How big will the global mPOS market become? How do Apple Music’s numbers compare with Spotify’s? How much money is moving around the Venmo P2P payments app?

You’ll find the answers to these and many more mobile data related questions in this week’s MEF market stats round up…

mPOS shipments expected to reach 245.21 million units by 2022

The market for mobile POS card readers continues to boom – it will grow 20x between 2014 and 2022, says a new report.

Transparency Market Research forecasts mPOS shipments will grow from 11.87 million units in 2014 to 245.21 million units by 2022. That’s a CAGR of 47 per cent during the forecast period.

mPOS describes the market for services that let merchants accept card payments via a bluetooth reader connected to smartphone app. This is much cheaper and easier to set up than a traditional dedicated card reading device. It also makes payment information easier to browse and analyse.

The report explains that the adoption of internet and mobile in developing markets is spurring growth in mPOS. It says the Indian market alone will grow by a CAGR of 55.8 per cent from 2014 – 2022.

It also projects big gains in China, Brazil and Mexico.

Read more…

Over $1 billion sent and received by Venmo users in a month

PayPal-owned Venmo has confirmed that its users transferred over $1bn via the app in January. That’s up 250 per cent on January 2015 and 1,000 per cent on January 2014. The service processed $7.5 billion in 2015.

Venmo has become hugely popular among young Americans in particular. The P2P payment app lets users send money to contacts without having to know their account details. It’s evolved into a kind of social network as much as a payments exchange.

Understandably, PayPal is planning to expand Venmo so that it becomes a person-to-business payment instrument. In October 2015 it announced that merchants will soon be allowed to accept payment through the app. P2P Venmo transfers are free, but merchants will be charged a fee of 2.9 percent, plus an additional 30 cents.

Read more…

European mobile wallet revenue to pass 1 billion euros in five years

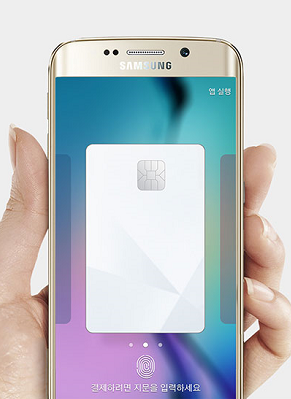

The combined impact of Apple Pay, Samsung Pay, Android Pay and Google Wallet will grow the European mobile payments market by 50 per cent a year, says Smart Insights.

Its report concedes that so far none of them has actually earned wide consumer adoption. But it believes they will adapt to the unique conditions of the European market. This will push revenues into nine figures by 2021.

Artur Khakimov, author of the report. says: “Although we see a growing adoption of tech giants’ mWallet initiatives in their home markets, companies like Apple, Google and Samsung have to adapt their mWallet business models to the specifics of the European market. Indeed, the report shows these tech companies have already set up necessary modifications ahead of the European launch”.

Read more…

China’s mobile gaming industry grossed $7.8 billion in 2015

A new report by DataEye and Niko Partners says China’s mobile games industry is as big as the US’s, and grew by around 75 per cent last year. It was worth $4.4 billion in 2014.

Moreover, mobile is also increasing its share of the overall digital games market in China. It represented 24 per cent of revenues in 2014 and 36 per cent last year.

The report says China now has more than 396 million gamers. It believes that, despite the growth of mobile, players are moving away from casual titles towards more ‘hardcore’ play. It says that during 2015, over 30 per cent of mobile users spent more than 30 minutes a day playing games.

Read more…

Visa Europe: “50 per cent of our transactions will be mobile by 2020”

Card network Visa expects that, by 2020, one in five consumers will make a mobile payment every day, and that half of all Visa transactions will come from a phone.

“People throughout Europe are encountering innovative new technologies that offer fast and frictionless ways to pay wherever, whenever and on whatever device they choose,” said Sandra Alzetta, Executive Director Product Enablement for Visa Europe.

Visa made the predictions as it rolled out an expanded version of its Visa Digital Enablement Program service.

Read more…

Apple Music 11 million paying subscribers; Spotify is closing in on 30m

The senior VPs behind Apple Music, Craig Federighi and Eddy Cue, have confirmed that the streaming service has now passed 11m registered users.

Apple Music was launched in June and chalked up its first 10m subscribers a month ago. The service is pre-loaded on iOS, and offers users a three month free trial after which it’s $9.99 a month.

Of course, this is way behind the clear leader in the streaming music space Spotify, which is closing in on 30m paying users and 75m in total. But it’s ahead of Deezer, with 6m.

Federighi and Cue also disclosed that Apple has 782 million iCloud subscribers and that its iMessage service is processing 200,000 iMessages a second.

Read more…

Gamers who make an in-app purchase in one game 6x more likely to pay in another

Publishers should focus hard on their paying customers, says a report by analytics company Soomla.

Its new report says users that pay for in-app items are six times more likely to buy again than any random player. This is hugely significant for a market in which just two per cent pay for anything. Zoomla recommends creating personalized offers at the user’s “comfort zone” price point.

Other insights include:

- Quick payers (first in-app purchase within 24 hours of install) are nine times more likely to pay in another game.

- Over 40 per cent of users who paid $25 or more in one game, will also pay in another game.

The ARPPU lift in December is 83 per cent above the annual average. - For each in-game item users purchase with real currency, an average of 18 additional items are purchased with virtual currency.

- 65 per cent of all app revenue comes from “lifetime” goods (e.g. characters, level packs, remove ads), which cost $2.60 on average.

- ”Single use” goods (e.g. “save me”, ammo, 30-second boost) account for 71 per cent of all in-game purchases.