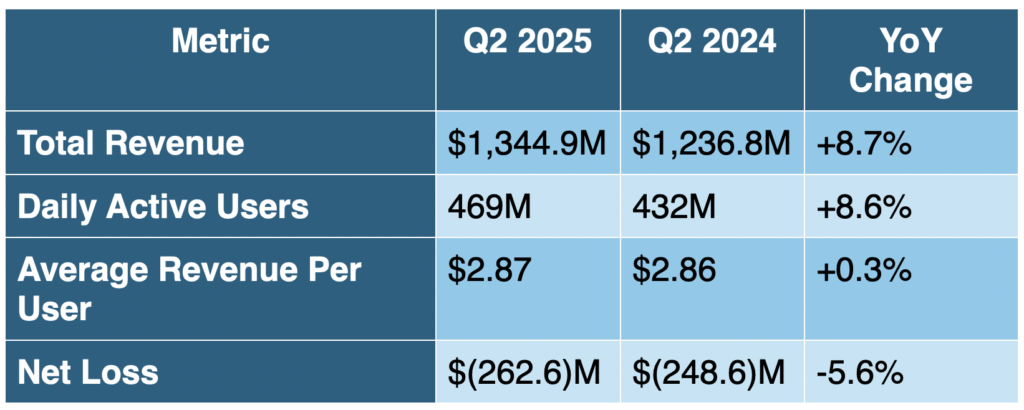

The social media platform reported revenue of $1.34 billion, representing an 8.7% year-over-year increase, alongside Daily Active User (DAU) growth of 8.6% to reach 469 million users globally. However, the company’s path to profitability remains elusive, with net losses widening to $262.6 million compared to $248.6 million in the prior year period.

The quarter highlighted Snap’s strategic pivot toward emerging technologies, particularly artificial intelligence and augmented reality, while facing headwinds in its core North American market.

These results show the evolving dynamics within the mobile ecosystem, where platforms must balance immediate monetization pressures with long-term technological investments. Can Snap invest fast enough into monetisation?

Financial Performance: Growth Amid Rising Costs

Snap’s revenue growth of 8.7% to $1.34 billion demonstrates the platform’s continued ability to expand its business despite challenging market conditions. The increase was primarily driven by a $41.5 million boost in advertising revenue, supported by expanded advertising delivery within Spotlight and Creator Stories. Global advertising impressions volume increased approximately 15% year-over-year, though this was partially offset by a 10% decrease in cost per advertising impression, reflecting inventory growth outpacing advertising demand.

Snap’s investments in AI and AR technologies highlight the importance of emerging technologies in maintaining competitive positioning within the mobile ecosystem. ”

The company’s Average Revenue Per User (ARPU) remained relatively flat at $2.87, up just one cent from the previous year, indicating challenges in monetization efficiency despite user base expansion. This modest ARPU growth suggests that while Snap is successfully attracting users, converting that engagement into meaningful revenue remains a persistent challenge.

Cost Structure and Operational Efficiency

Snap’s cost structure reveals the company’s significant investments in infrastructure and technology development. Cost of revenue increased 10.9% to $653.3 million, outpacing revenue growth and contributing to margin compression. This increase was primarily attributed to:

- Infrastructure costs: $43.5 million increase driven by DAU growth and investments in machine learning and AI capabilities

- Content and developer partner costs: Fees paid to content creators and publisher partners through revenue-sharing arrangements

- Advertising partner costs: Third-party fulfillment services and transaction processing fees

Research and development expenses rose 9.1% to $443.3 million, reflecting Snap’s continued commitment to innovation and product development. Meanwhile, sales and marketing expenses decreased 3.2% to $257.9 million, suggesting improved efficiency in user acquisition efforts.

Regional: North American Challenges and Global Opportunities

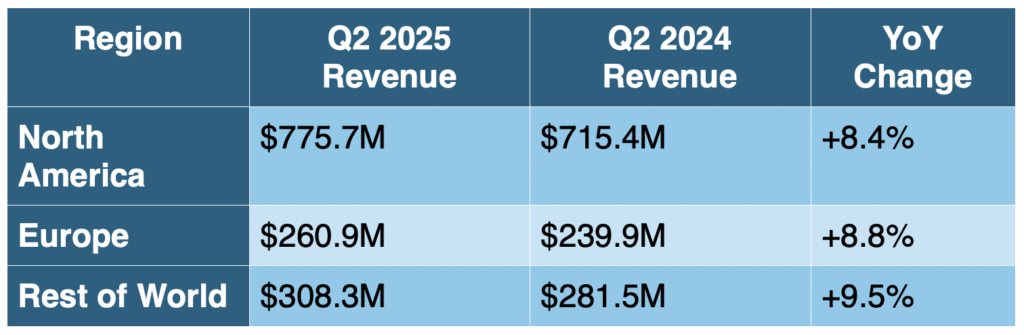

While Snap achieved revenue growth across all regions, the company faces distinct challenges in its most lucrative market. North America, which generates the highest ARPU, experienced modest user growth headwinds. The region’s revenue growth of 8.4% was the slowest among the three geographic segments, reflecting both market saturation and competitive pressures from established social media platforms.

Europe showed steady performance with 8.8% revenue growth, while Rest of World markets demonstrated the strongest momentum at 9.5% growth. However, these emerging markets typically generate significantly lower ARPU, creating a structural challenge for overall monetization as the user base shifts toward lower-revenue regions.

The company noted that platform policy changes and restrictions have particularly impacted North American revenue, affecting targeting, measurement, and optimization capabilities. This has resulted in reduced advertising effectiveness and, consequently, lower advertising revenue potential in the region.

Strategic Initiatives: Betting on AI

Snap’s AI strategy represents a significant strategic shift, with the company investing heavily in machine learning capabilities and AI-powered features. The deployment of “My AI,” an artificial intelligence-powered chatbot launched in 2023, exemplifies this. However, this initiative has not been without controversy, as the U.S. Federal Trade Commission referred a complaint to the Department of Justice in January 2025 regarding potential risks to young users.

The company’s approach to AI appears focused on enhancing user experience and advertising effectiveness rather than building proprietary large language models. This strategy of leveraging existing AI infrastructure while developing specialized applications may prove more cost-effective than competing directly with AI giants like Google and OpenAI.

Augmented Reality and Hardware Ambitions

Snap continues to position itself as a leader in augmented reality technology, with ongoing investments in AR glasses development. While specific financial details about this initiative were not disclosed in the quarterly results, the company’s commitment to AR represents a long-term bet on the next computing platform.

Creator Economy and Snap Stars Program

The company’s investment in content creators through programs like Snap Stars has shown results, with the program reportedly achieving 145% year-over-year growth in North America during Q2 2025. This growth in creator partnerships has contributed to expanded advertising delivery within Creator Stories, supporting overall revenue growth.

The revenue-sharing arrangements with content creators and publisher partners represent both an opportunity and a cost center for Snap. While these partnerships drive user engagement and advertising inventory, they also increase content and developer partner costs, impacting overall margins.

Mobile Ecosystem Implications

Snap’s Q2 2025 results illuminate several trends affecting the broader mobile ecosystem. The company’s experience with platform policy changes, particularly Apple’s iOS privacy updates, demonstrates the vulnerability of advertising-dependent business models to external platform decisions. This dynamic has forced mobile app developers and social media companies to diversify revenue streams and reduce dependence on traditional advertising models.

The shift toward subscription revenue, evidenced by Snap’s Snapchat+ growth, reflects a broader industry trend toward direct monetization models. This evolution suggests that successful mobile ecosystem participants must develop multiple revenue streams to maintain growth and profitability in an increasingly challenging advertising environment.

Snap’s investments in AI and AR technologies highlight the importance of emerging technologies in maintaining competitive positioning within the mobile ecosystem. Companies that fail to adapt to these technological shifts risk obsolescence as user expectations evolve and new interaction paradigms emerge.

This analysis is based on Snap Inc.’s Q2 2025 10-Q filing published on August 5 2025, and represents the company’s performance for the quarter ended June 30, 2025.

To learn more about MEF and how membership can support your business objectives, visit the MEF website or contact the membership team at info@mobileecosystemforum.com.