WhatsApp is now a key A2P messaging engine, driving Meta’s multi-billion-dollar business messaging growth in Q2 2025. With strong adoption in Asia and Latin America, AI-powered automation, and lower pricing, WhatsApp is reshaping enterprise communication. The shift challenges SMS dominance and boosts CPaaS strategies. MEF Data Analyst Pamela Clark-Dickson explores this transformation and its industry impact.

Meta’s Q2 2025 results have sent a clear message to the global mobile ecosystem: the advertising market is strong, AI investment are helping, Meta Apps are still sticky and especially WhatsApp’s A2P (application-to-person) channel, is no longer a side story.

A Record Quarter, and Messaging at the Core

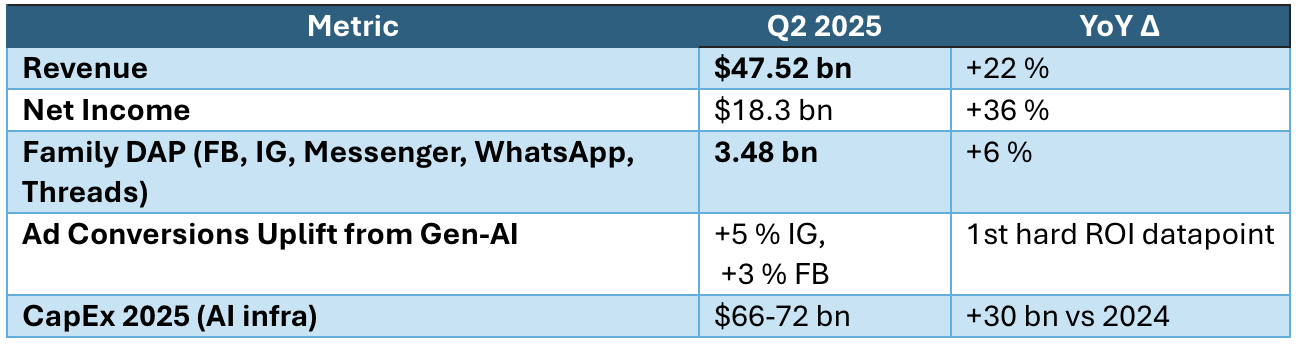

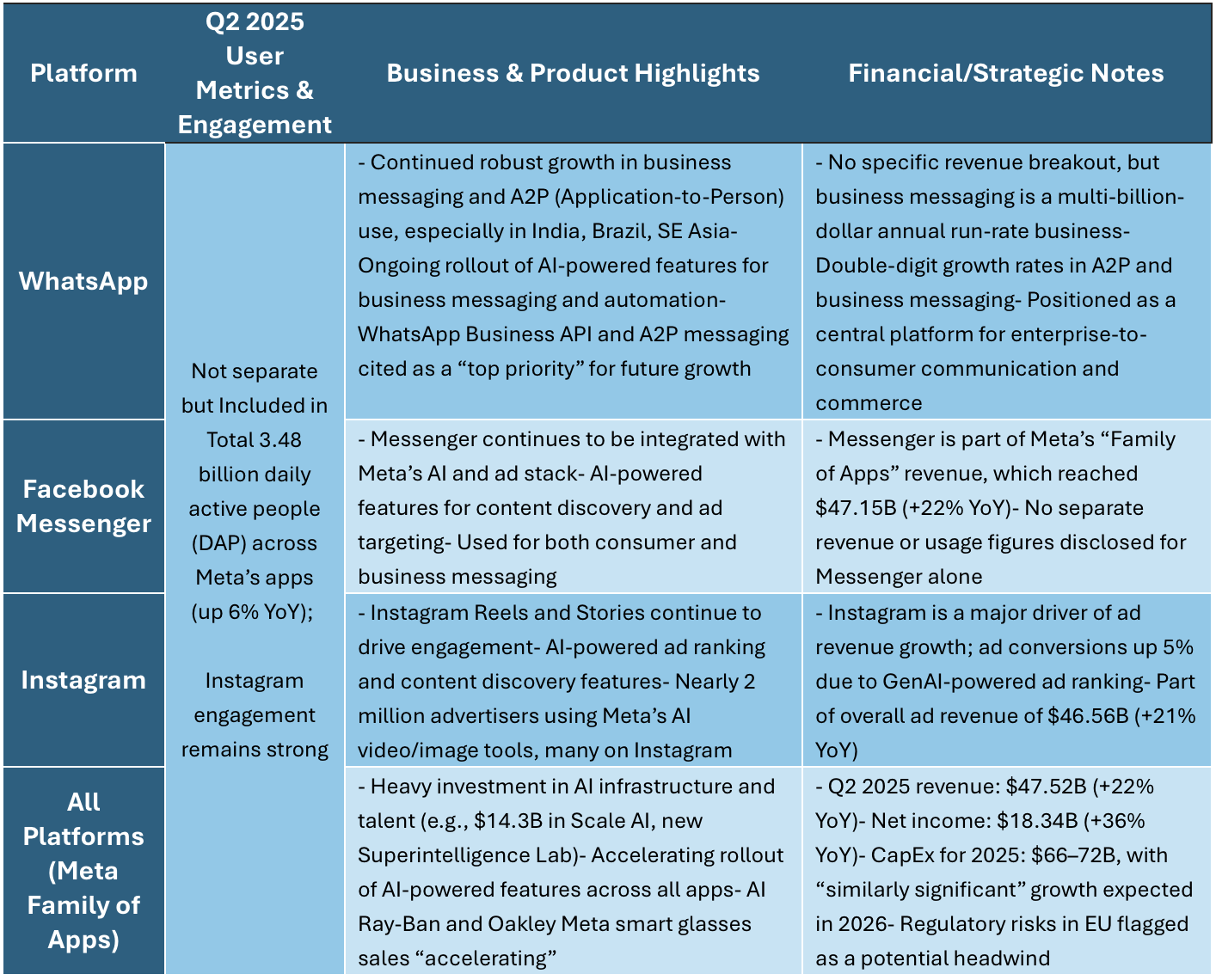

Meta’s financials dazzled Wall Street, with revenue surging 22% year-on-year to $47.5 billion and net income up 36% to $18.3 billion. But behind the headlines, it’s the scale and momentum of Meta’s messaging platforms that’s turning heads. Daily active users across Facebook, Instagram, Messenger, WhatsApp, and Threads reached a staggering 3.48 billion, up 6% from last year—a testament to the company’s global reach and the stickiness of its now family of apps.

While much of the analyst chatter focused on Meta’s AI investments and ad business, the real story for the mobile ecosystem is the explosive growth of WhatsApp Business and A2P messaging. Meta’s management, for the first time, described business messaging as a “multi-billion-dollar annual run-rate” with double-digit growth, and some external analysts are now projecting WhatsApp Business revenue to hit $6–7 billion this year, with a long-term potential of $30–40 billion ( Benzinga/Yahoo Finance).

While much of the analyst chatter focused on Meta’s AI investments and ad business, the real story for the mobile ecosystem is the explosive growth of WhatsApp Business and A2P messaging. Meta’s management, for the first time, described business messaging as a “multi-billion-dollar annual run-rate” with double-digit growth, and some external analysts are now projecting WhatsApp Business revenue to hit $6–7 billion this year, with a long-term potential of $30–40 billion ( Benzinga/Yahoo Finance).

Meta and the wider industry still need to whet the appetite of brands on a global basis to engage with what many would consider to be a ‘new’ messaging channel, and then also make it easier for brands to onboard campaigns on WhatsApp”

However, MEF considers these projections to be extremely optimistic, certainly for 2025. The business unit to which WhatsApp paid messaging belongs generated $1.1 billion in 1H25 (and not all these revenues came from WhatsApp paid messaging) making a ~6x uplift in revenues for WhatsApp paid messaging alone unlikely by year-end.

MEF estimates that Meta’s WhatsApp paid messaging revenues are more likely to be in the range of $2.5-2.8 billion in 2025 – which is still not insignificant. Meta’s recent pricing adjustments for the WhatsApp Business Platform are a long overdue and necessary growth lever, which will increase the app’s penetration and use among brands as a consumer engagement channel.

But other industry dynamics are in play – Meta and the wider industry still need to whet the appetite of brands on a global basis to engage with what many would consider to be a ‘new’ messaging channel, and then also make it easier for brands to onboard campaigns on WhatsApp. CPaaS vendors are helping solve these problems, and the AI-based automation that Meta is rolling out (see below) will help too.

WhatsApp Business: Regional Engines of Growth

The WhatsApp Business API is now the backbone of enterprise-to-consumer engagement in many of the world’s fastest-growing markets. In India, Indonesia, and across Southeast Asia, WhatsApp is the default channel for everything from customer support to commerce. Latin America tells a similar story. In Brazil and Mexico, more than 50% of mid-to-large brands are now using WhatsApp Business, and the platform is rapidly overtaking SMS as the preferred channel for A2P messaging. Even in Africa and the Middle East, banks and public-sector agencies are migrating critical alerts and authentication flows from SMS to WhatsApp, drawn by lower costs and richer customer experiences.

Europe, however, presents a more nuanced picture. While WhatsApp remains popular, regulatory uncertainty—especially around the EU’s Digital Markets Act and privacy rules—has slowed the growth of paid utility messaging. In North America, WhatsApp is still playing catch-up to SMS, but is gaining ground in cross-border retail and authentication use cases.

AI, Automation, and the New Business Messaging Playbook

Meta’s Q2 call was peppered with references to generative AI, and for good reason. The company is now rolling out AI-powered automation across its messaging stack, including WhatsApp Business. This means smarter chatbots, automated customer support, and even voice-enabled interactions—features that are already driving measurable ROI in Meta’s ad business and are now poised to supercharge A2P messaging.

The July 2025 pricing overhaul—shifting to per-message billing with volume discounts for utility and authentication traffic—has been welcomed by CPaaS providers and brands alike. Early feedback from India and Brazil suggests blended unit costs for business messaging have dropped by 5–10%, making WhatsApp even more attractive for high-volume enterprise use.

And the product roadmap keeps accelerating. The recent launch of business voice calling for large enterprises, and the integration of WhatsApp ads into Meta’s Ads Manager with AI-driven budget optimization, signal Meta’s intent to make WhatsApp the central hub for conversational commerce and customer engagement.

Analyst Views: A Tipping Point for A2P

The analyst community is taking notice. Bank of America, in its latest note, lifted Meta’s 2026 EPS forecast by 4%, citing faster-than-expected WhatsApp monetization. Evercore ISI predicts WhatsApp Business could eclipse Instagram Shop’s gross merchandise value by 2027 if Meta successfully integrates payments. Zacks, meanwhile, points to the “twin engines” of AI and WhatsApp A2P as key mitigants to regulatory risk in Europe.

Risks and the Road Ahead

Of course, challenges remain. The EU’s evolving regulatory landscape could dampen A2P monetization in Europe, and the rapid migration from SMS to WhatsApp is already putting pressure on operator A2P revenues. Privacy advocates are watching closely as Meta introduces ads in WhatsApp’s Status feed, even if these remain opt-in and limited in targeting.

What Should MEF Members Do?

For MEF members, the message is clear: the business messaging landscape is shifting fast. In some regions, Mobile operators should consider repositioning SMS away from its premium offer , or evaluating more value pricing offers in order to respond to WhatsApp pricing attack and defend market share.

CPaaS providers need to build smart routing that leverages AI to optimize between WhatsApp, RCS, and SMS in real time. Brands should take advantage of discounted utility and authentication templates and invest in AI-powered chatbots to maximize the value of the free 24-hour service window.

Conclusion: WhatsApp’s A2P engine

Meta’s Q2 2025 results confirm what many in the industry have suspected: WhatsApp Business is no longer an experiment—it’s a core growth engine, driving triple-digit A2P revenue growth in key markets, lowering costs, and setting the pace for the next era of enterprise messaging. For the MEF community, the opportunity is to both ride and shape this wave—integrating richer WhatsApp services into omnichannel strategies, and championing standards for transparency, privacy, and conversational quality.

For more information or to join the Insight Group, please contact the MEF team at info@mobileecosystemforum.com.