What is ‘messaging as a service’? Will bots change consumer service forever? When will SMS 2.0 arrive? In the latest Executive Insights video supported by Mahindra Comviva, MEF discusses the future of messaging with James Lasbrey, Global Head of Messaging at Telefonica.

It’s quite convenient to think of Facebook as the enemy of operator messaging. After all, Facebook Messenger has evaporated consumer text traffic in many markets.

Convenient, yes. But also wrong.

The truth is, Facebook is itself one of the world’s biggest consumers of SMS. The social network uses text to authenticate most of its own users.

Two-way authentication (sign in to a service with a password, and also a code sent to your mobile phone) is one of the world’s fastest growing use cases for A2P (application to person) messaging. Services like Facebook and Google, and multiple banks and retailers use it all the time.

In so doing they are acknowledging what everyone inside the telco messaging space knows only too well. When you need a messaging platform that reaches everyone, no matter where they are or what kind of handset they own, only SMS will do.

James Lasbrey, Telefónica’s global head of messaging, says: “Authentication is now our biggest single use case. It’s at least 20 per cent of volumes in all markets.

“And I think it can keep growing, especially as we add new capabilities on top, like the ability to discern from a message report whether a SIM has been swapped. Obviously, brands value the ubiquity of text and trust the safety of the channel.”

The growth of the A2P market is hugely satisfying for operators like Telefonica, which have seen P2P traffic decline sharply thanks to the aforementioned OTT apps.

“Enterprises will adopt a blended approach to customer messaging that will place SMS alongside other channels from one convenient dashboard. This will be marketed as ‘messaging as a service’ by the industry’s intermediaries”.

In fact, business messaging has been on a steady rise for the last five years. According to a recent Telefonica ‘Text Economy’ report, A2P global revenues rose from around $45 million a year in 2012 to $70 million some time in the middle of 2016. In so doing, they finally matched P2P messaging revenue.

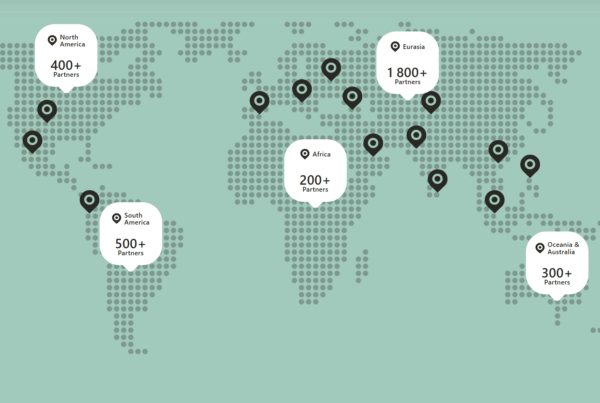

This is just the start, says Lasbrey. He forecasts more growth, with spectacular gains possible in developing markets. “High growth regions like Latam could be huge,” he says.

“These markets are 3x the size of many European countries, but are currently nowhere near as big in revenue terms. We have to resolve problems like SIM farms and grey routes that deliver on brands’ expectations. But if we can do that, I really think we can see 5x or even 10x growth in two or three years.”

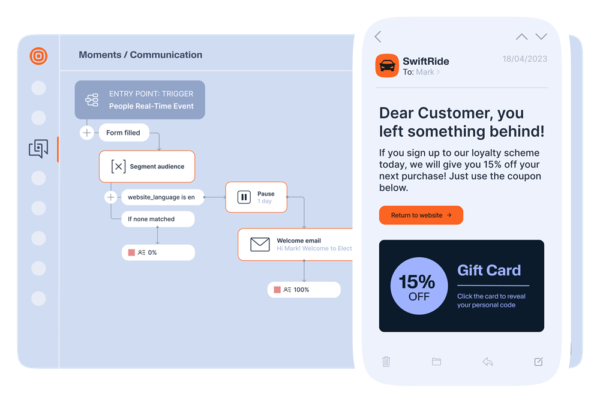

In more developed markets, Lasbrey believes enterprises will adopt a blended approach to customer messaging that will place SMS alongside other channels from one convenient dashboard.

This will be marketed as ‘messaging as a service’ by the industry’s intermediaries.

He says: “Brands see the value of SMS, but that doesn’t mean they can’t offer other options. The challenge is to make it easy for them to do so. That’s why aggregators are building convenient new services with one dashboard for sending texts, tweets, OTT messages and so on.

“It’s quite sensible of them to call this ‘messaging as a service’. We’ve seen a similar transition to cloud and to software-based offerings in other areas, so why not messaging? It’s good for perception, and I’m sure it helps with the market valuations of companies in the space too.”

enterprises will adopt a blended approach to customer messaging that will place SMS alongside other channels from one convenient dashboard. This will be marketed as ‘messaging as a service’ by the industry’s intermediaries

“One of the great advantages of text is that people expect it to be asynchronous. They actually prefer it. So you can create bot conversations that don’t have to be immediate, but can stretch across the day”.

Another dimension of these MaaS offerings may well be providing message ‘bots’ that answer consumer questions in natural language conversations.

Clearly, this process is already underway inside Facebook Messenger and other OTT platforms. Can it come to SMS?

“I really think it can,” says Lasbrey. “Obviously companies are already automating text delivery in response to customer queries. But for it to go further and become a real two-way conversation, we will need to develop something that is far better than a text version of ‘press one for this option’.

“That said, one of the great advantages of text is that people expect it to be asynchronous. They actually prefer it. So you can create bot conversations that don’t have to be immediate, but can stretch across the day.”

All of the impressive progress of A2P SMS to date rests on the platform’s simplicity and universality. But what if the world’s default messaging system were to evolve? How would that change things?

Well, it soon might. Last year, Google took control of RCS (Rich Communication Services) – the format that operators had tried and failed to establish as ‘SMS v2’. Lasbrey believes there’s a role for such an upgrade, though he is realistic about the effort required to make it happen universally.

“Consumers obviously want more from messaging. They want video and pictures. And I think enterprises do too. There will always be demand for simple text dialogue and alerts. But there will also be times when rich media can really enhance these communications – like when a bank wants to explain a product with a video, for example.

“The future might be RCS. It might not. Clearly, it’s very difficult to co-ordinate one system across every operator and every ecosystem in the world. So we’ll see. Ultimately, we’ll support whatever consumers see the value in.”