Nigeria’s new A2P messaging rules bring big changes—only licensed local aggregators can deliver international messages, and mobile operators are excluded. A new centralized platform aims to improve security and transparency, but may also limit competition. As WhatsApp continues to thrive, businesses must adapt quickly. MEF CEO Dario Betti discusses how these changes impact people, connections, and digital growth.

On July 8, 2025, the Nigerian Communications Commission (NCC) announced a new licensing regime for International Application-to-Person (A2P) Business Messaging. The NCC is trying to enhance service quality, and security of international messaging traffic entering Nigeria.

Due to the new framework only qualified, licensed aggregators can deliver international A2P messages, a number that might even be limited by the regulator. International A2P players might need to decide whether the market is still worth the higher complexity or if to limit the termination to local players.

Many regulators have been addressing the issues with A2P recently. However, NCC’s move of licensing international A2P is unique as it is much more invasive in the market and potentially creates barriers to limit competition and help the positions of local players.

Key features of the new licensing regime

-

- The creation of a ‘Single Platform’ that will give transparency to the regulator about international traffic. The regulator will centralize the routing of international A2P messages through approved channels to enhance compliance and transparency.

- Only licensed aggregators may deliver international A2P messages into Nigeria.

- Mobile Network Operators (MNOs) cannot apply for this license.

- Each applicant may partner with only one technical provider.

- A 5-year licence is priced at 10 million Naira ($ 6,500). A non-refundable administrative fee of 5% of the license cost is required upon application.

- Only Nigerian company can apply for the license (and they need to be registered in Nigeria at the time).

- According to early discussion with the regulator the application window was limited to seven days from the date of the announcement (8 July 2025), however at the time of writing (30 July) the application module was available on the regulator site.

- The regulator might limit the number of licences available to an undefined number.

Implications for the Mobile Ecosystem

Aggregators

According to the NCC new licensing requirements will raise the bar for compliance and technical standards. Only aggregators that meet the NCC’s criteria will be able to operate. NCC criteria seems to include Nigerian Digital Sovereignty in A2P, new taxation on the market and a Single Routing Platform for A2P international traffic.

NCC’s move of licensing international A2P is unique as it is much more invasive in the market and potentially creates barriers to limit competition and help the positions of local players. ”

This licensing scheme is likely to lead to market consolidation. Only Nigerian players can get a licence, and even MNO are not allowed to apply for one. It seems to have been designed with a clear view of the number of type of players allowed in the market. There will be fewer players, and some of the aggregators might have to decide if it is worth participating directly in this market. The short time to apply originally mentioned (in theory, 7 days) and the potential limited number of licences make the need for a fast decision very pressing. However, they also highlight the risk that compliance in the Nigerian market might be too complex by design, and not worth chasing.

The new “Single Platform” that will route international messages would be directly controlled by the NCC. This could establish a new level of transparency and security. The improved security would be welcome by many in the industry. However, many aggregators will question the realistic security impact without more details on the mechanics of the platform. The complexity of fraud A2P in the market would make a challenge to any single player to be able to control. Aggregators would also be a potential bottleneck and limitations of competition in a market so tightly controlled.

The NCC explains that the Single Platform would be a tool also to apply proper taxation to the market.

Presented with this information, many A2P SMS players should consider:

-

- Partner with a local player.

- Redirect traffic to OTT solutions such as WhatsApp to terminate messages in the country as a more efficient way.

Mobile Network Operators (MNOs)

MNOs are specifically excluded from holding the new license, which means they must work with licensed aggregators for international A2P traffic. This may also require MNOs to review and renegotiate their commercial arrangements with aggregators.

Enterprises and Brands

Organizations that rely on international A2P messaging—such as banks, fintechs, e-commerce platforms, and social networks—might experience the improved message delivery, reduced fraud, and greater regulatory certainty mentioned by NCC. However, they may also experience changes in pricing, service models, or technical integration as the market adapts to the new framework.

Market Sizing: Nigeria’s Mobile and A2P Messaging Landscape

Nigeria is Africa’s largest mobile market and one of the most dynamic globally. As of 2023, the country had over 223 million inhabitants, and 109 million active users (and 231 million SIMs in a market where double and triple SIM are often found). The mobile phone market was valued at $16.8 billion in 2024. SMS is still driving the A2P market, but it has become under fierce competition from other OTT solutions.

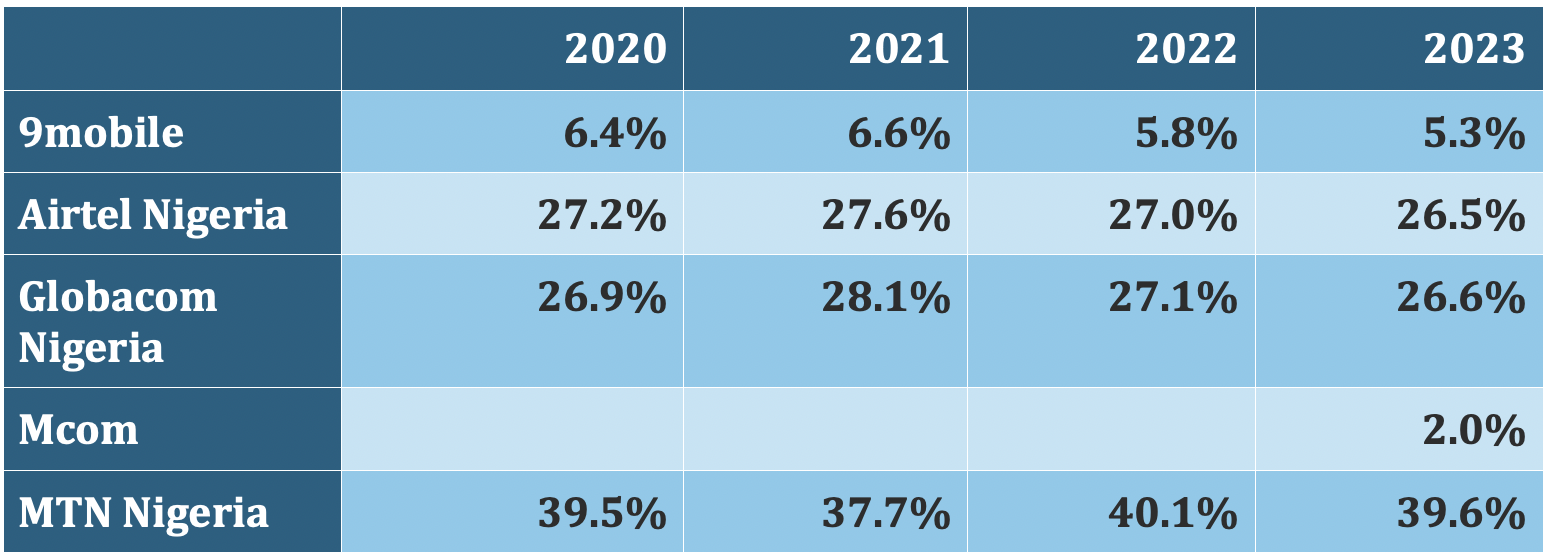

The market is now dominate by 3 mobile operators Airtel, Globacom and the leader MTN.

In 2025, WhatsApp dominated messaging. The numbers tell the story: with an estimated 90 to 100 million users, WhatsApp reaches about 45% of Nigeria’s entire population and an astonishing 95% of all internet users in the country or mobile users. But WhatsApp’s influence doesn’t stop at personal conversations. As of 2024, Nigeria ranks among the top five countries globally for WhatsApp Business adoption, with over 16 million downloads. For many small and medium-sized enterprises, WhatsApp Business is the first—and sometimes only—digital storefront they need. In short, WhatsApp and WhatsApp Business have become the digital backbone of Nigerian society. They are not just apps—they are essential platforms for communication, business, and community, shaping how Nigerians connect, trade, and thrive in a rapidly digitalizing world.

Review you market options

As the Nigerian mobile ecosystem evolves, industry participants face new regulatory, technical, and commercial challenges. The Mobile Ecosystem Forum (MEF) is a global industry association that provides members with access to market intelligence, regulatory updates, networking opportunities, and best practices. MEF membership enables organizations to remain compliant, competitive, and well-positioned to respond to regulatory and market developments in Nigeria and internationally. Join our members to

-

- Access to exclusive research and market data.

- Regular updates on regulatory changes and industry trends.

- Opportunities to network with industry leaders and peers.

- Advocacy and representation in policy discussions.

- Best practice sharing and capacity building.

To learn more about MEF and how membership can support your business objectives, visit the MEF website or contact the membership team at info@mobileecosystemforum.com.