Shiv Putcha, Principal Analyst at emerging tech specialists Mandala Insights, shares his insights from the recent Nokia event Global Analyst Forum 2019.

Recently, I had the opportunity to visit Finland to spend three days with Nokia at their Global Analyst Forum. It was an eventful few days, full of detailed presentations, grand vision statements, cool demos, a visit to Nokia’s Conscious Factory and labs in Oulu and great discussions with Nokia’s leadership and executive teams. Here, we highlight some key takeaways from the GAF2019 event.

Nokia’s Q3 miss was brewing for some time but the company will weather the storm

At many analyst events, it is not uncommon to hear the CEO and senior leadership trot out the official company line around challenging events and circumstances, with varying degrees of finesse and creativity. However, this event began on an earnest note. Rajeev Suri, Nokia’s CEO, began his speech by referencing a famous quote from the boxer Mike Tyson before his heavyweight championship match with challenger Evander Holyfield.

“Everyone has a plan until they get punched in the mouth!” The analogy was unexpected, but it was also clear that Suri was painting Nokia as Holyfield in this analogy, that despite getting “punched in the face”, Nokia would eventually come out on top just as Holyfield did.

There has been much hand wringing from the investment community about Nokia’s Q3 earnings “miss”. The Street punished Nokia heavily for lowering guidance for the full year and “postponing” dividends. Suri did well to acknowledge the elephant in the room and not only address it but spoke with some degree of passion about Nokia’s “plan” and their ability to execute. There were many proof points offered through the event, but one stood out for me personally. Nokia’s 2019 sales pipeline featured several multi-domain wins that comprised roughly fifty percent of the pipeline. Out of this, thirty-eight customer deals were 5-domain deals and fifty-four deals were across 4 domains, speaking to the strength of Nokia’s end to end (E2E) portfolio approach. The E2E portfolio approach has also helped Nokia mitigate lingering product roadmap issues in its core Mobile Networks business.

The launch of 4G LTE networks around the world began to shift the value equation back towards the network, with consumer demand for reliable coverage and capacity skyrocketing. With the advent of 5G, we appear to be on the cusp of another paradigm shift, with value aggregating back to the network.“

Shiv Putcha, Principal Analyst

Suri, and subsequently Tommi Uitto, president of the Mobile Networks division, addressed the challenges directly and honestly. The MN division has been caught out by a near-perfect storm in recent quarters. For one thing, 5G adoption has accelerated at a pace that Nokia was clearly not ready for as they grappled with the merger with Alcatel-Lucent. The accelerated pace for 5G meant that Nokia’s early decision to use FPGAs for its baseband and RF rendered the product line into a high-cost proposition relative to one based on SoCs. Third, delays in SoC-based products have hampered Nokia’s ability to hit key milestones as it ramps up for 5G. Lastly, there have also been delays in realizing large deals with T-Mobile/Sprint as well as the Chinese CSPs that have impacted the top line. While Nokia leadership did well to acknowledge these challenges, they also laid out steps taken to increase R&D investments into SoC and other product development, drive SoC availability for the baseband and RF components by the end of 2019 and volume shipments in 2020. Stability and a return to growth for Nokia’s core business will be a key theme for the company as it heads into 2020 and we believe that the company is well-positioned to weather the current storm.

Value is coming back to the network

One of the defining themes of the last decade-plus since the launch of the iPhone has been the aggregation of value first to the operating system (OS) and subsequently to the app store. This paradigm shift, coupled with the rise of mobile data bundles offered by CSPs, saw the rise of social media giants like Facebook, over the top (OTT) streaming companies like Netflix and e-commerce companies like Amazon. All these companies redefined the customer experience and relegated the connectivity aspects to a minor role. It’s there, it works (usually) and it’s affordable (in most cases). If it didn’t work the first time, try again…the Internet’s “best-effort” paradigm disrupted the value proposition of reliable telco connectivity, sending CSPs into a downward spiral of declining profitability.

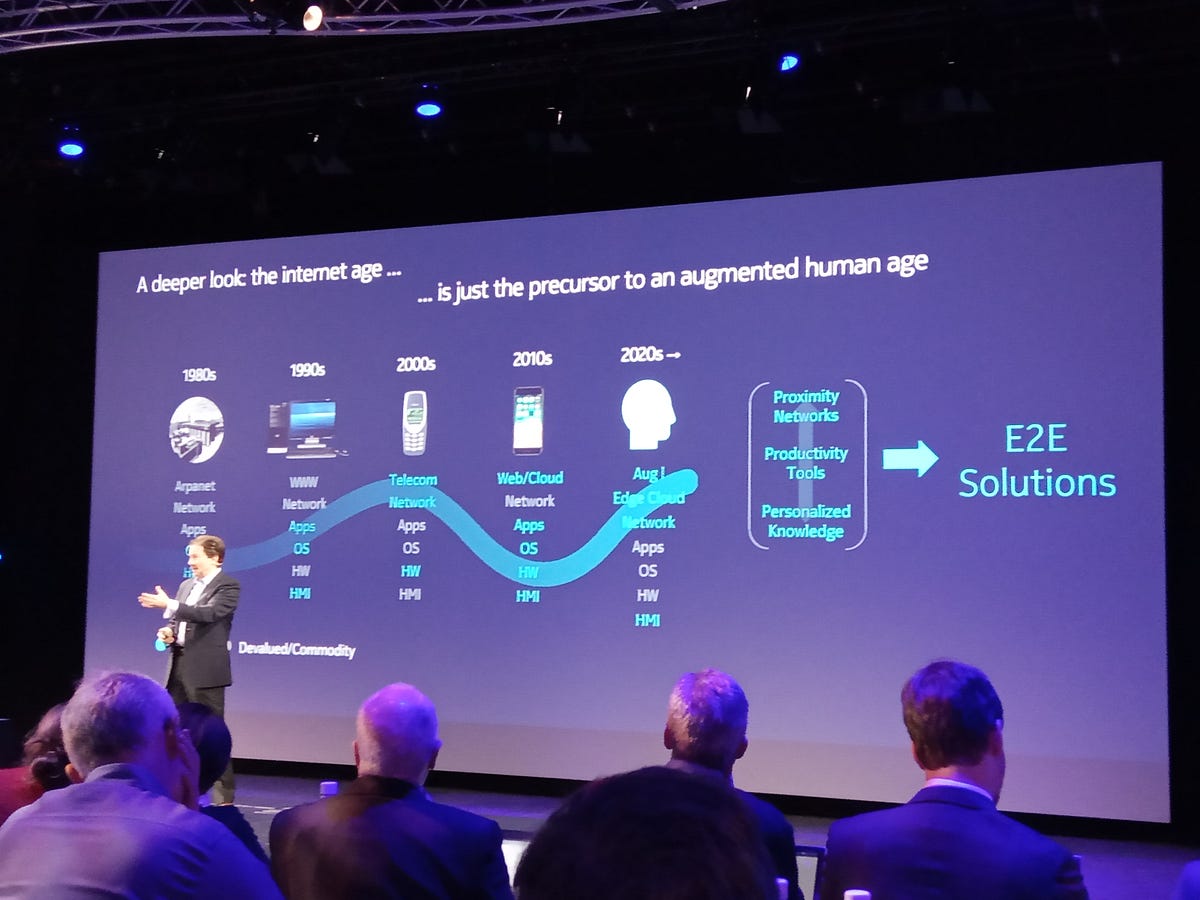

The launch of 4G LTE networks around the world began to shift the value equation back towards the network, with consumer demand for reliable coverage and capacity skyrocketing. With the advent of 5G, we appear to be on the cusp of another paradigm shift, with value aggregating back to the network. Marcus Weldon, Nokia’s CTO and President of Bell Labs, made an impassioned case for this shift by framing Nokia’s future opportunity in the context of the demand for increased productivity from the more “physical” industries. Weldon pointed out that efforts to digitalize industries would throw up a host of opportunities that Nokia was well-positioned to capitalize on. Weldon highlighted the coming decade as an era of personal augmentation or augmented human experiences. The rise of the Internet of Things (IoT), as well as the more specific Industrial IoT (IIoT), will mean that the number of endpoints will explode, with none of these requiring an OS because they will not be used to run apps in the way a smartphone does. Rather, all apps will be run in the cloud.

As more of these devices run in parallel and surround us, humans will start to lean more heavily on “assistants” to do the heavy lifting from a computing perspective. Today’s Alexa and Siri will have multiple cousins out in the field connecting back to the network, offering real-time information and compute resources for delivering personalized knowledge. Weldon even cited Buckminster Fuller’s theorem of knowledge doubling every roughly every 12 months as a benchmark for where we are headed and for the type of network(s) that will be needed. Put another way, the network must be a collection of high performance, low-latency networks! This is the core opportunity for Nokia as value starts to return to the network.

Nokia’s diversification strategy into enterprise, optical and software is paying off

While there were several business groups and products that are worthy of a more detailed look, for the purposes of this article, I want to focus on one area that really underlines Nokia’s successful attempts to diversify their business away from the core mobile networks area, namely, Nokia’s Enterprise business units.

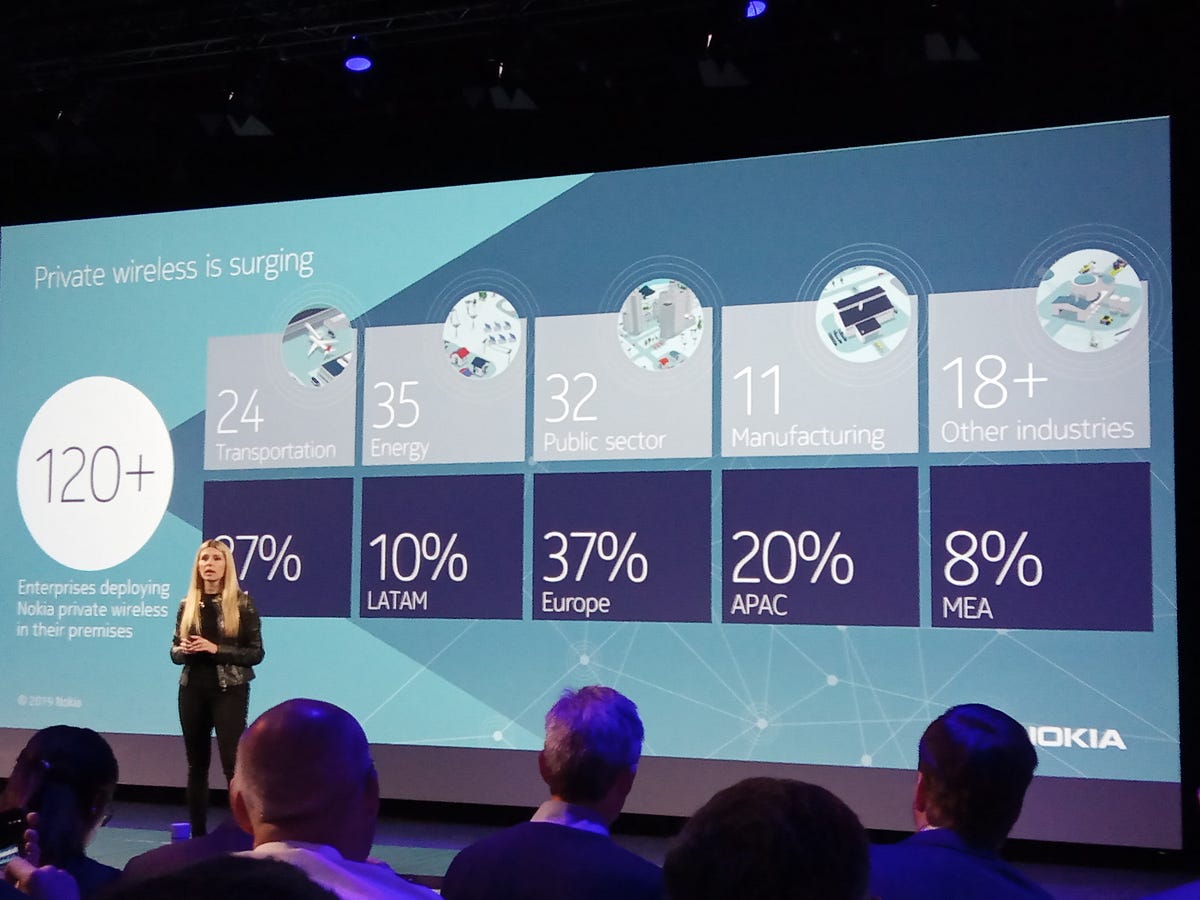

Launched a year ago, Nokia’s Enterprise division has had quite a stellar year under the leadership of Kathrin Buvac. Nokia announced that it had over 120 customers for its private wireless network offering, with broad regional adoption as well as across key verticals like transportation, energy, public sector, and manufacturing. Buvac also highlighted Nokia’s use case ‘catalog” that now boasted 568 use cases across multiple verticals. Private networks are in demand right now as the result of new spectrum availability around the world (licensed, MulteFire, CBRS, etc). There is also a growing ecosystem of devices and connected endpoints (2500+), though these are based on LTE today. Finally, the availability of industrial-grade connectivity solutions would drive traction within industry verticals. To this end, Nokia also announced several new products for the enterprise, including an optimized packet core for enterprise customers, a new MulteFire module that would enable industrial devices and grow the ecosystem, and ruggedized LTE-enabled IP/MPLS routers.

The Enterprise unit accounts for just over five percent of Nokia’s revenues and a little over a percent of its workforce. While we can expect such stellar growth to continue in the medium term, there are still open questions for Nokia to address, especially as it related to their channel strategy and go to market. At this event, the company appeared to be making a somewhat nuanced tilt back towards the CSP as a partner, but it has also struck partnerships with the likes of cloud providers like Microsoft as well as systems integrators (SIs) like IBM and Infosys. Taking an ecosystem approach is the correct and necessary step for the company to take, as Nokia simply can’t hope to be the “tip of the spear” driving private networks. CSPs remain an important channel partner and so far, Nokia appears to be responding well when faced with the question — “are you my friend or my enemy?” It needs to and must remain flexible as it assesses potential opportunities around the world. One final point to note is that here again, Nokia’s E2E strategy appears to be bearing fruit, with customers picking up optical transport solutions, small cells, routers, SD-WAN and products across the portfolio.

Notable mentions

Beyond what has already been discussed, there were some additional highlights from the analyst event.

- Nokia offered the analysts an opportunity (optional) to travel north to Oulu, the self-styled “Capital of Northern Scandinavia”. Boy, was I glad I took them up on it! It wasn’t nearly as cold as I had feared going in despite signs of a lingering deep freeze in the Bay of Bothnia. We were taken on a tour of Nokia’s Conscious Factory, a smart factory that, in the spirit of eating one’s own dogfood, has been engineered well enough to earn the moniker of “Industrial Lighthouse” from the World Economic Forum. The factory was a revelation, with highly automated production lines criss-crossed with robots and AGVs. According to Erja Sankari, Nokia’s head of the Oulu facility, they are now able to manufacture products at cost levels similar to India and Mexico.

- One product line that tends to fly under the radar but continues to impress is Nokia’s FastMile fixed wireless access CPE. It is a sleekly designed product and packs a significant punch, with antennas far superior to competitors as well as the best self-install tools that I have seen. The FWA use case is one of the frontline use cases for 5G adoption and Nokia is already seeing significant traction with leading CSPs like Optus and is involved in several trials across the globe. Nokia continues to innovate with its 5G outdoor receiver product coming out soon enabling multiple deployment scenarios. Despite several competitive CPE vendors hitting the market with a product in early 2020, we believe that Nokia will continue to be the frontrunner in this fast-growing product segment.

- Nokia’s customers clearly hold the company in high regard, despite any recent blips. This was apparent in the commentary from a stellar line-up of customer speakers that included Dr. Ron Marquadt of Sprint, Johan Wibergh of Vodafone, Steve Gegenheimer of ZAIN, Marko Mykkanen of the Port of Oulu and Janne Koistanen of Telia Finland. Analysts benefit tremendously from candid and detailed responses and these speakers did not disappoint, speaking at length on their 5G rollout plans and experiences and highlighting how strategic a partner Nokia has been for them on their respective journeys.

- Finally, Nokia is a company that is clearly and visibly imbued with values of diversity and sustainability. Nokia’s employee base, as well as its leadership team, is a highly diverse group of people, with representation from all regions as well as several women in senior leadership roles. The merger with Alcatel-Lucent has made this more pronounced, and in many ways, likely a better company. Nokia is also front and center with its commitment to sustainability, with notable commentary through several presentations on how the company’s products are being engineered for a lower power consumption and carbon footprint. Nokia even went to the extent of removing all single-use plastic from the analyst event, which was a first. A subtle but highly resonant message for the complicated times we live in!

This post originally appeared on the author’s website Mandala Insights and is reused here with kind permission