Two years after its launch, Threads has shown that its explosive start has slowed down considerably, but it has still managed to build a strong business. Meta’s version of microblogging has not yet surpassed X in terms of reach, but its monetization strategy may have already outpaced the well-established Twitter/X platform. Threads’ first two years have been marked by rapid growth, fast-paced feature development, and a clear challenge to X’s dominance. While it has not yet overtaken X, its momentum is undeniable.

What is Threads?

Threads, owned by Meta, is a text-based social media app, essentially a microblogging platform that integrates with Instagram. It allows users to share text updates, photos, and videos, similar to Twitter, and leverages the existing Instagram user base.

The first two years

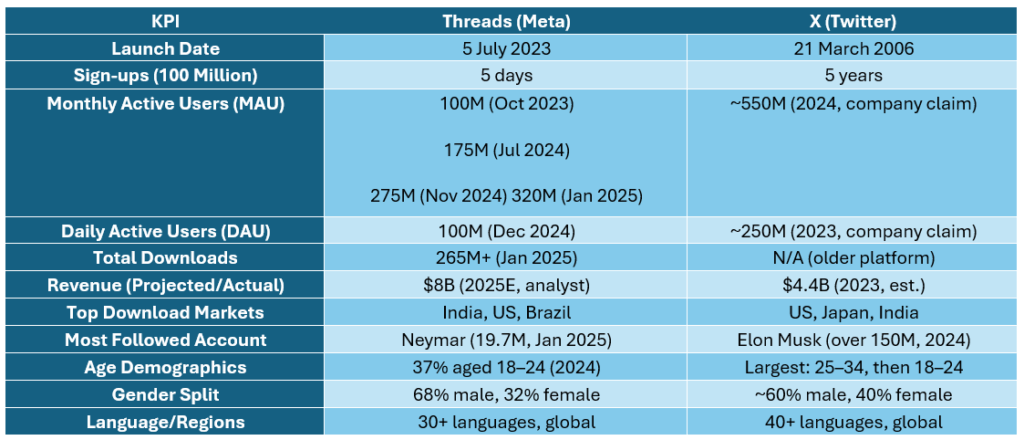

Meta’s Threads platform launched on July 5, 2023, making an immediate global impact. Within just five days, Threads surpassed 100 million sign-ups, outpacing even ChatGPT as the fastest app to reach that milestone. This initial surge was fueled by widespread dissatisfaction with Twitter (now X) following its acquisition by Elon Musk, as well as Meta’s ability to leverage Instagram’s massive user base for onboarding.

After the initial spike, growth slowed but remained robust. By November 2024, Threads had reached 275 million monthly active users, and by January 2025, that number had climbed to 320 million. Daily active users hit 100 million worldwide by late 2024. Downloads have also been strong, with over 265 million installs across Google Play and the App Store by early 2025. India, the US, and Brazil have been the top markets, with India alone accounting for nearly 20% of all downloads.

Despite this momentum, Threads still trails X (Twitter) in total user base—X reported around 550 million monthly active users in 2024. However, X’s growth has stagnated, while Threads continues to add tens of millions of users each quarter. The question remains: can Threads overtake X as the world’s leading microblogging platform? In the short term, an overtake is unlikely. The gap is narrowing, but X’s entrenched user base and cultural cachet remain significant hurdles.

The fragmentation of the social media advertising landscape between X (Twitter) and Threads is reshaping digital marketing strategies and has significant implications. Brands and agencies now need to split budgets and tailor campaigns across two major, but demographically distinct, microblogging platforms, increasing both the cost and complexity of reaching target audiences.”

Financial Performance: Revenue, Monetization, and Analyst Views

Threads’ financial trajectory has been closely watched by analysts and investors. While Meta did not immediately monetize Threads, the company began rolling out advertising and branded content tools in late 2024 – mostly as an extension of the Meta platforms. Analyst projections are bullish: Evercore ISI estimates that Threads will generate about $8 billion in revenue in 2025, rising to $11.3 billion by 2026. X has not publicly disclosed its performance, but valuation of revenue varies from $2.5 billion to $3.7 billion for 2024 – a downward trend from $4.4 billion in 2023.

Meta’s own filings highlight Threads as a key growth driver, especially as Facebook and Instagram’s ad growth matures. Threads’ integration with Instagram’s ad infrastructure is expected to accelerate monetization, with early campaigns showing strong engagement rates among Gen Z and millennial users. However, some analysts caution that Threads’ revenue per user still lags Instagram and Facebook, and that sustained growth will depend on continued feature innovation and user retention

Feature Development: Where Is Threads Headed?

Threads launched as a stripped-down, text-first microblogging app, but its feature set has expanded rapidly. Key developments over the past two years include:

- Integration with Instagram: Users can cross-post Threads to Instagram Stories and share content across both platforms, leveraging Instagram’s social graph for discovery and engagement.

- Longer Posts and Video: Threads allows up to 500 characters per post and supports videos up to five minutes, differentiating it from X’s shorter format.

- Privacy and Moderation: Meta has positioned Threads as a “safer, moderated” alternative to X, with content controls and user safety features.

- Algorithmic Feeds: Threads uses algorithmic curation to surface trending content and accounts “of interest,” similar to Instagram Reels and TikTok.

- Looking ahead, Meta is expected to deepen Threads’ integration with its broader ecosystem, including Facebook Groups and WhatsApp Channels. There are also hints of new monetization tools for creators and brands, as well as further investments in AI-driven content discovery.

Impact on the Mobile Ecosystem: Threats and Opportunities

Threads’ rapid ascent has already reshaped the mobile social landscape. For the mobile ecosystem, the platform’s growth presents both threats and opportunities:

- Platform Fragmentation: The rise of Threads, alongside TikTok, Snapchat, and others, is fragmenting user attention and making it harder for any single platform to dominate.

- Advertising Shifts: Brands are reallocating budgets to Threads, attracted by its younger, highly engaged user base and Meta’s proven ad tech. This is likely to drive up ad prices and competition across the sector.

- Privacy and Data: Meta’s handling of privacy and moderation on Threads will be closely watched by regulators, especially as the platform expands into new markets and integrates with other Meta services.

Threads vs X (Twitter): Key Performance Indicators (2023–2025)

- Growth: Threads’ initial growth was record-breaking, but X still maintains a larger overall user base, though its growth has slowed.

- Engagement: Threads DAU/MAU ratio is high for a new platform; X’s engagement has declined post-2022.

- Revenue: Threads is projected to surpass X in annual revenue by 2025, despite being much newer.

- Demographics: Threads is younger and more male-skewed, with a strong Gen Z presence. X has a broader age range and a slightly more balanced gender split.

- Geography: Threads is surging in India and emerging markets; X remains strong in the US and Japan.

The ecosystem view

The fragmentation of the social media advertising landscape between X (Twitter) and Threads is reshaping digital marketing strategies and has significant implications. Brands and agencies now need to split budgets and tailor campaigns across two major, but demographically distinct, microblogging platforms, increasing both the cost and complexity of reaching target audiences.

For CPaaS players, this fragmentation presents both challenges and opportunities. On one hand, it complicates partnership and integration strategies, as each platform may require different technical and commercial approaches. On the other hand, it makes the role of CPaaS providers potentially more important, opening new avenues for value-added services such as advanced analytics, campaign orchestration, and cross-platform engagement tools. Both Threads and X offer Direct Messaging functions alongside their advertising channels, with Threads using Instagram’s Direct Message interface. These features create a natural playfield for CPaaS.

For MNOs, greater fragmentation increases the relevance of SMS and RCS as mass-market reach channels. Mobile network operators may view the competition among OTT platforms as a positive development, as it diverts disruption/competition away from telecom markets, but across the OTT services themselves.

Advertisers, meanwhile, must adapt to divergent user bases—Threads’ younger, mobile-first audience versus X’s broader, more established demographic—requiring more granular segmentation and creative adaptation. Ultimately, this split is likely to drive innovation in ad tech, increase demand for interoperability solutions, and reward those who can navigate a more complex, multi-platform ecosystem.

To know more about the world of mobile messaging and engagement, join MEF as a member and subscribe to our newsletter.