Stefano Nicoletti, Head of MEF’s Sender ID Registry in the UK, explains how upcoming regulations could impact mobile messaging and platform control. The UK’s Competition & Markets Authority plans to grant Apple’s iOS and Google’s Android Strategic Market Status, introducing strict rules and potential fines. This move brings app stores and payment systems under closer scrutiny, aligning with EU’s DMA and DSA regulations.

The United Kingdom’s Competition & Markets Authority (CMA) has taken a decisive step toward tighter control of the two dominant mobile platforms. On 23 July 2025, the regulator published draft “road-maps” that would designate Apple’s iOS and Google’s Android ecosystems with Strategic Market Status (SMS)—a new legal label that brings bespoke conduct rules and the threat of fines up to 10 % of global turnover.

Mobile app stores and payments systems might be soon under tighter scrutiny in the UK. This is in line with other tighter regulation in the EU under the DMA DSA.

The CMA Announcement in Brief

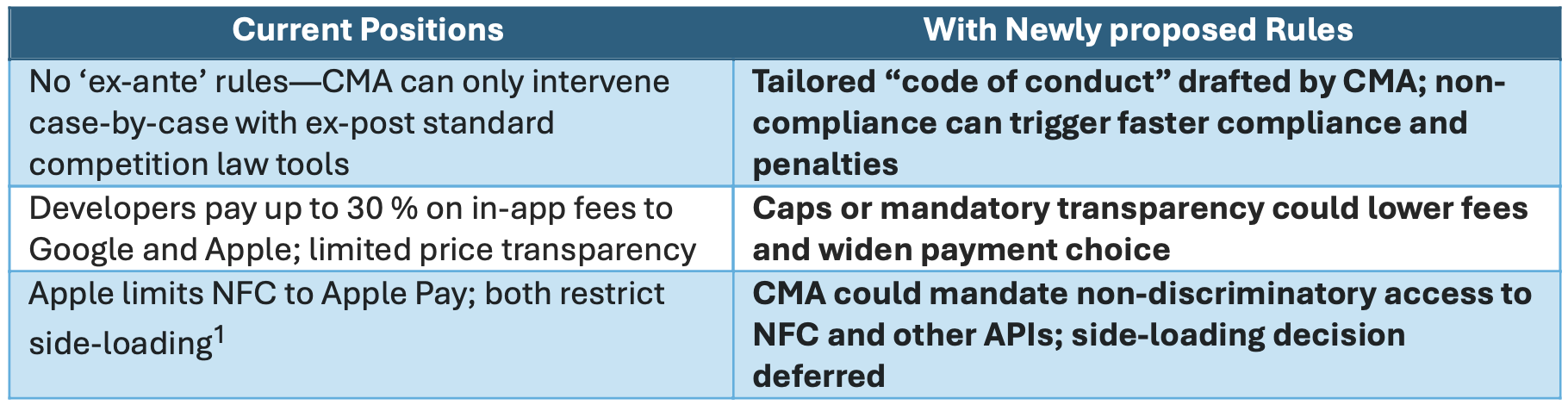

The introduction of Strategic Market Status (SMS) represents a fundamental shift in how the UK approaches the regulation of dominant digital platforms. Until now, the CMA’s interventions have been ex-post, reactive, through competition law only and addressing issues on a case-by-case basis, often only after lengthy investigations. With the SMS status, the regulator would move to a proactive, rules-based system, drafting a tailored “code of conduct” for Apple and Google that sets clear expectations for their behaviour in the market. This means that practices such as charging up to 30% commission on in-app payments, limiting transparency around pricing, and restricting access to device features could all come under direct regulatory scrutiny.

Developers might as a result benefit from lower/capped fees to pay to these platform providers and also new transparency requirements, while consumers could benefit from a wider array of payment options and greater clarity about how apps are reviewed and ranked.

The CMA is also considering measures to ensure that default access to hardware features like NFC is granted on fair and non-discriminatory terms, potentially opening the door to more competition and innovation in areas like digital wallets and contactless payments. While some of the most radical changes—such as mandating alternative app stores—are being deferred for now, the proposed rules signal a clear intent to level the playing field and foster a more open, competitive mobile ecosystem.

Stakeholder Reactions

The CMA’s announcement has sparked a wide range of responses from key players in the mobile ecosystem, each reflecting their unique interests and concerns. Apple, for its part, has voiced strong reservations about the proposed rules, warning that such regulatory intervention could undermine the privacy and security protections that its users have come to expect. The company argues that the new requirements might stifle innovation and force it to share proprietary technology with competitors, potentially weakening its competitive edge and the overall user experience.

Google has also pushed back against the CMA’s proposals, describing the move as both “disappointing and unwarranted.” The company points to the significant economic contribution of its Android platform in the UK, highlighting that in 2022 alone, Android generated more than £9.9 billion in revenue for UK-based developers and supported over 450,000 jobs. Google’s leadership contends that any new regulation should be carefully balanced, evidence-based, and designed not to impede growth or innovation within the UK’s digital economy.

Meanwhile, some of the most vocal criticism has come from the developer community, particularly from Epic Games CEO Tim Sweeney. Sweeney has characterized the CMA’s approach as “surprisingly weak,” expressing frustration that the regulator has chosen to delay more radical reforms—such as allowing alternative app stores—until at least 2026. He likened the current state of the UK app store market to “a Soviet supermarket,” lamenting the lack of vibrancy and competition. Some competition lawyers we reached out to describe the CMA’s position as “cautious but authoritative”: perhaps too late to change the entrenched positions of Apple and Google.

Together, these reactions underscore the complexity and high stakes of regulating digital platforms, as well as the divergent perspectives of those most affected by the CMA’s evolving approach.

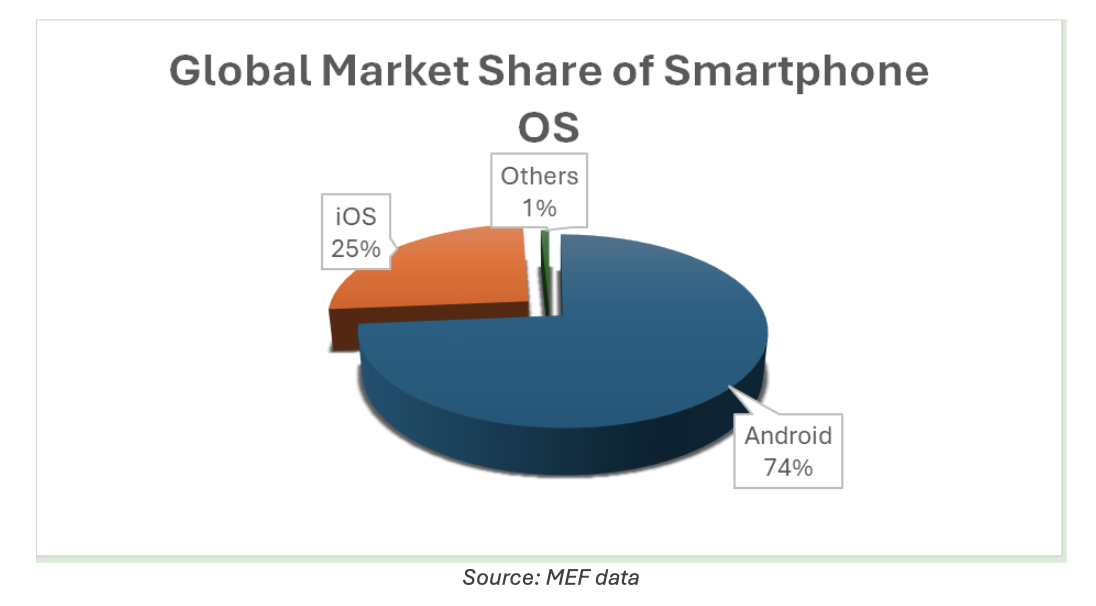

MEF Data accessible to our members reports datasets on mobile industry including market size by Operating system and can be accessed through our portal at this link here.

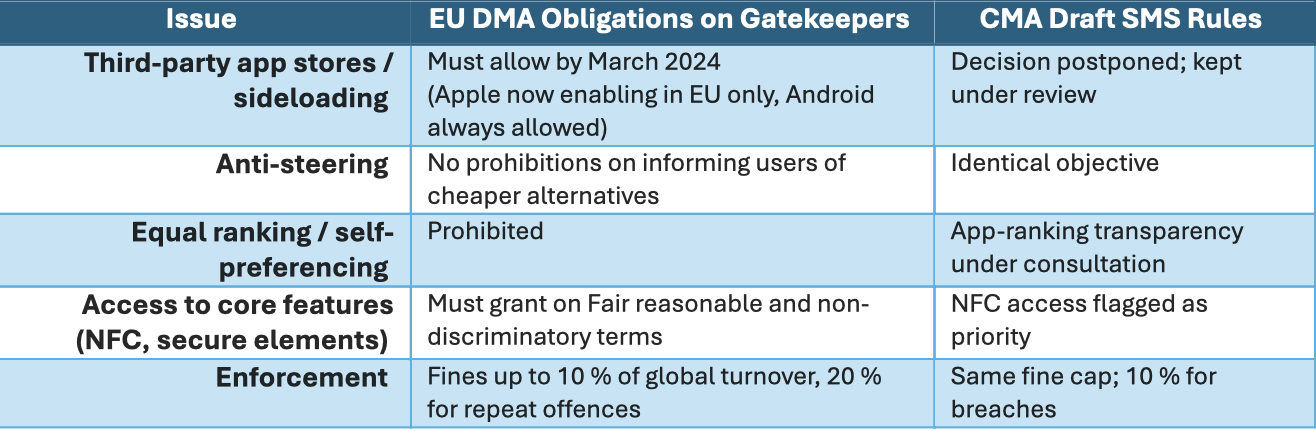

Parallel Track in the EU: DMA & DSA

The CMA’s proposal mirrors the EU’s Digital Markets Act (DMA) and, to a lesser extent, the Digital Services Act (DSA). Under the EU DMA act both companies were already assigned the “Gatekeeper” status, a similar status to CMA’s SMS, under the DMA act in March 2024, and launched formal investigations under Google, Apple, and Meta.

Under the DSA act instead, which complements the DMA act, but focuses more on content moderation and transparency obligations, Google and Apple were also assigned the ‘Very-Large online platform’ status (VLOP). The combined EU regime shows a broader trend toward ex-ante tech regulation that the UK is now emulating.

Where Else Might Similar Rules Emerge?

The UK’s regulatory push is part of a much broader global movement, as governments around the world grapple with the growing influence of major mobile platforms. South Korea has already taken a pioneering role in this space, passing legislation in 2022 that compels app store operators to allow alternative payment options—a direct challenge to the business models of both Apple and Google. This bold move has set a precedent that other countries are now closely watching.

In Japan, lawmakers are actively debating what has been dubbed the “App Store Fairness Act.” If passed, this legislation would introduce requirements similar to those found in the EU’s Digital Markets Act, aiming to ensure greater competition and fairness in the mobile app ecosystem. The Japanese parliament discussions reflect a growing consensus that more oversight is needed to prevent anti-competitive practices and to give both developers and consumers more choice.

Across the Pacific, the United States has also seen bipartisan momentum for reform, most notably with the proposed “Open App Markets Act.” Although the bill has stalled in Congress for now, it remains very much alive and could be revived in the next legislative session, especially as scrutiny of big tech continues to intensify.

Meanwhile, in Australia and Canada, competition authorities are conducting in-depth studies into app store dominance and the control of key device features like NFC. These investigations could pave the way for new legislation as early as 2026.

In Summary, the push to regulate mobile platforms is accelerating. Europe and the UK are leading the way, and other countries are now preparing to follow with their own rules targeting tech giants.”

Implications for the Wider Mobile Ecosystem

-

- Developers – possibly lower distribution costs and new payment routes, but potentially increased fragmentation across regions.

- Consumers – potential savings and more choice of mobile app markets, offset by a less curated experience and security trade-offs. Apple and Google also suggests that the new rules could increase fraud and put personal data integrity at risk.

- Device OEMs & Operators – in the longer term they may renegotiate revenue-share deals tied to app-store spend; could also explore pre-installing rival app stores.

- Payments & Fintech – open NFC and anti-steering rules create opportunities for independent wallets and “super-apps” that bypass proprietary stores.

- Security & Privacy Vendors – heightened need for third-party verification and threat-detection services if sideloading expands.

For ongoing analysis of mobile content market, join our member insight meetings for the Content & Advertising and Payments Programs.