In our 5 minutes with profiles, MEF members talk about their business, their aspirations for the future and the wider mobile industry.

This week from Fraud Intelligence Limited, Board members Andrew Wong and Anthony Sani introduce the Fraud Intelligence Blockchain Platform.

What does Fraud Intelligence Limited do?

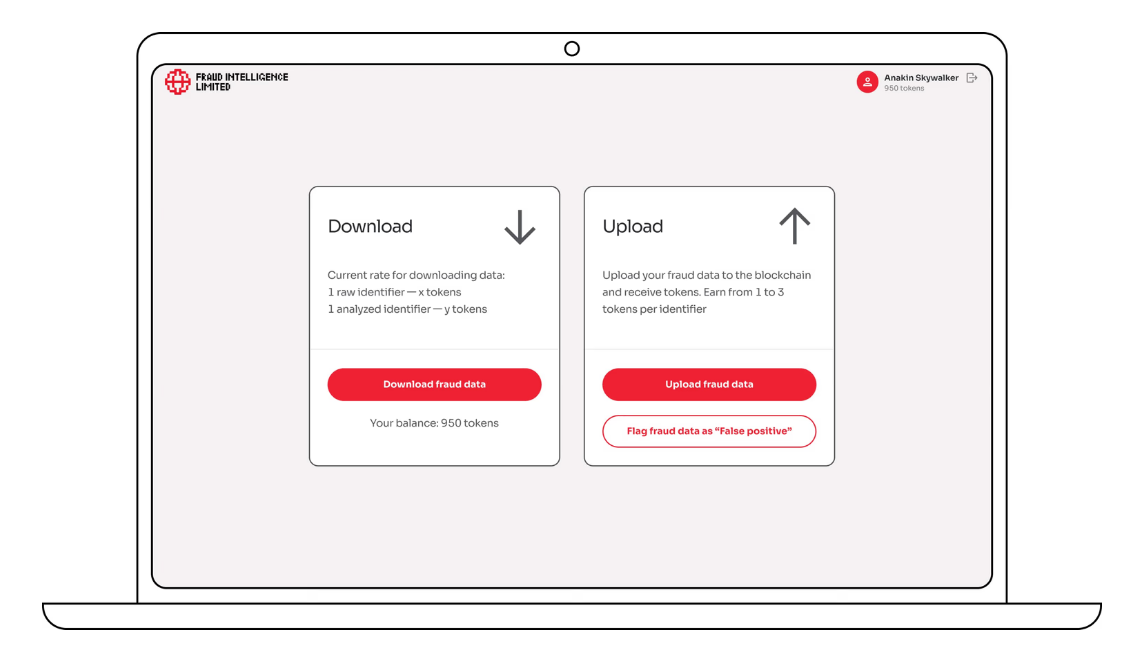

Fraud Intelligence Limited operates the Fraud Intelligence Blockchain (FIB), which is a vendor- and consortium-agnostic platform; a network of networks designed to enable real-time, secure, and collaborative fraud intelligence sharing between telcos, vendors, and law enforcement using SORAMITSU’s Hyperledger Iroha distributed ledger technology.

When did you launch and what growth have you seen?

Fraud Intelligence Limited (FIL), founded in the United Kingdom in 2019, is a joint venture between SORAMITSU and Orillion Solutions, with a mission to combat fraud, particularly in the telecommunications industry.

Through our customers and partners, we have seen a 3x growth or more than 13M+ fraud identifiers, catering to regional needs and area-relevant information.

This currently includes fraud types such as Wangiri, IRSF, A2PSMS, and IP Fraud, with planned support for both scam URLS and Flash Calling.

What are your main goals?

Fraud Intelligence Limited believes that fraud cannot be solved by any one party alone; it requires the power of the community to unite and work towards a common goal built on a global solution approach.

Our Goal is to build and strengthen an open-source ecosystem where all parties can share their fraud intelligence to benefit retail customers ultimately.

What aspect of mobile is the most exciting to you right now?

The most exciting development right now is the emergence of network APIs — and with them, the opportunity for telcos to move beyond passive infrastructure and become active protectors of the digital ecosystem. These APIs enable secure access to real-time network data, offering a game-changing way to detect fraud, verify identity, and protect consumers at the network edge.

But this potential will only be realized if we get the fundamentals right: data governance, interoperability, and a commitment to collaboration over competition. Without that, APIs will just become another siloed solution. Used wisely, however, they can help telcos play a leading role in fraud prevention — not just for themselves, but for every digital business relying on their networks.

What’s the most critical issue that will hit mobile within the next 12 months?

The most pressing issue will be the regulatory response to fraud’s growing impact across sectors. As more fraud starts with a connected device or a telephony service — from OTP interception to voice phishing and spoofed identities — regulators will rightly expect telcos to do more.

Cross-sector requirements are coming, and they’ll push telcos, financial services, digital platforms, and even governments to collaborate on data sharing, intelligence frameworks, and accountability models.

Those that prepare ahead — by investing in intelligence capabilities, consent-based data infrastructure, and cross-industry alliances — will be best positioned to lead.

Apart from your own, which mobile companies are the ones to watch in the year ahead?

The companies to watch are those that are unlocking the value of telco data to support fraud prevention far beyond the telecom domain. Fraud doesn’t just harm subscribers — it undermines digital trust everywhere. Telcos have rich, underutilized data that can protect e-commerce, fintech, and online platforms in real time — if made accessible securely and ethically.

The leaders in this space will be those who combine technical innovation with responsible data stewardship and a clear focus on enabling digital businesses to grow safely. We’re seeing momentum in fraud intelligence platforms, API security layers, and collaborative data-sharing models — and we’re actively partnering with those pushing this forward.