Flipkart’s latest fintech push is reshaping India’s digital landscape through its fast-rising Supermoney platform. Already gaining ground in the country’s massive UPI market, the app signals a deeper convergence of commerce, finance, and mobile ecosystems. As rivals jostle for dominance, the bigger question is what comes next. MEF CEO Dario Betti explains the industry-wide implications of this shift.

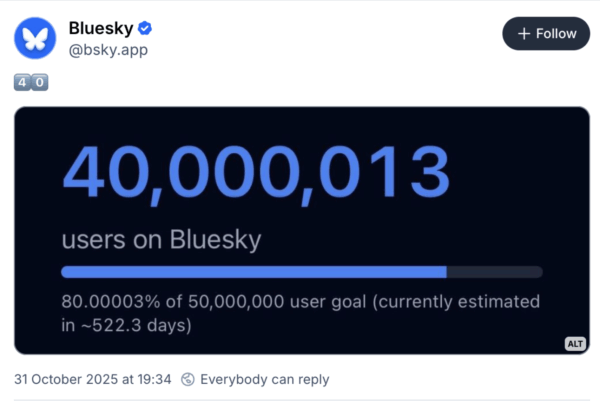

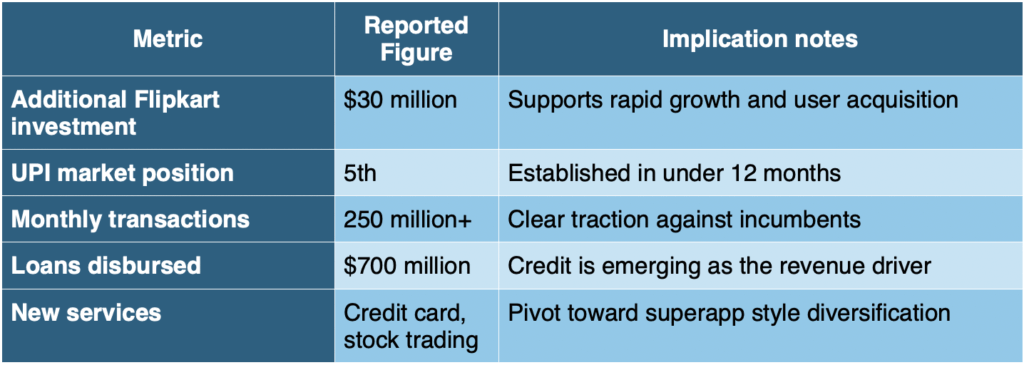

Walmart-backed ecommerce giant Flipkart has taken a decisive step to expand its fintech play, injecting an additional $30 million into its financial services arm, Supermoney on September 10th, 2025.

The move comes less than a year after Supermoney entered the crowded India’s Unified Payments Interface (UPI) ecosystem — and already ranks as the country’s fifth largest UPI app, logging over 250 million transactions every month.

The news matters well beyond fintech. For the mobile ecosystem in India — one of the world’s largest and most dynamic — Supermoney’s rapid rise raises new questions about competition, customer engagement, and the convergence of commerce and finance inside every smartphone.

A New Force in India’s UPI

India’s UPI platform is often described as the crown jewel of digital public infrastructure. It is a standardised solution to provide payments, key to the mobile payments in the market. It now processes billions of transactions each month, covering everything from peer-to-peer transfers to micro merchant payments.

With UPI, India has effectively turned the smartphone into a national digital wallet.”

Supermoney’s ascent into the top five, alongside PhonePe, Google Pay, Paytm, and Amazon Pay, has been swift. Armed with Flipkart’s consumer base of 450+ million shoppers, Supermoney has capitalised on its ecommerce integration to rapidly onboard users.

The $30 million capital infusion will allow Supermoney to accelerate feature buildout and brand positioning. Already, the platform has launched a co-branded credit card and begun offering stock trading services — clearly positioning itself not only as a payment provider but as a multi-service financial hub.

It has also distributed more than $700 million in loans, reflecting how credit will be a central lever for monetisation, particularly in a regulatory environment where basic UPI payments generate negligible revenue.

Intensifying Competition

The digital payments landscape in India remains one of the most hotly contested globally.

- PhonePe, another Flipkart spinoff now and also owned separately by Walmart, leads with significant share and merchant penetration. The two apps compete but are owned by the same investors. It may seem counterintuitive but there are several strategic reasons for this move. In India, the National Payments Corporation of India (NPCI) sets market share caps for UPI transaction volumes. The dual-app strategy allows Walmart to control a larger portion of the overall UPI market through two separate entities, preventing either one from hitting the market-share ceiling.

- Google Pay enjoys scale, baked into the Android ecosystem.

- Paytm, despite a rocky postIPO period, remains deeply embedded across payments, wealth management, and bill services.

Supermoney’s arrival therefore intensifies an already crowded field. But its unique differentiator is platform linkage: by tying financial services to the commerce flows of Flipkart, Supermoney can tap customer spending data, offer credit at the point of sale, and lock users deeper into a single mobile wallet experience.

From an ecosystem perspective, this fits a broader global trend: retail and commerce giants integrating embedded finance to create “stickier” digital ecosystems.

What Supermoney Signals for the Mobile Industry

The story here is less about one startup and more about how mobile-led finance is transforming smartphone usage in India. Supermoney’s ability to integrate payments, credit, and trading into Flipkart’s ecosystem reflects a superapp trajectory that has precedent in Asia (e.g., WeChat in China, Grab in Southeast Asia). India’s regulatory environment may chart a different course, but the trendline is evident.

Flipkart’s fintech expansion is also framed by its anticipated IPO. A thriving payments and credit arm will strengthen its market story, presenting Flipkart as more than an ecommerce player: instead, an ecosystem platform anchored around the smartphone.

Financial services add layers of monetisation but also big data advantages — insights into customer spending habits can inform not only lending decisions but also personalised ecommerce promotions. From the perspective of global investors, coupling commerce and fintech has proven attractive across emerging markets, as it signals longer-term capture of consumer lifetime value.

With UPI, India has effectively turned the smartphone into a national digital wallet. In that context, Flipkart’s Supermoney strategy is not just about transactions — it is about owning consumer journeys within the mobile environment. The implications are global: as India proves out how embedded finance reshapes mobile competition, other markets may follow with their own regulatory and technological frameworks.

Analysis

Supermoney’s rapid trajectory illustrates three critical dynamics for the mobile ecosystem community to watch:

- Platform Convergence – The line between commerce apps and fintech apps is blurring; mobile players should assume finance will be embedded into other verticals.

- Scale vs. Differentiation – Winning market share in UPI requires both deep pockets and unique integrations; incumbents will face pressure to innovate beyond payments. However, regulatory pressure supports a more fragmented market.

- Data-Driven Competition – The real prize is not only transaction volume but also data insights that can shape credit, commerce, and engagement strategies.

As Flipkart channels more resources into Supermoney, the real test will be sustaining growth while navigating India’s competitive and regulatory pressures. For now, however, it signals that the mobile ecosystem in India remains one of the fastest moving and most strategically important globally.