Find out the week’s top mobile stories from around the world. Headlines this week include… Facebook’s next hardware product will be “smart” Ray-Ban glasses, Google shows off Play Store’s upcoming data privacy section, Mobile Banking Adoption In The United States Has Skyrocketed (But So Have Fraud Concerns) and much more…

Facebook’s next hardware product will be “smart” Ray-Ban glasses

Ars Technica

In an earnings conference call on Wednesday, Facebook CEO Mark Zuckerberg told investors that the company’s next hardware launch will be “smart glasses” made in partnership with classic sunglasses vendor Ray-Ban.

Zuckerberg segued into the Ray-Ban announcement following a lengthy discussion of Facebook’s plans for Oculus Quest, its all-in-one virtual reality (VR) platform. Zuckerberg says that social media is the real “killer app” for VR, backing that up with data from Oculus Quest: “The most popular apps on Quest are social, which fits our original thesis [that] virtual reality will be a social platform.”

Read more…

Google shows off Play Store’s upcoming data privacy section

The Verge

Google has revealed an in-progress design for the Play Store’s upcoming safety section, which will provide information about an app’s data collection, privacy, and security practices. Announced in May, developers will be able to start declaring their safety info in October until a deadline of April next year. The safety section is currently due to start appearing in app descriptions in the first quarter of 2022.

Although Google says the design is subject to change, screenshots released today show the safety section sitting above a listing’s existing Ratings & reviews section. It offers a summary of an app’s data privacy features, including the types of data collected and whether data is encrypted. There’s also a “See details” option to get more specifics on what collected data is used for, and whether the collection is essential for using the app.

Read more…

Mobile Banking Adoption In The United States Has Skyrocketed (But So Have Fraud Concerns)

Forbes

It’s become popular among some industry experts to say that digital transformation in banking accelerated as a result of the pandemic. I’m not convinced there’s been that much “transformation,” but there’s no doubt that digital adoption has skyrocketed.

Two recent studies from Cornerstone Advisors underscore the change in adoption. As of May 2021, mobile banking penetration has grown to 95% of Gen Zers, 91% of Millennials, 85% of Gen Xers, 60% of Baby Boomers, and 27% of Seniors.

Read more…

How AI and Machine Learning Can Make or Break Our Mobile Privacy

B2C

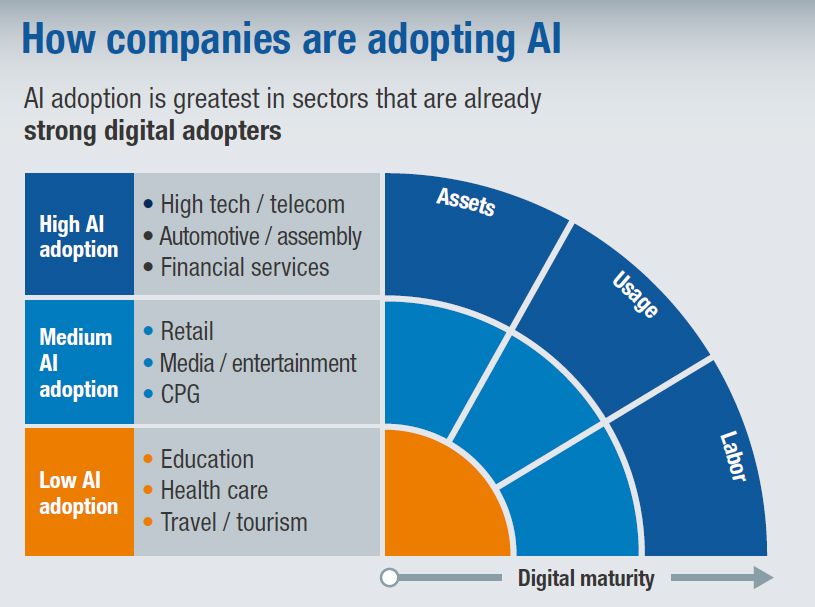

Like many different technologies, Artificial Intelligence (AI) has been widely adopted and implemented in a variety of businesses and everyday life. As a result, it has the potential to solve many business challenges as well as give consumers a new perspective in the digital world.

However, as welcoming as its changes are to us, there is a flipside to AI and its advances. Like most technologies, there are concerns for privacy involving customer and vendor data protection. In addition, AI is fueled by algorithms that create new sensitive information that can affect consumers and employees.

Why Netflix is moving into gaming

FT

For years, Netflix has watched as the world’s largest technology companies try to position themselves as the “Netflix of gaming” — and agonised about whether to join them.

Google, Amazon, Microsoft and Sony have all rolled out video game streaming services that use sophisticated cloud technology to bring console-quality video games to any device, just like watching a Netflix show. “We talked about video games for several years, writing up the pros and cons of the timing of entry,” Reed Hastings, Netflix’s chief executive, said this week.

Read more…

The past, present, and future of mobile ad formats

Venture Beat

Mobile advertising has come a long way. While the first SMS message was sent in 1992, it took eight years before anyone cottoned on to its advertising potential, with the initial SMS advert sent out in 2000. Since then, and particularly since the birth of the iPhone in 2007, mobile advertising’s acceleration and the proliferation of ad formats has been staggering. With SMS, Wireless Application Protocol (WAP) ads, and eye-catching in-app banners that watched as we blew stuff up with birds, ran through temples and surfed subways, mobile became the digital advertising medium.

Read more…

How Apple could build the world’s greatest ad network – and save digital advertising

The Drum

Mobile advertising today is riddled with the challenge of delivering a great user experience while remaining transparent and trustworthy in light of growing pressure to prioritize data privacy. Among all players in the space, Apple could be uniquely well-positioned to create a trustworthy and flourishing mobile ad ecosystem – by working hand-in-hand with its greatest rivals. Casey Saran, chief executive of Spaceback, spells out what this reality might look like.

There has been a lot of speculation surrounding what Apple is up to regarding advertising.

Ever since the company made it much harder to track consumers across iOS apps, it’s become a popular guessing game in our industry to try and discern the typically quiet company’s motivations.

Read more…

China Targets Mobile Pop-Ups in Latest Tech Crackdown

Bloomberg

China ordered Tencent Holdings Ltd. and 13 other developers to rectify problems related to pop-ups within their apps, adding to a wide-ranging crackdown on the country’s tech sector.

The companies must address the “harassing” pop-up windows, which could contain misleading information or divert users away from the apps, the Ministry of Industry and Information Technology said in a statement on Wednesday. The 14 services, including an e-books app by Tencent’s QQ and a video platform by Le.com, will have to fix the problems by Aug. 3.

QIA to invest USD200 million in Airtel Africa’s mobile money business

PEW

Qatar Holding, an affiliate of the Qatar Investment Authority (QIA), is to invest USD200 million in Airtel Mobile Commerce BV (AMC BV), a subsidiary of Airtel Africa.

AMC BV is the holding company for several of Airtel Africa’s mobile money operations; and ultimately is intended to own and operate the mobile money businesses across all of Airtel Africa’s fourteen operating countries.

The transaction values Airtel Africa’s mobile money business at USD2.65 billion on a cash and debt free basis. QIA will hold a minority stake in AMC BV upon completion of the Transaction (alongside other minority investors), with Airtel Africa continuing to hold the majority stake. The Transaction is subject to customary closing conditions.