Company Profile/

Your business and your customers need to confidently access and exchange information simply, seamlessly and securely.

iconectiv’s extensive experience in information services, digital identity and numbering intelligence helps you do just that. In fact, more than 5K customers rely on our data exchange platforms each day to keep their networks, devices and applications connected and 2B consumers and businesses protected. Our cloud-based information as a service network and operations management and numbering solutions span trusted communications, digital identity management and fraud prevention.

For more information, visit www.iconectiv.com. Follow us on X and Linkedln.

MEF Minute/

Securing The Rich Messaging Experience

At MEF Connects Rich Communications one of the sessions focussed on what the industry needs to do to build the next wave of B2C communications on a trusted foundation that will help brands better engage consumers. Here, Tara Condon, Director of Product Marketing at iconectiv, shares the key themes of the discussion, which you can watch in full on demand now.

MEF Briefing – Combating Robocalling with STIR/SHAKEN

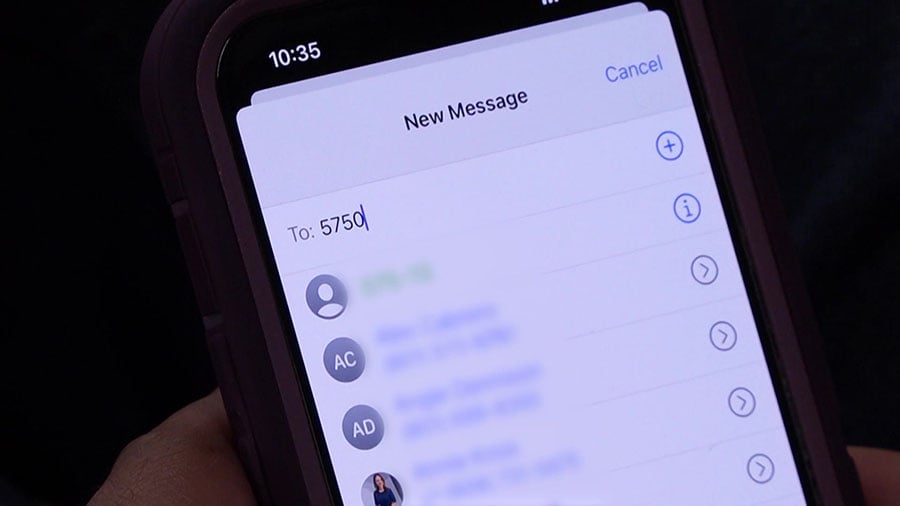

Both the US Government’s House of Representatives and the Senate recently approved respective dedicated anti-robocalling measures which if signed into law will make it easier for tougher penalties to be imposed on illegal robocallers and fraudsters. It will also demand carriers deploy call authentication technology at a much faster rate.

iconectiv: Fighting Fraud in USA – STIR SHAKEN, Short Codes & Portability

MEF CEO Dario Betti speaks to Chris Drake, CTO of communications infrastructure specialist iconectiv about the USA communications market and how it is responding to the growing threat of telecoms fraud. Chris explains how the US regulator, the FCC, has reacted to robocalls with STIR / SHAKEN , where iconectiv administers SHAKEN, and how they also operates as the Local Number Portability Administrator and the Short Code Registry in the USA.

Industry Views: AI, chatbots and banking

Accenture’s 2017 Banking Technology Vision report explores the role of AI in banking and customer engagement. It found that 78 per cent of bankers believe AI will revolutionise the way banks gather information and interact with customers.

One of the key advantages highlighted was that whilst AI is increasingly automating customer interaction, it is also providing a more personalised experience.

Chatbots for example are increasingly used by banks to handle routine enquiries and represent a more personalised experience than visiting the modern day substitute for branch banking, a website or app, where customers interact with layers of screens and drop-down menus instead of a person.