YouTube is stepping deeper into the world of commerce, where creators, communities, and content increasingly shape how people discover and buy products. As social platforms evolve into shopping ecosystems, YouTube’s latest report explores how influence turns into action. MEF CEO Dario Betti highlights the growing power of “shoppable communities” and creator-driven trust shaping mobile commerce.

YouTube’s 2025 Culture & Trends “YouTube Shopping” report outlines how the platform is evolving into a key environment for product discovery and purchase influence.

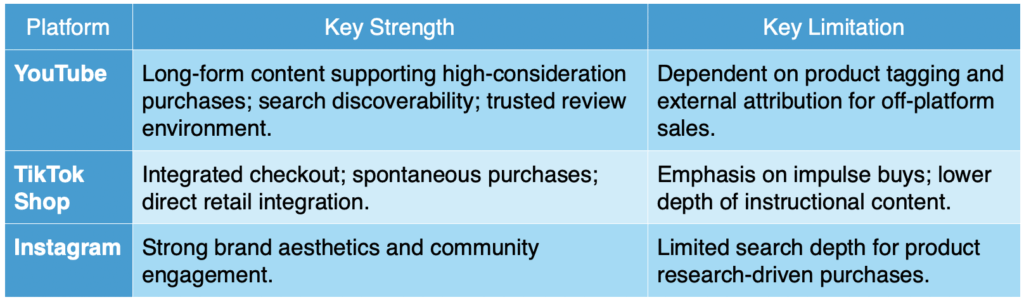

Despite the report conclusion, it seems that the platforms still lag TikTok (reportedly generating $28-33 billion in 2024). However, YouTube is now following the steps and wants to be associated to commerce as much as video. The study analysed the 5,000 most-purchased products and 1,000 most-transacted videos from the first half of 2025, alongside consumer surveys conducted by Google and SmithGeiger in April 2025. Respondents were active online users aged 14–49, with a Gen Z–specific U.S. sample of 500 participants. Looking at the much younger profile might help to look at the future and share better trends for YouTube, The report is available here, and below are the main trends.

The Trends in Video Shopping

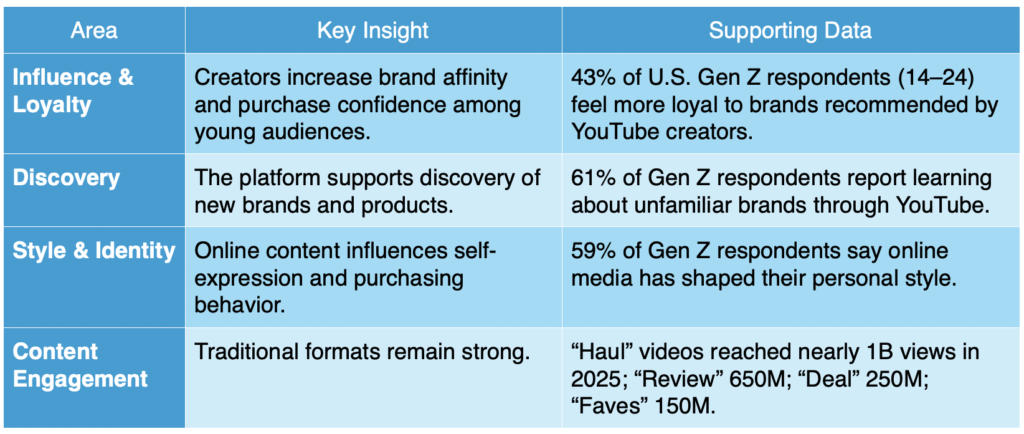

In the U.S.A. Gen Z sample (14–24), 43% say they feel more loyal to brands they buy because a YouTube creator recommended them; 61% say YouTube helped them discover unknown brands/products; and 59% say online content shaped their personal style. In practice, the survey sizes are modest and U.S-leaning, but they validate what merchants and creators live daily: the advice layer is the commerce layer now.

In practice, the survey sizes are modest and U.S.-leaning, but they validate what merchants and creators live daily: the advice layer is the commerce layer now.”

How is You Tube Becoming a Sale Channel

ChicOnTheCheap, a channel born from one creator’s love of a good deal provides seasonal, store-specific ‘hauls’ (the YT video reviews): from a description of Walmart product arrivals to Target home décor options. ChicOnTheCheap now has evolved into fully shoppable experiences where users can buy online – you can watch and buy. Or take CoryxKenshin, better known for horror game playthroughs than retail: his self-published manga sold an estimated 200,000 copies in week one, channelling cultural purpose (Black representation in manga) into record-setting commerce. Neither story is an anomaly in the report, they’re archetypes of how trust, specificity, and community density convert attention into transactions.

Then there are the trends that break containment. The lip liner revival is a tidy case study. A creator insight (using brow tint for long-wear lip line) becomes a product (SACHEU’s peel-off liner), then it became a community talking point, then a celebrity the creator became a celebrity in its own right. This was followed by Google Search interest for lip liner reaches an all-time high.

Communities as Commerce Drivers

The report describes “shoppable communities” as clusters of creators unified by product categories, forming “product fandoms.” Examples include:

- Fragrance creators, whose reviews and tutorials influence high-value purchases by offering detailed insight on scent profiles and longevity.

- Home improvement channels, such as Ben’s Appliances & Junk, which integrate tutorials with purchase links for parts and tools, demonstrating direct conversion from instruction to transaction.

According to YouTube’s data, communities that repeatedly cover the same category generate ongoing product visibility and sales velocity similar to traditional “category marketing universes.”

Content Strategy and Title Specificity

An analysis of highly transacted videos suggests that specificity in titles enhances visibility and conversion, including brand names, use cases, or seasons. Keywords like haul, review, sale, and budget appeared frequently in the titles of top-performing content.

Titles that name the retailer, season, use case, and value signal “this is for you” in a search-first ecosystem: “Target Spring Home Decor Haul Under $50,” “Drugstore Fragrances for Summer Heat,” “Nordstrom Anniversary Sale—Capsule Wardrobe.” The report’s own signals back this up: “Haul” videos saw roughly a billion views in 2025; “Review” about 650 million; “Deal” 250 million; “Faves” 150 million. Classic templates continue to win, especially when reimagined for Shorts (“Buy or Bye,” “Faves or Fails”) and synchronized with live links, chapters, and pinned comments.

Industry Context and Comparisons

Collectively, these platforms illustrate a maturing “content–commerce continuum,” in which consumer journey stages—discovery, evaluation, and purchase—are increasingly hosted within social ecosystems.

A Review of the Methodology

The 2025 YouTube Culture & Trends report is a solid triangulation of data sources and offers a multifaceted view of how content translates into purchasing behaviour. However, it might also be designed with a too narrow focus on the users to highlight fast change in a leading market ( GEN Z users in the USA).

Here are some of the strengths of the analysis:

- Data Triangulation: By integrating actual behavioural transaction data (from the top 5,000 purchased products and 1,000 most-transacted videos) with attitudinal surveys (conducted by Google/SmithGeiger), the study provides a comprehensive picture. This combination allows for the correlation of observed purchasing actions with stated consumer perceptions and motivations, offering a richer understanding than either data type could provide in isolation.

- Cross-Category Generalizability: The inclusion of case studies and data points from diverse product categories—ranging from beauty and fashion to home improvement, fragrance, and even self-published manga—demonstrates that the identified commerce mechanisms are not confined to a single vertical. This cross-category evidence suggests that the principles of creator influence, community engagement, and content specificity may be broadly applicable across various segments of the mobile ecosystem.

- Clear Signals on Content Efficacy: The analysis effectively highlights the impact of specific content strategies. The report provides clear signals regarding the efficacy of particular content formats (e.g., hauls, reviews) and the importance of title specificity (e.g., including brand names, seasonal references, or value propositions). These insights offer actionable guidance for creators and brands seeking to optimize their content for commerce.

While the methodology provides valuable insights, certain aspects would require further consideration for a more complete understanding:

- Temporal Scope and Potential Bias: The analysis of transaction data over a 60-day window in the first half of 2025, while providing a snapshot, could potentially exaggerate the influence of seasonal shopping patterns or specific retail events.

- Geographic and Demographic Representativeness: The report’s reliance on a U.S.-heavy Gen Z survey (N=500) for key attitudinal statistics, while valuable for understanding a crucial demographic, means these findings are directional rather than globally definitive. Consumer behaviours, payment preferences, and platform engagement can vary significantly across different geographies and older age brackets, suggesting a need for broader demographic and international sampling to enhance the universality of the conclusions.

- Outlier Case Studies vs. Median Performance: While compelling, the inclusion of high-impact outlier case studies, such as CoryxKenshin’s 200,000 week-one manga sales, may not fully represent the typical creator experience.