MEF Advisor and Programme Lead Matt Ekram, highlights how mobile payments are reshaping Latin America. Brazil leads with PIX and WhatsApp Pay driving instant, mobile-first transactions. In Mexico, Clip and Klar empower small businesses and young consumers, while Colombia’s Nequi and Daviplata accelerate inclusion through digital wallets. Regional innovation, regulation, and CPaaS integration fuel rapid adoption across markets..

Mobile payments might trigger an immediate reaction “Africa!”, but there is another region that is surprising showing local and global activity: Latin America. Payments are converging as regional innovation, regulatory shifts, and changing consumer behaviours accelerate digital transformation. Brazil, Mexico, and Colombia stand out as case studies in how mobile-first services can reshape financial inclusion and business communications.

Brazil: WhatsApp Payments and PIX Transform Daily Transactions

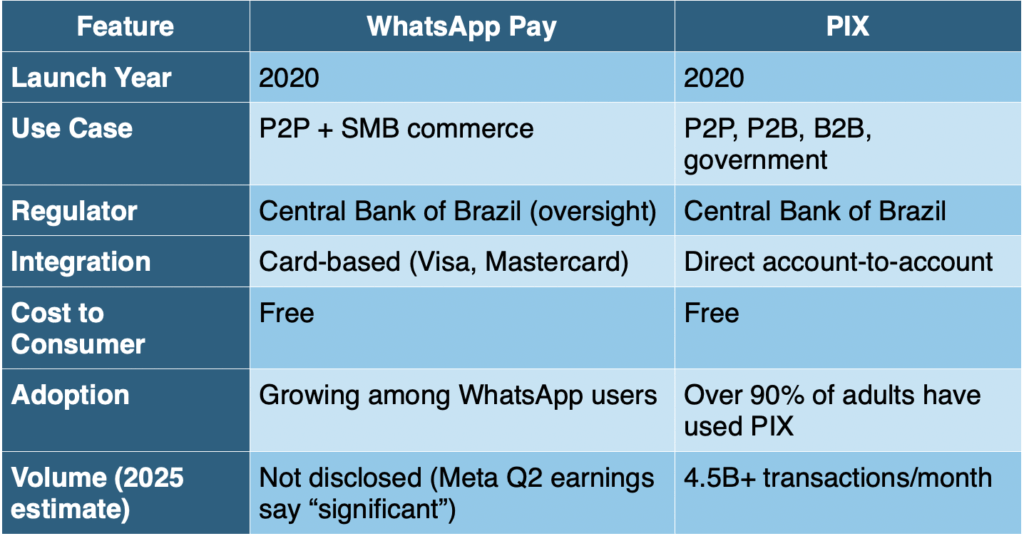

Brazil is arguably the global laboratory for mobile-first finance and messaging convergence. On one hand, PIX, launched by the Central Bank. The system was recently profiled by MEF in June 2025 as it has become one of the most successful instant payment systems in the world. On the other, WhatsApp, the country’s most used app, is steadily rolling out its payment and commerce capabilities that has built a services (also using PIX) in the country.

Payments are converging as regional innovation, regulatory shifts, and changing consumer behaviours accelerate digital transformation.“

WhatsApp Payments in Brazil

Meta launched WhatsApp Pay for person-to-person (P2P) transactions in Brazil in 2020. It was launched in stages after initial suspension. Initially, peer-to-peer transactions were enabled in 2021, followed by in-chat business payments in 2023. The service faced initial hurdles with the Central Bank of Brazil but eventually integrated with the country’s PIX instant payment system. Originally it partnered with Visa and Mastercard, but it had to stop and later integrate with the wider Brazil payment landscape. WhatsApp Pay in Brazil does not charge users for transactions. Despite regulatory delays, the feature is gaining traction, especially among small businesses. Key Features:

- Peer-to-peer payments using debit/credit cards

- Merchant payments supported via integrations with licensed PSPs (e.g., Cielo, Mercado Pago)

- No fees for consumers; small fees may apply to merchants

- Embedded in chat, catalogue, or reply to messages

PIX: The Gold Standard for Instant Payments

Launched by Brazil’s central bank in 2020, PIX is now used by more than 150 million Brazilians, covering individuals, businesses, and government. It supports:

- 24/7/365 real-time transfers

- QR code and mobile phone number initiation

- Direct debits, payrolls, tax payments

Recent initiatives include offline PIX for areas with limited connectivity and international PIX pilot schemes to link regional payment systems.

Mexico: Clip and Klar

Mexico is Latin America’s second-largest economy but still has a significant financial inclusion gap, with around 50% of adults unbanked. Here, fintech and CPaaS providers are stepping in to deliver mobile-led solutions.

- Clip is a leading Mexican point-of-sale (POS) and mobile payments startup, recently valued at over $2 billion. It enables card acceptance via mobile devices and offers inventory and messaging tools to merchants. Its mission: empower small businesses in Mexico to digitise payments and engagement.

- Klar is a digital banking platform offering credit, savings, and debit services via mobile app. Backed by investors like General Atlantic and Prosus, Klar targets young, underserved Mexicans. It uses in-app messaging, email, and push notifications to deliver statements, promotions, and alerts.

Both companies are scaling their user base rapidly. (Clip: 600k+ merchants; Klar: 3M+ users). Thery are also heavy users of CPaaS platforms for multichannel communication and exploring integrations with WhatsApp and SMS for real-time updates.

Colombia: Nequi and Daviplata Drive Mass Adoption of Mobile Wallets

Colombia has taken a policy-led approach to digitisation, using mobile wallets to deliver financial and social services.

- Nequi (by Bancolombia) is a fully digital neobank with over 15 million users. It offers P2P transfers, bill payments, budgeting tools, and virtual debit cards—all via mobile app. It also supports integration with WhatsApp for notifications and access.

- Daviplata (by Davivienda) serves 14 million+ users, many of whom were reached through government disbursements during the pandemic. It plays a central role in Colombia’s financial inclusion strategy, with features like offline access, chatbots, and multi-channel alerts (SMS/WhatsApp).

Both platforms are deeply integrated into the communications fabric of daily life—not just payment apps, but financial engagement tools.

At MEF, we see this as a call to collaborate, innovate, and act.