Find out the week’s top mobile stories from around the world. Headlines this week include… Meta announces plans to monetize the Metaverse, and creators are not happy, Will Apple build its own blockchain?, Location-based mobile games like Pokémon Go may help alleviate depression and much more…

Meta announces plans to monetize the Metaverse, and creators are not happy

Ars Technica

Meta, the company formerly known as Facebook, announced some initial plans on Wednesday to allow content creators to monetize in its would-be Metaverse platform, Horizon Worlds. Meta’s planned revenue share for contributors’ creations could add up to nearly 50 percent.

Horizon Worlds is a network of shared 3D spaces that is currently exclusively available on Oculus Quest headsets. (Meta has plans to bring it to mobile, game consoles, and desktop VR in the coming months and years.)

Read more…

Will Apple build its own blockchain?

Tech Crunch

This week, my colleague Sarah wrote an interesting story on an “NFT” app in the App Store that Apple seemed to suddenly ban despite the fact that it had already operated in plain sight for months. Apple argued that the app was misleading consumers by selling “NFTs” that could not be resold and furthermore weren’t even stored on a blockchain. The app seems a little dodgy in my opinion, but that’s not particularly the fault of the app developer at hand; the app seems built to live in the gray area of Apple’s nonexistent guidance for NFTs. (It’s worth noting that within an hour of our story going live, Apple had somewhat surprisingly reinstated it in the App Store.)

Read more…

Location-based mobile games like Pokémon Go may help alleviate depression

LSE

Playing location-based games, such as the popular augmented reality game Pokémon Go, may alleviate non-clinical forms of mild depression, a new study from the London School of Economics and Political Science (LSE) has found.

In the new study, published this week in the Journal of Management Information Systems, the researchers examined the effect of location-based mobile gaming on local depression trends. Location-based games are those that revolve and progress around a player’s physical location. This is often monitored using GPS technology.

Read more…

How will auction packages address some of mobile advertising’s big challenges?

The Drum

While the scale and opportunity of mobile advertising are undeniable, its growth has been challenged. The Drum and PubMatic have asked some of the industry’s leading voices across APAC whether the rise in solutions like auctions packages can make an impact.

Global ad spend on mobile is still growing at over 25% per year, according to Statista. This growth, however, is set against challenges in the perception of mobile being particularly troubled by brand safety and fraud issues.

Read more…

Barbados Announces Plans for Mobile IDs

Mobile ID World

The government of Barbados has confirmed that it is planning to supply citizens with mobile identity cards. The country is currently in the process of replacing laminated ID cards with a more advanced National Trident ID card, but it wants to supplement those physical cards with a digital version that can be stored in an app on a standard smartphone.

The news comes courtesy of Davidson Ishmael, Barbados’ Minister of Industry, Innovation, Science and Technology. Ishmael made the announcement at the Barbados Chamber of Commerce and Industry (BCCI) digital conference, and framed the mobile IDs as part of a broader digital transformation for the country at large.

Read more…

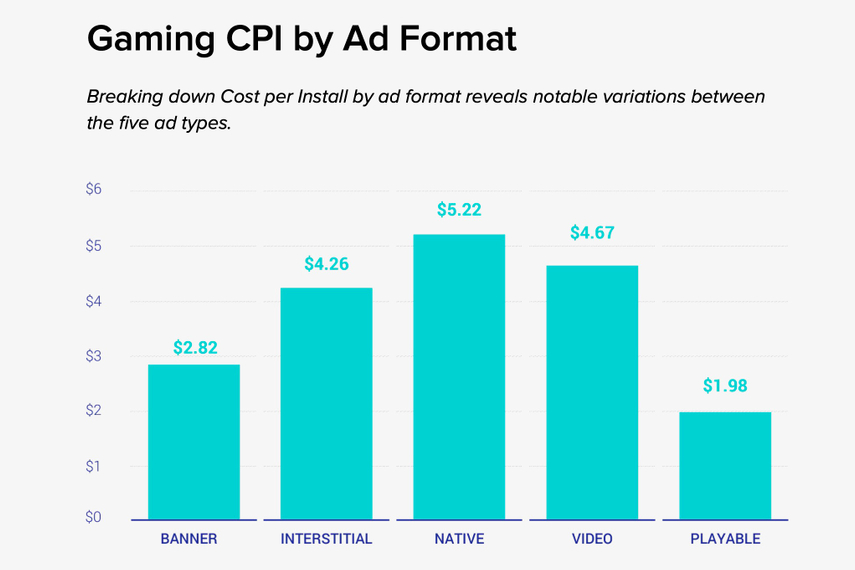

Playable ads rise above other formats in mobile advertising: study

Campaign

Playable ads have proven to be a clear winner for mobile marketer needs in a new study from Liftoff, a growth acceleration platform for the mobile industry. The global study, 2022 Mobile Ad Creative Index, which analysed trends across four key app verticals—gaming, e-commerce, finance, and entertainment—showed that playable ads have the most affordable cost-per-install (CPI) landing at US$1.98, well below the average of US$3.79 for other ad formats, making playable ads an attractive format for game marketers.

Read more…

Mobile and blockchain gaming’s future belongs on the cloud, argues BlueStacks

Pocket Gamer

Bluestack’s Rosen Sharma on now.gg’s commitment to browser-based gaming, and doubts on Apple and Google accepting blockchain gaming

Rosen Sharma, CEO of BlueStacks, has a straightforward vision for mobile gaming: “I send you a link to click on, and you play it.”

It sounds like simplicity itself, but Sharma argued that now.gg, Bluestack’s mobile cloud platform, and recently-launched Creator Hub and Creator Studio represent something more disruptive to mobile gaming.

Read more…

Why Good UX & Strong Security Are Critical in Mobile Banking

The Financial Brand

Trying to thwart cybercriminals through complex security requirements may stop some fraud, but will cost banks customers. People simply won’t tolerate overly complicated mobile banking apps. Here’s how fintechs have figured out how to keep things simple and secure.

In banking, there’s a long-standing belief that apps can be secure or user-friendly — but not both. Stronger security requires usability compromises, the thinking goes, while a slicker, smoother and simpler experience inevitably introduces vulnerabilities that cybercriminals can exploit.

Read more…

Barcelona market uses 5G to create AR-powered remote personal shopping

Internet Retailing

The famous La Boqueria market in Barcelona has become the site of an innovative trial where 5G is used to provide shoppers with a virtual shopping experience using augmented reality that, says its creators, maintains the link between real-world market shopping and ecommerce.

The application – called Augmented Reality Personal Shopper – allows virtual shoppers to select in real time specific products from market stalls and obtain additional information about them with augmented reality using their mobile, tablet or laptop.

Read more…

Digital bank Umba raises $15M, plans to expand into three new African markets

Tech Crunch

There’s no shortage of digital banks in Nigeria and, in general, in Africa. As the region continues to experience rapid growth in mobile usage and the corresponding growing young population, these fintechs think this is the right time to provide financial services to every market category, from the banked to the unbanked.

We’ve covered a host of these platforms in the past. Their overarching pitch is to provide financial services to the underserved market, so their customers essentially overlap. In the latest development, Umba, a digital banking platform operating in Lagos, Nigeria, has raised $15 million in Series A funding. The news comes almost two years since the fintech raised a seed round of $2 million.