Telecoms remain vital to the digital economy, yet their financial performance tells a more complex story. Despite stable margins, revenue growth is sluggish and returns are under pressure. In this post, MEF CEO Dario Betti examines the sector’s challenges and highlights why finding new growth paths beyond connectivity is now essential.

Telecoms remain at the heart of the growing digital economy, but when we look at their financial performance over the past decade, a different financial picture emerges.

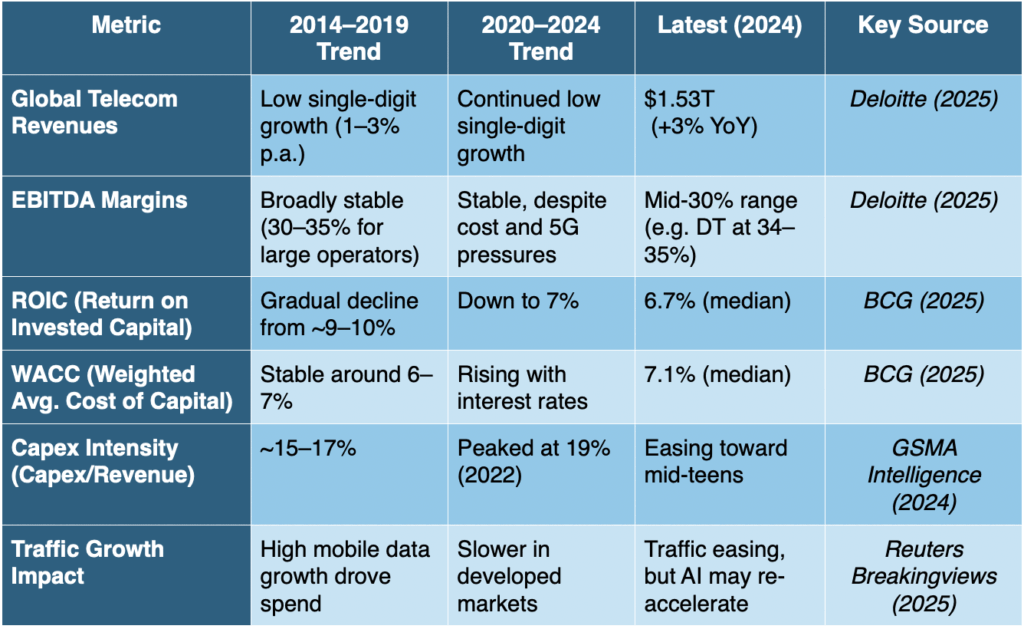

Recent reports paint a picture of a sector that has some financial challenges at a global level. While operating margins have held steady, the sector’s overall profitability has been under pressure, with returns even slipping below the cost of capital.

Stable Margins, Slower Growth

At the headline level, telecoms still generate healthy cash flows. Operating profitability, measured through EBITDA margins, has been broadly stable in most regions—often in the mid-30% range for large integrated operators. This resilience reflects careful cost management and the enduring demand for connectivity.

But revenue growth has been modest. Deloitte estimates global telecom revenues at around $1.53 trillion in 2024, a year-on-year increase of just 3%, in line with the low single-digit growth typical of the last decade.

For telecoms, the question is no longer just about efficiency, but about new growth paths. Whether through digital services, infrastructure sharing, or partnerships across the mobile ecosystem, operators must find ways to create value that go beyond connectivity alone.”

Returns Under Pressure

The deeper story is one of declining economic returns. BCG’s latest Telecommunications Value Creators report shows that the median telecom operator delivered a return on invested capital (ROIC) of about 6.7% in 2024, while the sector’s cost of capital (WACC) had risen to roughly 7.1%. In simple terms, many operators failed to earn back the cost of the money they invested.

McKinsey analysis points to a long-term trend: over the past decade, telecom ROIC has been on a slow but steady decline, squeezed by heavy capital requirements, regulatory constraints, and fierce competition.

Capex Intensity Peaks and Eases

One bright spot is capital expenditure. According to GSMA Intelligence, global mobile Capex intensity—Capex as a share of revenue—peaked at around 19% in 2022, as operators raced to deploy 5G. Analysts at Analysis Mason and Dell’Oro expect that ratio to fall into the low-teens by the late 2020s, relieving some pressure on cash flow.

In the near term, slower growth in data traffic across developed markets could allow operators to moderate spending, though the surge in AI-driven applications may renew capacity pressures in future years.

A Sector at a Crossroads

The financial picture of the last decade shows a mixed reality:

- Stable operating margins support strong short-term cash generation.

- Weak revenue growth and falling ROIC point to structural challenges.

- Easing Capex intensity offers a welcome reprieve for investors.

For telecoms, the question is no longer just about efficiency, but about new growth paths. Whether through digital services, infrastructure sharing, or partnerships across the mobile ecosystem, operators must find ways to create value that go beyond connectivity alone.

Here at MEF we are fostering debated on multiple new area of growth, join our members in reshaping the future of mobile telecom.