Find out the week’s top mobile stories from around the world.

This week.. Facebook faces $1.6bn fine and formal investigation over massive data breach, Mobile Privacy and the Presidential Alert, Ofcom launch new rules to limit mobile bills, Japanese banks to offer instant money transfers using blockchain and much more…

Facebook faces $1.6bn fine and formal investigation over massive data breach

The Guardian

The Irish Data Protection Commission has opened a formal investigation into a data breach that affected nearly 50m Facebook accounts, which could result in a fine of up to $1.63bn.

The breach, which was discovered by Facebook engineers on Tuesday 24 September, gave hackers the ability to take over users’ accounts. It was patched on Thursday, the company said.

“The investigation will examine Facebook’s compliance with its obligation under the General Data Protection Regulation (GDPR) to implement appropriate technical and organisational measures to ensure the security and safeguarding of the personal data it processes,” the commission said in a statement on Wednesday.

Read more…

There are Many Problems With Mobile Privacy but the Presidential Alert Isn’t One of Them

EFF

On Wednesday, most cell phones in the US received a jarring alert at the same time. This was a test of the Wireless Emergency Alert (WEA) system, also commonly known as the Presidential Alert.

This is an unblockable nationwide alert system which is operated by Federal Emergency Management Agency (*not* the President, as the name might suggest) to warn people of a catastrophic event such as a nuclear strike or nationwide terrorist attack. The test appears to have been mostly successful, and having a nationwide emergency alert system certainly doesn’t seem like a bad idea; but Wednesday’s test has also generated concern. One of the most shared tweets came from antivirus founder John McAfee.

While there are legitimate concerns about the misuse of the WEA system and myriad privacy concerns with cellular phones and infrastructure (including the Enhanced 911, or E911, system) the tweet by McAfee gets it wrong.

Read more…

Ofcom launch new rules to limit mobile bills

Choose

New rules have been put in place by the communications regulator to allow customers to avoid paying additional charges on their mobile phone bill.

From the start of this month, customers taking out new contracts with any mobile phone provider will be allowed to request a limit on their bill. These limits are designed to avoid additional or unexpected charges being applied, over and above the basic rate of their contract.

Known as ‘out of plan’ fees, Ofcom’s intention to cap these fees has been known about since May 2017. Now, all new contracts must comply with these rules.

This comes on the back of the regulator’s recent proposals to provide fairer, more transparent pricing on mobile phone contracts. These include separating the cost of the handset from the airtime, and automatically introducing a fair tariff at the end of a contract.

Read more…

Japanese banks to offer instant money transfers using blockchain

FT

Japan will this month become the first major economy to launch a domestic payments system based on blockchain technology when three Japanese banks start offering customers free real-time money transfers via a new mobile app.

The launch of the MoneyTap system, which secured approval for its licence from the ministry of finance last week, could be an important step in helping Japan to achieve its goal of reducing the use of cash, which still accounts for 80 per cent of transactions in the country.

The new platform has been developed by SBI Ripple Asia, a joint venture between Japan’s SBI Holdings and US blockchain specialist Ripple. It will be launched by three of the country’s mid-sized lenders: SBI Net Sumishin Bank, Suruga Bank, and Resona Bank.

Read more…

How 85% of mobile apps violate security standards

Tech Republic

Cybercriminals are increasingly targeting mobile apps for attacks, due in part to lax security standards, according to a Thursday report from WhiteHat Security. The majority of mobile apps—85%—violate one or more of the Open Web Application Security Project (OWASP) Mobile Top 10, meaning they contain at least one common security vulnerability that can be exploited, the report found.

Half of the 15,000 applications analyzed in the report violated the OWASP standard for insecure data storage—the most common risk found. This means they may include data leakage in local files and system logs, client-side injection, and weak server-side controls. Android apps had a higher rate of violations in this area than iOS apps, the report found: 52% of Android apps included the world writable executable vulnerability, which could put data at risk—especially concerning for businesses, as GDPR is now in effect.

Read more…

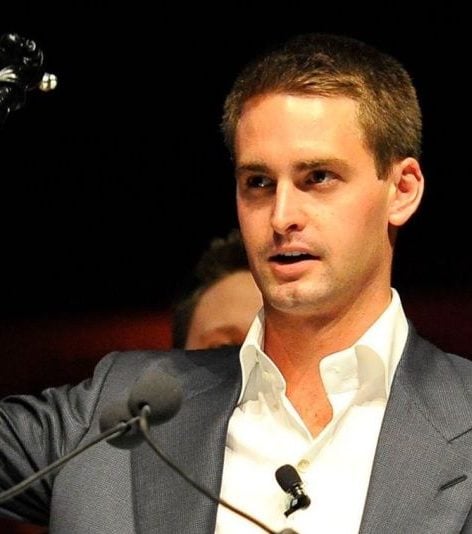

9 highlights from Snapchat CEO’s 6000-word leaked memo on survival

Tech Crunch

Adults, not teens. Messaging, not Stories. Developing markets, not the US. These are how Snapchat will make a comeback, according to CEO Evan Spiegel . In a 6,000-word internal memo from late September leaked to Cheddar’s Alex Heath, Spiegel attempts to revive employee morale with philosophy, tactics, and contrition as Snap’s share price sinks to an all-time low of around $8 — half its IPO price and a third of its peak.

“The biggest mistake we made with our redesign was compromising our core product value of being the fastest way to communicate” Spiegel stresses throughout the memo regarding ‘Project Cheetah’. It’s the chat that made Snapchat special, and burying it within a combined feed with Stories and failing to build a quick-loading Android app have had disastrous consequences.

Read more…

In brief: Grab is close to raising $500m from SoftBank

Tech in Asia

SoftBank Group is nearing a deal to invest about US$500 million in Grab as part of roughly US$1 billion that Southeast Asia’s biggest ride-hailing firm is seeking in its latest funding, sources with knowledge of the matter said.

Six-year-old Grab has garnered more than US$6 billion in total funding, led by SoftBank, Chinese ride-hailing firm Didi Chuxing, and Toyota Motor.

The capital would be a boon to Grab as it seeks to expand its presence in verticals beyond ride-hailing, including financial services and on-demand services. Archrival Go-Jek is said to be close to closing US$2 billion in fundingto fuel its own regional expansion plans.

Read more…

Facebook tests tracking Location History via Instagram

Engadget

After an abrupt exit by Instagram’s founders, there have been reports that they weren’t always happy with being seen as one of Facebook’s apps, instead of a standalone platform. With curious timing, TechCrunch reports that at least one user, Jane Manchun Wong, has spotted a setting that would let Facebook use Instagram to build up Location History data from a user’s phone.

Google does a similar history with Maps and using Android phones, and Foursquare’s data business is built upon this model. Perhaps ironically, this is a bit of a return to form for Instagram, which sprouted to life from a location-sharing app called Burbn. Data showed that people liked sharing photographs more than anything else, and they developed Instagram to take advantage of that.

Read more…

Massive increase in SIM-swop fraud in South Africa

My Broadband

The South African Banking Risk Information Centre (SABRIC) has released its inaugural digital banking crime statistics report.

The report looks at digital technology and how it is exploited by criminals.

SABRIC found that in 2017, 13,438 incidents were recorded across banking apps, online banking, and mobile banking – costing the industry more than R250 million in gross losses.

“While incidents from January to August 2018 already show a 64% increase, we are pleased that the increase in gross losses is just 7% when compared to the same period in 2017,” said SABRIC.

Read more…

How can EPoS data help pub operators?

Morning Advertiser

Big data is becoming more accessible because EPoS companies are able to help pubs measure and analyse customers’ experience at their venues. Experts reveal the latest digital trends and what to expect

A massive amount of information can be garnered by pub operators from just a brief digital interaction with a customer via a site’s electronic point of sale systems (EPoS). Industry experts say technologies developed for other industries are rapidly being adapted for the pub trade. Think drones, online food delivery services and recruitment apps. It can even help pubs be better prepared for Brexit.

Digital feedback systems are evolving with the desires from publicans to understand their customers as accurately and quickly as possible.