MEF Advisor and Programme Lead Matt Ekram, explores The World Bank’s Global Findex Database, which has long served as a barometer for the world’s progress in financial inclusion.

The 2025 edition, released this July, offers a comprehensive and data-driven look at how digital financial services—especially mobile money—are reshaping access to finance across the globe. The latest Findex report confirms what many in our industry have observed: mobile money is not just a tool for payments, but a catalyst for broader economic participation and resilience.

A Decade of Progress, Accelerated by Mobile

Since its inception in 2011, the Global Findex Database has tracked the world’s journey toward universal financial access. The 2025 report is particularly significant, as it captures the aftermath of the COVID-19 pandemic—a period that forced rapid digitalisation in many sectors, including finance. According to the World Bank, 79% of adults globally now have an account at a bank, financial institution, or through a mobile money provider. This is a remarkable leap from 51% in 2011.

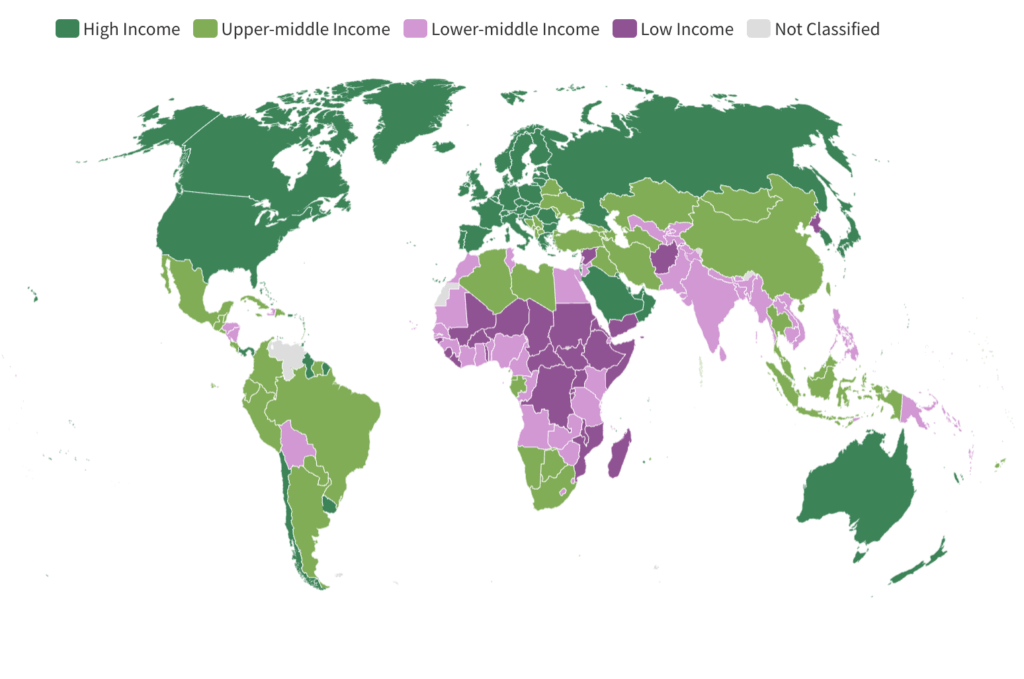

The most striking gains have been in low- and middle-income economies, where mobile money has become a primary driver of inclusion. In Sub-Saharan Africa, for example, 40% of adults now have a mobile money account, up from 27% just three years ago. This region remains the global leader in mobile money adoption, with services like M-Pesa, MTN Mobile Money, and Orange Money becoming household names.

The Findex data shows that digital payments are now the most popular financial service in low- and middle-income economies, with 61% of adults making or receiving digital payments in 2024.“

Mobile Money: Beyond Payments

The Findex 2025 report highlights a critical shift: mobile money is no longer limited to peer-to-peer transfers or bill payments. Increasingly, these accounts are being used for formal savings, access to credit, and even insurance. In Sub-Saharan Africa, the share of adults using mobile money to save formally has doubled since 2021. In Latin America and the Caribbean, 37% of adults now have a mobile money account, and the integration of mobile wallets with traditional banking is accelerating.

This evolution is not just about convenience. It is about empowerment. For millions, mobile money provides a first step into the formal financial system—a system that can help families manage risks, invest in education, and build for the future. The Findex data shows that digital payments are now the most popular financial service in low- and middle-income economies, with 61% of adults making or receiving digital payments in 2024.

The Digital Divide: Progress and Persistent Gaps

While the headline numbers are encouraging, the Findex report is careful to highlight the challenges that remain. Despite the rapid growth in account ownership, 1.3 billion adults worldwide still lack access to formal financial services. The digital divide is a stubborn barrier: many of the unbanked do not own a mobile phone, and the cost of devices remains a significant obstacle, especially for women and rural populations.

The report also notes that increased account ownership has not yet translated into improved financial resilience for all. Many account holders continue to rely on informal mechanisms to manage financial shocks, and a significant proportion of accounts remain dormant. Digital safety and trust are ongoing concerns, with users citing fears of fraud and lack of digital literacy as reasons for not fully embracing mobile financial services.

Regional Insights: Sub-Saharan Africa and Latin America

Sub-Saharan Africa’s leadership in mobile money is well documented, but the Findex 2025 report provides fresh insights into how these services are evolving. The region’s mobile money ecosystem is becoming more sophisticated, with providers offering a wider range of products, from microloans to health insurance. The report finds that women, in particular, are benefiting from mobile money, with the gender gap in account ownership narrowing significantly over the past three years.

In Latin America and the Caribbean, the story is one of integration. Mobile wallets are increasingly linked to traditional bank accounts, enabling users to move funds seamlessly between platforms. This hybrid model is fostering innovation and competition, with fintech startups and established banks alike racing to offer new digital products.

The Role of Policy and Regulation

The Findex report underscores the importance of supportive policy environments in driving financial inclusion. Countries that have embraced regulatory frameworks for mobile money—such as tiered know-your-customer (KYC) requirements and interoperability mandates—have seen faster growth in account ownership and usage. The report calls for continued investment in digital infrastructure, consumer protection, and financial education to ensure that the benefits of digital finance are widely shared.

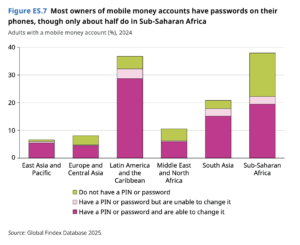

A note of concern is present in Sub-Sahara Africa where about half of the users of mobile money do not have a password or PIN to protect their accounts (or do not know how to change it). There is a clear need to improve usability and promote education in the market for mobile money. As the following graph shows, there are still important gaps in other regions too.

At MEF, we have long advocated for a balanced approach to regulation—one that encourages innovation while safeguarding users. The Findex findings reinforce the need for collaboration between governments, industry, and civil society to address the remaining barriers to inclusion.

Next: Opportunities and Responsibilities

The 2025 Global Findex Database is both a celebration of progress and a call to action. The expansion of mobile money has brought millions into the financial mainstream, but the journey is far from over. As digital financial services become more embedded in daily life, the industry must address issues of trust, security, and accessibility.

For the mobile ecosystem, the opportunities are immense. The next wave of innovation—whether in digital identity, cross-border payments, or embedded finance—will depend on the foundations laid by mobile money. But with opportunity comes responsibility. Providers must invest in user education, robust security measures, and products that genuinely meet the needs of underserved communities.