Gavin Patterson, MEF’s Director of Data, explores the rapid evolution of mobile connectivity as 5G adoption accelerates worldwide. From high-growth Asian markets to global trends in device uptake and network expansion, the rollout of next-generation networks is reshaping the mobile landscape. While opportunities abound, economic, technical, and regulatory challenges continue to shape the pace and reach of 5G deployment across regions.

The impact of fifth-generation (5G) networks on mobile connectivity in many markets worldwide was highlighted recently by Reliance Jio, the largest mobile operator in India.

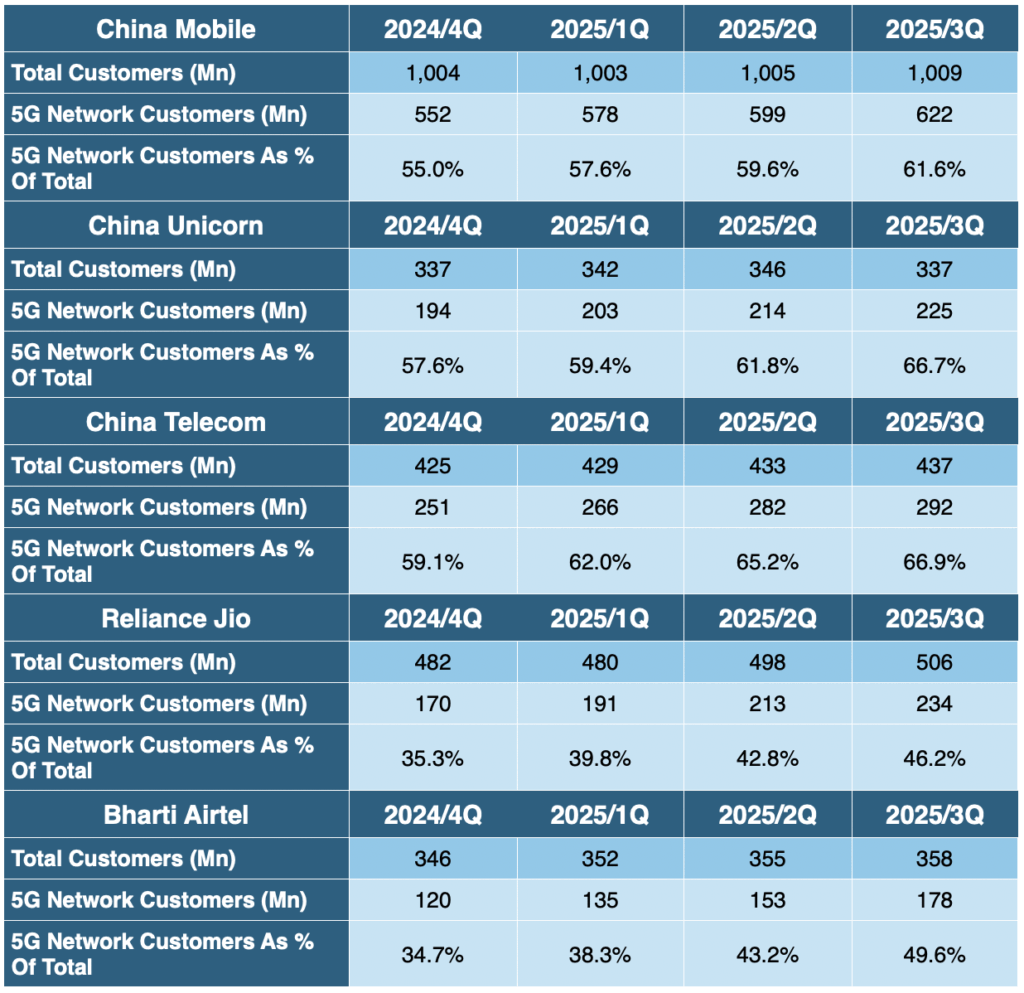

It announced 234 million 5G customers at the end of September, 2025 – equivalent to 46% of its total subscriber base in just three years since the service launched in October 2022.

While 5G coverage continues to rise steadily, progress remains uneven across different regions, hampered by a series of economic, technical, and regulatory challenges.”

Bharti Airtel, which launched 5G at the same time as Jio, is on course to announce around 178 million 5G users when it reports numbers early November – equivalent to almost 50% of its user base, with Vodafone Idea a little way behind having only launched 5G last year.

However, while rate of growth in 5G services in India has been staggering, the country still trails penetration in its eastern neighbour, China, where all operators launched 5G networks almost three years ahead of their counterparts in India. China Mobile reported 622 million 5G customers at the end of September, which is equivalent to almost 62% of its entire mobile base, China Telecom had 234 million (almost 67% of its user base), and China Unicom had 225 million (again, almost 67% of its base).

It is clear that volume of 5G users is being driven by Asian carriers and, in particular, those from China and India stand out for the sheer velocity and scale of 5G adoption, but both these markets lag others in terms of overall 5G penetration.

According to MEF Data, global 5G handset connections rose from 1.48 billion at the end of 2023 to 2.06 billion at the end of 2024 (the last full year we have data for) when they accounted for 25% of the total 8.28 billion handset connections worldwide. China saw the launch of 5G services in October 2019, three years ahead of India in October 2022 and, as a result, boasts much higher penetration of 5G, averaging 56% end-24 versus 26% in India.

However, other markets are also advancing steadily, with 40% or higher 5G penetration in 18 of the 218 markets covered by MEF, and eight markets claiming more than 50% penetration – with Denmark leading the pack on 78%, followed by Macau on 68%, South Korea on 65%, and then the USA (62%), Qatar (58%), China (56%) and Bahrain & Iceland (both 50%).

Barriers to growth

While 5G coverage continues to rise steadily, progress remains uneven across different regions, hampered by a series of economic, technical, and regulatory challenges. One of the biggest hurdles is the high cost of infrastructure. Building 5G networks requires dense deployment of small cell towers, advanced antennas, and extensive fibre backhaul – investments that are proving difficult for many operators, particularly in developing markets. Spectrum availability is another major obstacle, while delays in government auctions, coupled with inconsistent regulatory frameworks, have slowed network rollouts in several countries.

Device affordability also remains an issue. Although 5G-enabled smartphones are becoming more common, their cost still places them out of reach for millions of consumers. At the same time, operators face the challenge of maintaining existing 4G services while investing heavily in next-generation networks.

While 4G technology is now almost ubiquitous, with network services offered by almost 95% of the 663 live MNOs in the 218 markets covered by MEF at end of last year, 5G services were only commercially available from around 356 MNOs – which is equivalent to just 54% of the total.