The UAE’s recent regulatory move to phase out SMS and email-based One-Time Passwords (OTPs) marks a turning point in global digital security. This decisive shift signals the beginning of a new era for authentication, trust, and mobile ecosystem innovation. MEF Director of Programmes, Nicholas Rossman highlights what this means for stakeholders worldwide.

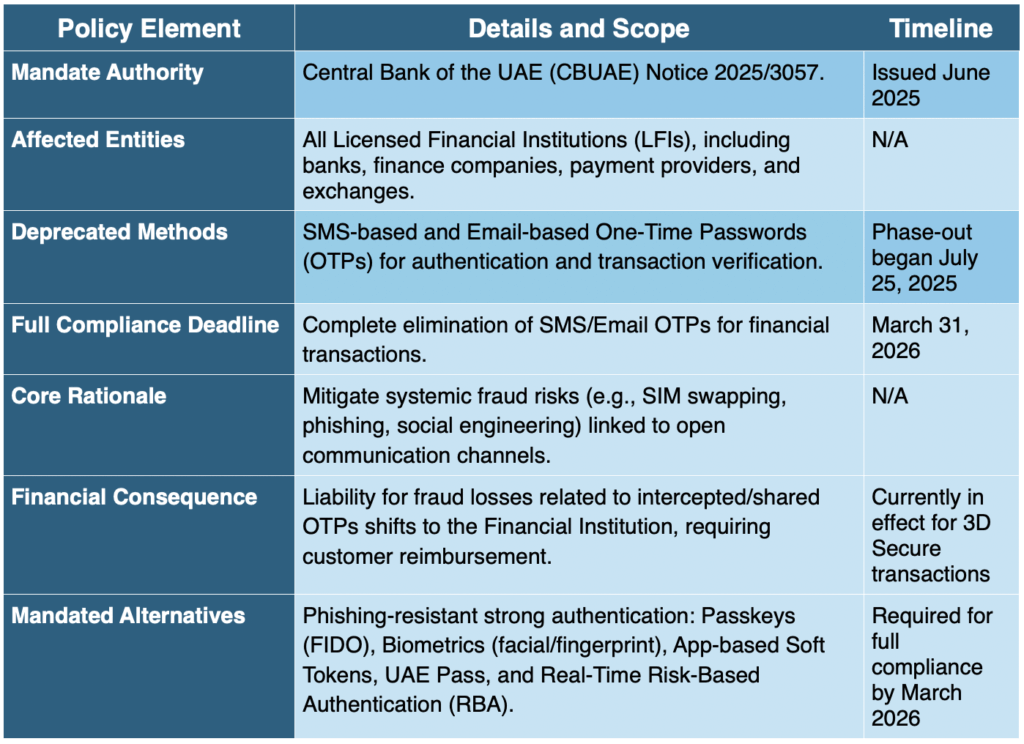

The way millions of people access their money is about to fundamentally change. The Central Bank of the UAE (CBUAE) has drawn an unambiguous line in the sand, issuing a mandate that calls for the complete regulatory end of SMS and email-based One-Time Passwords (OTPs) for financial services. This is not a gradual suggestion; it is a hard deadline set for March 31, 2026.

For the global mobile ecosystem—from Mobile Network Operators (MNOs) and CPaaS providers to banks and identity firms—this is the most decisive regulatory action seen yet. The era of relying on simple phone networks for high-assurance security is over, and the race to implement phishing-resistant authentication has officially begun.

The Rationale: Why the SMS Blanket Failed

For years, SMS OTPs served as a familiar and convenient security blanket for digital banking. But as digital crime evolved, this blanket became a critical liability and a single point of failure. The CBUAE’s definitive action was driven by three stark realities:

For the mobile ecosystem, the future revenue structure will move away from volume-based messaging and toward value-based digital trust services.”

- Explosive Fraud Rates: Fraud spiked by an unacceptable 43% year-over-year in 2023, with SMS OTPs serving as the primary entry point for attackers. Fraudsters exploited the fact that the codes are transmitted over open communication channels and are not cryptographically bound to the user’s device or transaction.

- The Rise of SIM Swap: The security flaws are foundational to the Public Switched Telephone Network (PSTN). Sophisticated identity takeover attacks, like SIM swap fraud, involve tricking or bribing telecom employees to transfer a victim’s number to a rogue device. This instantly allows the hacker to intercept the SMS OTP, bypassing all security controls.

- The Liability Shift: The CBUAE Notice 2025/3057 introduced the most powerful enforcement mechanism: financial liability. If a customer’s OTP is intercepted or shared during a phishing or SIM swap attack, the financial institution is responsible for reimbursing the customer for the entire loss. This shifts compliance from a mere regulatory burden to an overwhelming financial imperative.

The Global Trajectory: Is This the Death of the SMS OTP?

While the UAE’s complete phase-out in the financial sector is the most aggressive mandate globally, it confirms a broader, definitive trend: the functional death of SMS OTP as a default, high-assurance multi-factor authentication (MFA) mechanism.

- UAE Model (Elimination): The strictest stance, mandating total elimination of SMS/email OTP for financial institutions by March 2026.

- US/European Model (Restriction): The US National Institute of Standards and Technology (NIST) has classified SMS OTP as a “restricted authenticator.” While not outright banned, its continued use for high-assurance applications requires organizations to implement mitigation strategies (like addressing SIM swap risk), offer superior alternatives, and maintain an explicit plan to migrate away.

- India Model (Mandate for Choice): New Reserve Bank of India (RBI) rules, effective April 2026, mandate that digital payments must require two different verification methods. While SMS remains available, banks must provide and encourage the adoption of newer, more secure alternatives like device-based tokens and biometrics.

The global consensus is clear: legacy SMS authentication no longer satisfies modern security benchmarks.

What Replaces the OTP? The Phishing-Resistant Future

To meet the CBUAE’s deadline, Licensed Financial Institutions (LFIs) must migrate to authentication methods that are cryptographically tied to the user’s device and transaction session. The mandated alternatives are already leading the digital trust revolution:

The New Standards:

- FIDO and Passkeys: Explicitly endorsed by the CBUAE, Passkeys utilize public-key cryptography to provide phishing-resistant, device-bound authentication. They offer the trifecta of benefits: stronger security, a frictionless customer experience (CX), and reduced operational costs by eliminating A2P message fees and fraud management overhead.

- Biometrics and Soft Tokens: Solutions include fingerprint scans, facial recognition, and app-based soft tokens or push notifications. These methods move verification off the vulnerable PSTN and bind the authentication event to the user’s registered application.

- Real-Time Risk-Based Authentication (RBA): Compliance requires institutions to build real-time systems to fuse identity verification with continuous fraud intelligence (e.g., behavioral biometrics). This ensures that the level of authentication friction adapts to the transaction risk.

The Strategic Impact for MEF Members: A Pivot to Value

For members of the Mobile Ecosystem Forum (MEF), the mandate presents both a threat to legacy revenue streams and a massive opportunity for innovation.

- CPaaS Providers and Aggregators: The Revenue Pivot

The OTP use case drives a significant, high-margin share of the global Application-to-Person (A2P) SMS market (valued near $78.18$ billion in 2024). The UAE’s phase-out threatens a sharp decline in commodity OTP traffic volume within the next 12–18 months. The Call to Action: CPaaS providers must pivot “upstream” to offer comprehensive ‘customer interaction solutions.’ This means investing heavily in richer, more monetizable channels like Rich Communication Services (RCS) and Over-The-Top (OTT) platforms (e.g., WhatsApp), focusing on conversational AI and advanced campaign management. Crucially, they must integrate network-level security features, such as the SIM Swap API, to offer essential, high-value signals that modern authentication platforms need. - Mobile Network Operators (MNOs): Monetizing the Network

The loss of reliable A2P authentication revenue forces MNOs to accelerate their most critical strategic transition: transforming from traditional connectivity providers (“dumb pipe”) into programmable technology platforms (“TechCo”). The Call to Action: The CBUAE mandate provides a perfect market catalyst for monetizing security-focused Network APIs. By exposing the SIM Swap API, MNOs allow banks to query the network state in real-time to detect fraudulent number reassignments—the very attack vector that triggered the ban. This transforms the network from a source of vulnerability into a source of unique, high-value security intelligence. Projections suggest these new Network API revenue streams could unlock approximately $100$ billion to $300$ billion globally over the next five to seven years. - Financial Institutions (Brands) and Identity Providers

For banks, the incentive is no longer just compliance; it’s about competitive advantage. By adopting frictionless Passkeys and biometrics, institutions can leapfrog competitors, offering stronger security alongside a superior customer experience (CX). Furthermore, eliminating the unstable and costly SMS channel cuts recurring A2P message fees and reduces fraud management overhead, leading to substantial OpEx savings. The Call to Action: Authentication and Identity Service Providers face an immediate market expansion. They must deliver rapid time-to-market CIAM solutions that enable quick deployment of passwordless MFA, passkeys, and biometrics, while ensuring their solutions meet stringent CBUAE requirements for device fingerprinting, fraud detection, and auditability.

Conclusion: The Future of Digital Trust

The UAE’s bold directive sets a new global benchmark. The era where the Public Switched Telephone Network (PSTN) was the default vehicle for authentication is unequivocally ending.

For the mobile ecosystem, the future revenue structure will move away from volume-based messaging and toward value-based digital trust services. Success hinges on a formal and rapid public-private collaboration—strengthening coordination between banks and telecom providers to share intelligence and jointly counter evolving fraud tactics. By embracing the mandate as a strategic inflection point, MEF members can secure their position as leaders in the next generation of digital identity and network intelligence.

If you’re a MEF member, join our ID & Data and Antifraud insight groups. These groups offer a platform for discussions, initiatives, and continuous updates on these crucial topics.