Match Group will pay $14M and revise practices after an FTC settlement over misleading guarantees and tough cancellations. The case underscores risks for subscription businesses, payment providers, and aggregators in the mobile ecosystem. It stresses transparency, fairness, and trust as essentials. MEF CEO Dario Betti examines how consumer protection remains central, urging businesses to simplify cancellations and avoid dark patterns.

Match Group, the company behind Match.com, OkCupid, Plenty of Fish, and The League, has agreed to pay $14 million and overhaul its cancellation and advertising practices on August 12, 2025.

This is ending a nearly six-year legal battle with the U.S.A. Federal Trade Commission (FTC). The case is a wake-up call for all subscription-based businesses, especially those operating in the mobile ecosystem.

The FTC’s lawsuit from 2019 accused Match Group of misleading users with its “six-month guarantee,” which promised a free renewal if users didn’t “meet someone special.” The guarantee had ‘hidden’ requirements, such as sending a minimum number of messages within specific timeframes, details that were not clearly disclosed at the time of signing. The FTC also found that Match locked out users who disputed charges, even after collecting payment, and made it difficult for users to cancel subscriptions.

Match Group’s $14 million lesson is clear: in the mobile subscription economy, transparency, fairness, and user empowerment are non-negotiable.”

Under the settlement, Match must: disclose all terms of its guarantees and offers clearly, make account cancellation straightforward and accessible, stop retaliating against users who dispute charges, and pay $14 million, which the FTC will use to compensate affected consumers. Match did not admit or deny wrongdoing as part of the settlement.

The “Click-to-Cancel” Rule: Gone, But Not Forgotten

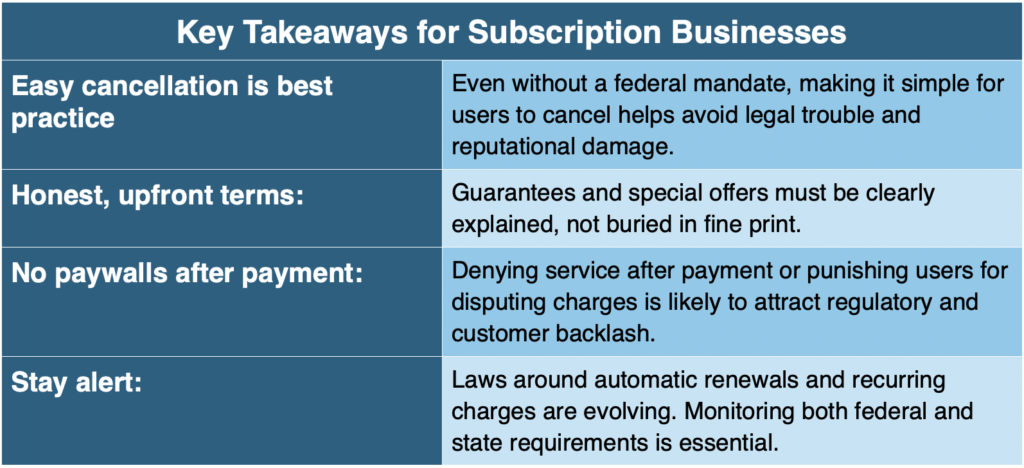

Just before the FTC’s new “click-to-cancel” rule was set to take effect in July 2025, the Eighth Circuit Court removed it. This means there’s currently no federal requirement for companies to make cancellation as easy as sign-up. However, the FTC and state regulators continue to scrutinize “dark patterns” and difficult cancellation processes under existing consumer protection laws. States like California already require accessible cancellation for automatic renewals. So these are the Key Takeaways for Subscription Businesses.

Impact: What This Means for the Mobile Ecosystem

For Payment Providers

The Match case highlights the risks of “retaliatory” practices—such as suspending accounts after billing disputes. Payment providers must ensure that their partners do not penalize users for exercising their rights to dispute charges. Transparent billing and easy refund processes are not just regulatory requirements; they are essential for maintaining trust and reducing chargeback rates.

For Mobile Content and Service Aggregators

If you aggregate or distribute subscription-based services, you are in the regulatory spotlight. The FTC’s action signals that all parties in the value chain, platforms, aggregators, and app developers, must ensure that offers are clear, cancellation is easy, and users are not misled by “dark patterns.” Aggregators should audit partners’ practices and provide clear, accessible cancellation pathways within their own platforms.

For the Broader Mobile Industry

The settlement is a reminder that consumer protection is not going away. In a world of recurring charges and auto-renewals, transparency and easy exits are not just legal obligations—they are brand essentials. Companies that prioritize user trust and compliance will be better positioned as regulators and consumers demand higher standards.

In conclusion

Match Group’s $14 million lesson is clear: in the mobile subscription economy, transparency, fairness, and user empowerment are non-negotiable. The companies that get this right will not only avoid legal trouble—they’ll build stronger, more loyal customer relationships.