In a major step forward for conversational marketing, Meta has launched enhanced marketing messages on Messenger—unlocking direct promotional messaging for businesses globally. While WhatsApp takes a more cautious path, Messenger becomes the testing ground for more aggressive monetisation. MEF CEO Dario Betti explores what it means for brands, developers, and the future of chat-based engagement.

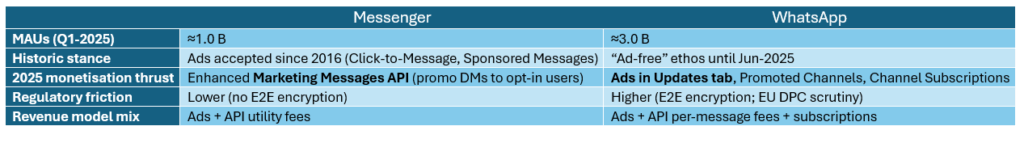

In July 2025, Meta has announced the global rollout of enhanced marketing messages on Messenger, giving businesses a new way to re-engage and retain customers through chat. Meta is now running distinct but complementary monetisation strategies for Messenger and WhatsApp: Messenger is being positioned as a direct channel for business marketing and re-engagement, while WhatsApp is introducing ads in a limited, non-intrusive way and expanding business/commercial features. Both strategies are designed to unlock new revenue while balancing user experience and privacy concerns.

Messenger ads go all the way, WhatsApp more cautious.

Meta is now clearly pursuing two parallel monetisation strategies for Messenger and WhatsApp, both centred on advertising and business messaging, but with distinct approaches tailored to each platform’s user base and regulatory context. On WhatsApp, the strategy is cautious and privacy-focused, with ads kept out of private chats and a strong emphasis on business tools and subscriptions. On Messenger, the focus is on direct business-to-customer engagement, with more flexibility for promotional messaging and integration with Meta’s broader ad ecosystem.

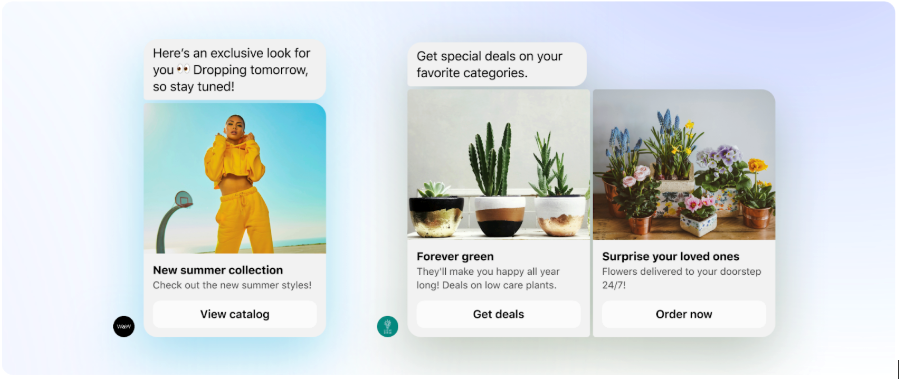

The new feature, available via the Marketing API, allows businesses to initiate promotional conversations with users who have opted in, aiming to drive loyalty and repeat sales in a privacy-conscious way. Messenger has long supported business messaging and click-to-message ads, but in July2nd , Meta launched enhanced marketing messages, allowing businesses to send promotional content directly to opted-in users via the Messenger API.

This step comes just after announcing that WhatsApp will include marketing messages in the Status screen. Meta is going after a more aggressive monetisation of ads on messaging. And it has chosen to leave WhatsApp as the less ‘intrusive’ messaging platforms, using its second largest messaging platform Facebook Messenger. Messenger is linked to Facebook accounts, but it functions as a separate application for mobile devices and the website Messenger.com.

Messenger continues to support click-to-message ads from Facebook and Instagram, driving users into Messenger conversations with businesses. The new marketing messages feature is positioned as a replacement for older promotional tools, with a focus on opt-in, personalized, and measurable business-to-customer communication.

A New Approach for Conversational Marketing

With over a billion monthly users, Messenger is already a key channel for customer support and commerce. However, until now, businesses had limited options to follow up with customers after an initial interaction. The new marketing messages feature changes that, enabling brands to send personalized or broadcast messages to subscribers, whether for exclusive offers, product updates, or tailored recommendations.

Meta highlights several benefits for businesses:

- Direct access to hard-to-reach customers: Messenger’s scale and engagement make it ideal for reconnecting with users who may not respond to other channels.

- Flexible subscriber management: Businesses can easily add subscribers using CRM lists, custom audiences, or ads that click to Messenger.

- Personalization at scale: Marketers can craft freeform messages for individuals or broadcast to all subscribers, depending on their goals.

- Actionable insights: Down-funnel measurement tools help brands understand the impact of messaging and optimize their marketing mix.

Developer and Business Readiness

To use marketing messages, developers must configure Facebook Login for Business, set up a Business-type developer app with advanced access, and handle Messenger webhook notifications. Meta recommends updating user interfaces to support subscriber management, message creation, and reporting before onboarding clients.

In short, these will be the steps for Messengers ads:

- Opt-in subscriber model – brands must capture explicit consent; sends are capped by user block rates.

- API workflow – businesses pull a subscription token ➜ create a marketing_message ➜ send via Marketing API ➜ receive delivery & CTR stats.

- Ad funnel synergy – Click-to-Message ads on Facebook/Instagram (purchase/lead optimisation) fill the top of the funnel; marketing messages re-engage.

- Pricing – No public rate card yet. Pilot partners report CPM-style internal billing based on delivery volume + engagement uplift fees.

The feature is now available to developers globally, but business access is currently limited to select countries, including the US, Australia, Brazil, India, Indonesia, Mexico, the Philippines, and several others across APAC, LATAM, and the Middle East.

Industry Adoption

Meta is already working with brands like Nestle Philippines and partners such as Pancake and Smartly to bring marketing messages to market. The move is expected to accelerate the adoption of conversational marketing, helping brands build stronger, ongoing relationships with their customers.

Revenue expectations

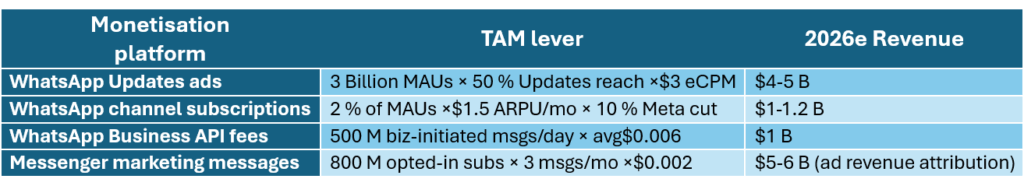

An empirical review of financial analyst has shared the ranges of revenue in the table below. If Meta delivers even 70–80% of these forecasts, messaging will become a$10B+ annual business line—transforming WhatsApp and Messenger from “sleeping giants” into core profit engines. The next 18 months will be a crucial test of user tolerance, business adoption, and Meta’s product discipline.

The most aggressive plays stays in the smallest of the messaging platform, Messenger, that with marketing messages would challenge the total monetisation on the much larger WhatsApp platform

What’s Next?

Meta’s messaging monetisation is highly adaptive to regional realities. In India, Brazil, and Indonesia, WhatsApp’s business API and new ad formats are being adopted rapidly, thanks to high mobile penetration and a culture of business messaging. In contrast, the EU rollout is delayed due to strict privacy regulations, and Meta must tread carefully to avoid regulatory backlash. Messenger remains a staple in North America and Western Europe, where business messaging is more established.

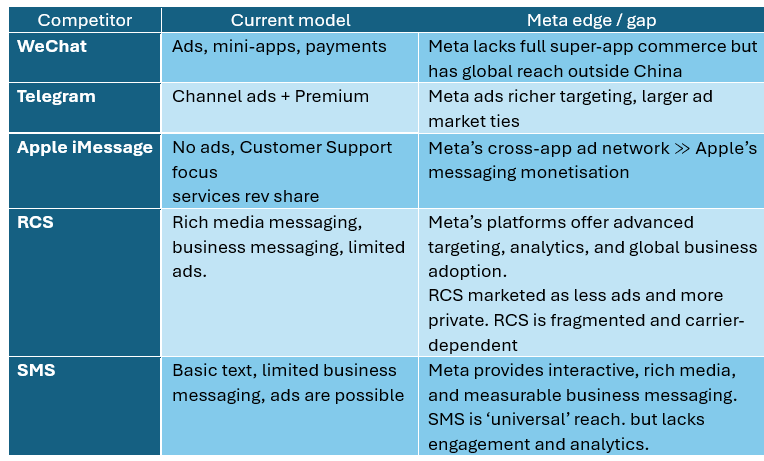

WeChat’s dominance in China is unrivaled, but its model is difficult to export due to privacy concerns and regulatory barriers in other countries. Telegram, with its strong privacy stance, is popular in regions where users are wary of surveillance but faces blocks in some authoritarian regimes.

RCS and SMS might be less prone to embrace advertising, but this might also position the platforms as more private and less prone to spam.

Takeaway for the industry

As Meta’s messaging platforms open new monetisation channels, brands looking to stay ahead should act now to build a strong foundation for success.

The first step is to start list-building immediately securing opt-ins on Messenger is crucial, especially as Meta is expected to introduce stricter send-rate limits in the near future. The earlier you begin, the larger and more engaged your subscriber base will be when these throttles take effect.

Once you have your audience, segmentation becomes your secret weapon. Focus on identifying high-intent cohorts—those customers most likely to engage or convert—and deliver them personalised Messenger promotions that feel relevant and timely. Meanwhile, use WhatsApp Status ads to reach broader audiences, driving awareness and discovery at scale.

It’s also essential to measure the impact of these new channels on customer lifetime value. Messenger marketing messages are particularly effective for retention, helping you nurture relationships and drive repeat business. In contrast, WhatsApp ads excel at top-of-funnel discovery, introducing your brand to new prospects and expanding your reach.

Finally, prepare your budgets for this shift in the marketing landscape. By mid-2026, some brands are already discussing an allocation of 15–20% of your overall social media spend to messaging placements.

What next?

If you are member of MEF join the Messaging Insight Group for more information, tools and debated on the development of OTT messaging platforms.