I once read an article about retail psychology, which said unisex shops should always locate mens’ departments on the ground floor. Such obvious good advice, and so rarely followed.

How many male readers have, like me, wandered into a shop, looked at the stairs, muttered ‘how dare you’, then turned around and walked straight out again. For 90 per cent of us geezers (the ones lacking peacock tendencies) it’s just not worth the extra effort even if we really liked that shirt in the window.

And why am I boring you with this?

I’m convinced, like many others, that this is a big deal. But at the same time… well, not so big. Not because of the experience, but because of the numbers.

.

Because it’s a ‘real life’ analogue for the enduring problem of mobile and e-commerce: the dreaded abandoned checkout.

Those long card and address forms on web sites? They’re the online equivalent of the staircase in Gap. Giving up and clicking out of the site? That’s me walking out of the shop.

Virtually every new mobile payment innovation and startup ultimately has the abandonment problem in its sights – from SEQR’s barcodes to Jumio’s optimal character recognition to PayPal’s stored credentials.

Now, of course, there is a new option. Apple Pay.

Last month, Apple confirmed it would extend Apple Pay beyond in-store and in-app and make it available for Safari users on the desktop web. It’s a pretty big deal given that roughly 60 per cent of e-commerce is still on desktop and laptop computers.

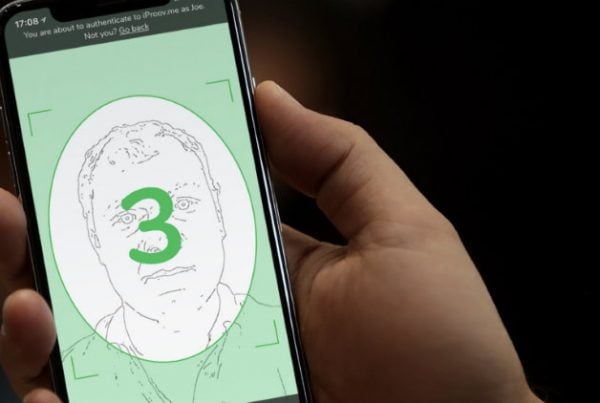

Thus, Apple will roll out code that lets merchants add an Apple Pay option that, when pressed, will display a pop down window. Click that and consumers will get a prompt on their phone to pay. A fingerprint will then complete the purchase.

Obviously this is fast and easy. But it is also safe. All your credentials are stored on your phone and only a token representing those details is ever shared with the retailer. So there’s nothing for a hacker to steal from the merchant site.

Everybody wins. And the obvious benefits – along with the brand halo of Apple – have already persuaded some big hitters to sign up. They include companies like Target, Expedia and United Airlines, as well as e-commerce site builders like Shopify (which handle e-commerce for thousands of small retailers).

I’m convinced, like many others, that this is a big deal. But at the same time… well, not so big. Not because of the experience, but because of the numbers. All the excitable coverage of the news just reminds me of how myopic the US tech press can be.

Here are the facts: iOS has a 30 per cent market share in the US, 24 per cent in the EU5, and 21 per cent in China. And you can shave off a few more points when you factor in iPhone owners without TouchID. And a few more for all those iPhone users who haven’t set up Apple Pay.

Meanwhile Safari has barely a five per cent share of desktop browser usage.

Multiply these percentages together and you can only conclude that Apple Pay is a wonderful option for the relatively tiny cohort of willing users. But it’s not an option that’s going to spell doom for PayPal and other payment providers, as the more excitable reports have claimed.

Features Editor

MEF Minute

This could change. It will be interesting to see if Apple start selling MacBooks with TouchID so users don’t even have to use their phones to pay by fingerprint. Then there’s Android. Chrome represents virtually half of browser use, so enabling Android fingerprint payment there could have a much bigger impact.

I suppose one hurdle would remain even if every browser and every merchant and every phone OS supported this way to pay: the male e-shopper who gets to the checkout and realises he left his phone downstairs.