Fantasy sports platforms like Dream11, My11Circle, and MPL have taken India by storm, while in the United States, DraftKings and FanDuel have transformed from niche offerings into multibillion-dollar businesses. The recent growth of these platforms is forcing the mobile ecosystem to ask some important questions. MEF’s Dario Betti discusses the state of play.

The Fantasy Boom: India’s Leading Platforms

In India, fantasy sports platforms now account for some of the most popular mobile apps:

- Dream11 leads with over 200 million registered users and posted revenues of ₹6,384 crore (approx. USD $765 million) in FY2023, alongside a profit of ₹188 crore (USD $22.5 million).

- My11Circle and MPL (Mobile Premier League) trail at a distance, each serving tens of millions of active users. During peak sporting events such as the Indian Premier League (IPL), these platforms collectively drive an estimated ₹3,000 crore (USD $360 million) in revenue from an active user base exceeding 60 million.

India’s overall fantasy market was valued at approximately ₹45,000 crore (USD $5.4 billion) in 2023 and is projected to reach ₹1 lakh crore (USD $12 billion) by 2027, with user numbers potentially surpassing 500 million.

The US Perspective: DraftKings and FanDuel

In the United States, the two giants—DraftKings and FanDuel—have evolved well beyond fantasy sports into regulated sports betting operators:

- DraftKings reported 2.7 million monthly paying users as of early 2024 and generated revenues exceeding USD $3.7 billion in FY2023. Their business is now heavily focused on mobile sports wagering. DraftKings remains fundamentally mobile-centric, with app-driven products forming the core of its strategy. The app integrates fantasy, sportsbook, and casino offerings under one account, facilitating deep cross-sell and retention in-app while enhancing user experience across mobile. DraftKings also credits mobile UX innovations and streamlined app flows for boosting engagement and user acquisition .

- FanDuel, owned by Flutter Entertainment, leads the US sports betting market with an estimated 12 million users and annual revenues approaching USD $4 billion. It integrates fantasy sports, daily fantasy contests, and sports betting under a unified mobile platform.

Responsible adoption, clear compliance frameworks, and ongoing regulatory clarity will determine whether fantasy sports apps become a lasting pillar of mobile content—or face the fate of many early VAS products disrupted by regulation or market distrust.”

Both USA companies have invested heavily in responsible gaming tools, age verification systems, and state-specific compliance structures, illustrating the challenges of operating at the intersection of gaming and gambling.

DraftKings is a top mobile advertiser.

DraftKings continues to invest heavily in acquiring mobile users—but has driven notable efficiency gains. Total sales and marketing spend was approximately $1.2 billion for FY 2024, consistent with FY 2023 levels. The Financial Year 2024 saw 3.5 million new customers acquired at “record low CACs”, according to their FY earnings presentation.

A 40% YoY reduction in cost per acquisition was reported in April 2024—though exact dollar CACs were undisclosed. Industry analysts estimate these CACs to range from $200–300 per user, supported by earlier indications of $282 CAC and improved LTV (approximately $687 per customer).

DraftKings does not release specific SMS marketing spent, but it shares a multi-channel mobile marketing mix that likely includes SMS as well as personalized push notifications, email, , and in-app messaging to promote bets, bonuses, and live events.

Gaming, Gambling, or New Value-Added Service (VAS)?

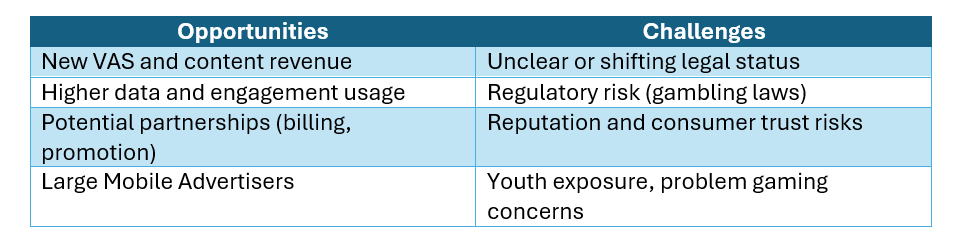

One way to look at these fantasy sports platforms is to see them as a new generation of mobile Value-Added Services (VAS). After all, they share many characteristics with traditional mobile content offerings: they drive heavy mobile engagement, rely on micro-payment models, and see strong seasonal spikes—especially around major sporting events like the IPL or FIFA tournaments. There’s even potential for mobile operators to partner directly with these platforms, either through user acquisition campaigns or by integrating carrier billing options to simplify payments.

But there’s another, more cautious perspective: could these platforms fall into the category of services that require gambling-level oversight and compliance? The legal landscape certainly suggests complexity. In India, fantasy sports are broadly classified as games of skill at the federal level, but this is not the case everywhere—some states have moved to restrict or ban such services outright. This patchwork of regulation raises real challenges.

Beyond legality, there are also wider consumer protection concerns. These platforms encourage repeated play and financial stakes, potentially exposing users to risks of addiction or financial loss. For mobile network operators and app stores, this presents a dilemma: if local regulations are ambiguous or change suddenly, they could find themselves unintentionally facilitating services that fall foul of gambling laws.

In short, fantasy sports platforms sit in a grey area between entertainment and risk—one that the mobile industry will need to navigate carefully.

App Stores and MNOs: Walking the Compliance Tightrope

Both Google Play and Apple App Store have adjusted policies to allow real-money fantasy sports apps in regulated markets. However, operators and distributors face risks if platforms:

- Misrepresent their nature (i.e., gambling disguised as gaming)

- Fail to protect minors or problem players

- Violate payment regulations (anti-money laundering, KYC norms)

For Mobile Network Operators (MNOs), this raises key considerations:

- Should fantasy sports platforms be included in direct carrier billing partnerships?

- What due diligence and legal vetting are needed before promoting such services?

- How do these platforms fit into new bundles or promotional packages?

For the wider mobile industry, fantasy platforms may represent a new category of interactive, monetizable mobile content—but only if regulatory and ethical standards are upheld.

A Market with High Potential, But an Uncertain Ceiling

While fantasy sports platforms are seeing impressive user growth and revenue spikes, analysts caution that long-term sustainability is far from certain. According to reports from KPMG India and Deloitte, the sector faces inherent risks tied to regulatory volatility, high customer acquisition costs, and market saturation. For example, while India has embraced fantasy gaming as a game of skill at the federal level, some state-level bans (such as in Tamil Nadu and Andhra Pradesh) create an unpredictable legal environment, limiting market scalability.

A 2023 analysis by Statista also noted that while the Indian fantasy sports user base could exceed 500 million by 2027, monetization per user remains low compared to Western markets, reflecting price sensitivity and the limited spend capacity of a large share of the user base. This suggests a potential ceiling in profitability unless business models evolve.

In the USA, similar caution has been raised by market research firm Eilers & Krejcik Gaming, which pointed out that the convergence of fantasy sports and regulated sports betting is creating intense competition, reducing differentiation and margin opportunities for standalone fantasy platforms.

Therefore, while the market’s current momentum is undeniable, its stability over the next decade is subject to multiple variables—including regulation, consumer protection measures, and evolving player preferences.

In the US, the convergence of fantasy and sports betting suggests that fantasy may simply be a gateway to broader gambling—a development that would significantly shift compliance requirements.

The Future: What Does This Mean for the Mobile Ecosystem?

For MEF members—including MNOs, CPaaS providers, aggregators, and app developers—this sector offers both opportunity and caution:

Responsible adoption, clear compliance frameworks, and ongoing regulatory clarity will determine whether fantasy sports apps become a lasting pillar of mobile content—or face the fate of many early VAS products disrupted by regulation or market distrust.

The MEF ‘Content, DCB & Advertising’ Insight Group will continue to monitor and explore this important trend. We invite MEF members to contribute to our working group discussions on:

- The classification of fantasy sports and real-money apps in mobile ecosystems

- Operator and app store policy development

- The balance between monetisation and consumer protection

For more information or to join the Insight Group, please contact the MEF team at info@mobileecosystemforum.com.