Digital technologies will transform the health insurance business. Early adopters have started to implement new digital business models with initial success. A new report from mobile apps market analysts Research2Guidance describes ten digital business models for health insurers that will disrupt the industry, as explained by business analyst Zhang Jie.

Advances in higher-quality digital technology – especially apps, sensors, and artificial intelligence (AI) – along with their proliferation among members have spurred the emergence of new business models.

The new report “The 10 Disruptive Digital Business Models for Health Insurers” published by Research2Guidance describes how start-ups, health insurance and general payer organizations have started using these technologies to venture into new forms of health insurance offerings and increasingly step into the healthcare provider role.

New digital models change the way the insurers interact with patients. For example, digital insurers have reworked the trust equation with the patient, outsourced much of their value chain to their members, and now know much more about them. Digital business models tend to also blur the lines between payer and care giver organizations.

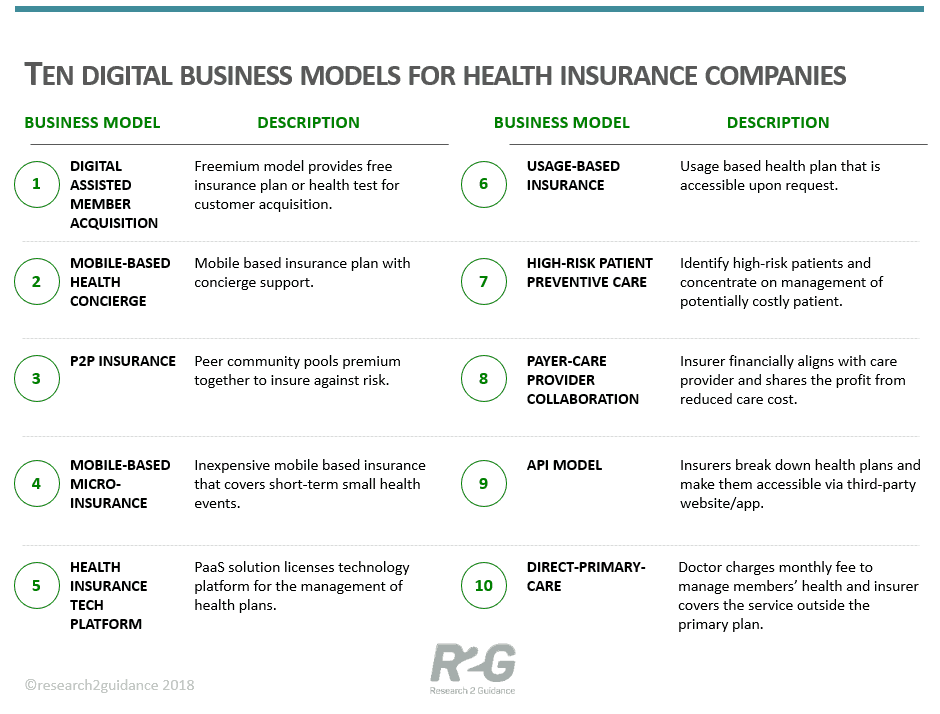

Some of the first-movers already crossed the line and started to offer services which have previously been provided exclusively by doctors and nurses. The ten digital business models are defined as follows:

- Digitally assisted member acquisition is a freemium business model concept.

- Mobile health concierge is a business approach designed for members to complete all health insurance tasks using mobile phones with the support from a concierge team.

- Peer-to-peer (P2P) insurance refers to a risk-sharing community.

- Mobile micro-insurance refers to the health insurance plans that cover short-term small health events or minimal ongoing health insurance.

- Health insurers tech platforms license their technology for the management of health plans and members to their customers.

- On-demand insurance is a usage-based model that enables members to access desired health plans upon request with the help of a mobile app.

- High-risk patient preventive care model concentrates on insuring and managing potentially costly patient groups.

- The payer & provider collaboration model stands for a closer, digitally enabled partnership between payers and care providers, especially hospitals.

- The API health insurance model uses a list of pre-defined health insurance products accessible to websites and app providers via an application programming interface (API).

- Direct primary care model. Within this model, a care provider or a hospital act like a health insurance company using a monthly subscription model.

First implementations of these models indicate the positive impact that they have on the company evaluation, the ability to attract new members, the cost structure, and new revenue streams. Currently, the main impact of digital business models is on company evaluation, which reflects the hype that some companies have created in the investor community. Companies like Oscar, Clover Health, and Bright Health are valued at over $1 billion USD each after only a few years of operation.

Health insurers and start-ups from the USA and China are the most aggressive in adopting new digital business models. Companies from other regions tend to choose a follower approach or implement copycats.

The report also profiles first-mover digital implementations. Profiles include their target groups, operating models, service offerings, and early evidence for success where available.

This post originally appeared on the Research2Guidance blog and is reused with kind permission.

Want to be featured on the MEF Minute?

The MEF Minute is an award winning blog that provides a cross-ecosystem and international perspectives on all things mobile. With contributions from MEF’s members and other industry experts it is a dedicated global news resource and thought leadership platform.

We welcome contributions from members and non-members across a range of formats including opinion pieces, industry views, stats, videos and infographics. MEF Minute offers a 360 look at any given topic impacting the mobile ecosystem whether that be from a MNO, enterprise, developer or provider perspective.