The newly merged Fastweb + Vodafone’s H1 2025 results show stable €3.6B revenues, with ICT and “beyond-core” growth offsetting telco declines. Fixed–mobile integration boosts customer retention, while Italy’s telecom sector sees modest growth. MEF CEO Dario Betti explores whether measured consolidation can curb price wars, enhance value services, and strengthen long-term industry resilience.

The first half of 2025 results for the newly merged Fastweb + Vodafone combine offer an early—and encouraging—signal that the consolidation wave in Italian telecommunications may be beginning to work.

Why These Numbers Matter at an Industry-Level

The mid-year results from the Fastweb–Vodafone partnership have provided one of the first concrete datapoints in assessing whether Europe’s latest telecom consolidation wave can finally deliver on its promise: moving the sector away from relentless price competition and towards sustainable value creation. The alliance, which integrates fixed and mobile network capabilities, was announced as a strategic pivot away from chasing subscriber volumes at all costs. Instead, the focus is now on quality of service, value-added offers, and long-term customer retention. Six months in, the data suggests that the transition is on track, the celebratory champagne bottles are still chilling in the fridge, but the signs are good.

According to the latest figures, revenues remain stable. This is an important achievement in a market where traditional telecom service income has been under pressure for years. Declines in pure telco revenues are being offset by growth in ICT services and “beyond the core” offerings such as cybersecurity, cloud, and IoT solutions. This is not merely a financial reshuffling; it reflects deeper shifts in customer demand, as businesses and households increasingly integrate digital services into daily operations and lifestyles.

Fixed–mobile integration is a key factor here. Bundled offers and seamless connectivity across home, office, and on-the-go scenarios are not just upselling tactics—they are becoming the expectation for a part of the market. By combining Vodafone’s mobile reach with Fastweb’s fixed-line strength, the partnership can offer more compelling converged products, increasing customer stickiness and lowering churn rates.

If the Fastweb–Vodafone trajectory holds, it could bolster the case for measured consolidation as a remedy to Europe’s long-standing telecom profitability challenges.”

Of course, caution is warranted. The Fastweb–Vodafone partnership is still young, and other market integrations are at varying stages of execution. History shows that not all mergers achieve their promised synergies—misaligned cultures, regulatory hurdles, and integration costs can dilute gains. Furthermore, increased market concentration will draw ongoing scrutiny from regulators concerned with preserving competition and consumer choice.

Peer markets offer a mixed picture. In Spain, the integration of MásMóvil and Orange has similarly aimed to rebalance pricing power, while in the UK, the Vodafone–Three merger seeks to unlock investment in 5G and fixed–mobile convergence. Early indicators from these markets also point to modest revenue stabilization, but the jury is still out on long-term impacts.

If the Fastweb–Vodafone trajectory holds, it could bolster the case for measured consolidation as a remedy to Europe’s long-standing telecom profitability challenges. The industry’s ability to invest in network modernization, digital services, and customer experience will increasingly depend on such structural moves. In other words, Italy might be offering a preview of a future where fewer but stronger operators can finally break the cycle of shrinking margins and build the resilience needed for the next wave of technological transformation.

What Does the Broader Market Say?

It is importing to put these numbers in context. According to AGCOM’s latest ‘Osservatorio’ survey of the market (covering full year 2024). There are signs the total market is possibly turning a corner, even before the merger:

- Total communications-related revenues across electronic communications, media, online advertising, postal and parcel services reached €56.2 billion, a healthy +3.5% year-on-year, this index still puts Italy as the laggard in Europe for communication revenue growth in the decade.

- Within that, electronic communications service revenues alone grew +3.4% in 2024, buoyed by fixed network gains that helped offset mobile service declines.

These figures show that while some traditional segments remain under pressure, the industry overall appears to be on a modest growth trajectory—driven in part by infrastructure investment, value-added services, and digital diversification.

The Numbers of the New Company

In an industry long battered by relentless pricing competition and margin pressure, the Fastweb + Vodafone performance is a real-world experiment in whether strategic consolidation can restore stability, or even growth, through value-focused service offerings and operational synergies.

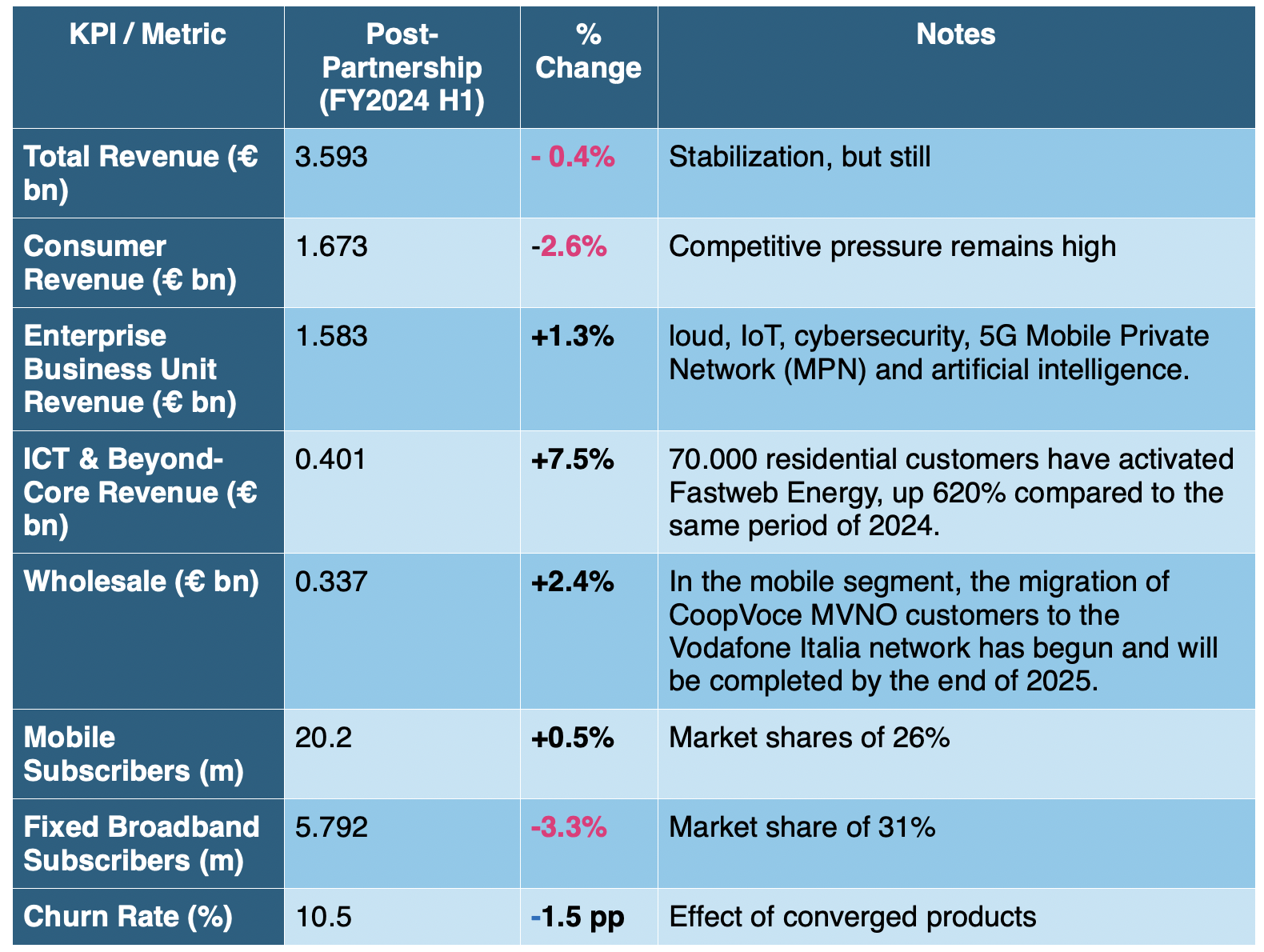

- Revenues held steady at around €3.6 billion, with declines in core telco services offset by gains in ICT and “beyond-the-core” services such as Fastweb Energia, the bundle of energy and gas utilities. Overall customer satisfaction (NPS) and churn metrics are improving.

- Enterprise and ICT segments are gaining traction, with ICT-value services up significantly (~+7.5%) and enterprise revenues rising.

- Wholesale broadband lines and revenues are also growing healthily, enhancing the broader ecosystem. Fastweb was an early fiber build out project, and fiber is paying back in other telco access charges.

These early outcomes suggest that the jury is still out on the operational efficiency. The combination of Vodafone and Fastweb is still sharing plenty of negatives, even if small negatives (Total revenue is slightly in the red, fixed line customer However, we can see a certain the shifting away from volume-driven tactics to a strategy emphasizing service value, differentiated offerings, and integration may be yielding positive customer and financial metrics. It’s still early days, but promising days.

*AGCom 2024 preliminary figures.

*AGCom 2024 preliminary figures.

Too Soon to Declare Victory—but Directionally Promising

Certainly, one quarter or semester does not make a trend. The Fastweb + Vodafone integration is still unfolding, and full synergies and cost efficiencies will take time to materialize. Yet, the convergence of two indicators. Corporate-level performance maintaining revenue stability while shifting toward value services, and sector-level trends signaling modest but real growth in total communications revenues

All of this suggests that consolidation, if executed well, could be a meaningful path toward relieving systemic pricing pressure and lowering returns in the sector.

For more insights on the evolving world of mobile messaging, become a member of the Mobile Ecosystem Forum, join our events, insight calls and exclusive information services at info@mobileecosystemforum.com.