Find out the week’s top mobile stories from around the world.

This week… 34% of Thanksgiving & Black Friday sales were mobile, Swatch and Visa team up for wearable payments, Blackberry into Africa, out of Pakistan… plus much more.

Thanksgiving/Black Friday Online Sales Hit $4.5B, 34% Of Purchases Made On Mobile

Tech Crunch

The first two days of the holiday sales period have netted $4.45 billion in U.S. online purchases, with mobile devices — led by smartphones — accounting for a record $1.5 billion of that amount, with $2.72 billion spent on BlackFriday and $1.73 billion on Thanksgiving. The figures come from Adobe, which has been tracking some 4,500 sites, including 80% of the top 100 retailers.

IBM says Black Friday outpaced that with the average basket size of $134.45, and sales up 20.7% on a year ago with popular items including Apple Watch, Microsoft’s Surface Pro 4, and TVs from Samsung, Sony and LG.

Read more…

Swatch and Visa Team Up for ‘Pay-by-the-wrist’

Mobile Marketing Magazine

Watch manufacturer Swatch has partnered with Visa to give eligible Visa cardholders in the US, Switzerland and Brazil the ability to tap and pay with the company’s new Swatch Bellamy ‘pay-by-the-wrist’ model, which is slated to launch in early 2016.

The device uses contactless NFC technology to enable payments, and will be usable globally, but only available to customers in a limited number of countries to begin with. The Swiss watchmaker had previously announced a launch for the timepiece in China through partnerships with Bank of Communications and UnionPay.

Swatch has limited its entry into the smartwatch sector, and beyond the NFC capability, the Bellamy is a regular analogue watch without any extra functionality. However, this does mean that the Bellamy has the same battery life as any other watch, a factor that may make it appeal to those looking for a quick NFC pay solution without the constant charging of a smartwatch.

Read more…

BlackBerry is bringing BBM mobile payments to Africa

VentureBeat

BlackBerry announced Monday that it plans to allow BBM users in Africa (starting with Nigeria) to send money or airtime “as simply as they transfer photos or files.” It’s part of a wider push by BlackBerry to establish a presence in the mobile payments space, especially in emerging markets.

In Nigeria and South Africa, the company says it sees over half a million new users install BBM per month, which it believes is allowing “a network effects [to] take root in several markets across the continent.” Beyond that, it’s seeing “close to 10 million visits to the BBM Shop per month, and now over 26 million ad requests per day.”

Read more…

Google has found a clever way to make web pages load faster and save your mobile data by up to 70%

Business Insider

Google has a new feature in its Chrome browser for mobile that it thinks could save mobile data use by up to 70%. How? By automatically stripping out images from web pages.

The search and mobile giant is expanding the Data Saver mode included in Chrome for Android devices. If you’re on a slow connection and the feature is enabled, it won’t enable most of the images on a page unless you ask it to — saving significant amounts of data.

Google didn’t invent this idea, of course. There was a similar feature on my Nokia E63, which came out way back in 2008…

Read more…

Forget China — Google Has to Fight Off Alibaba on Mobile in India

re/code

Should Google return some services in mainland China, as many expect it to do soon, it will have to go head to head with China’s Internet giants. In the meantime, Google is squaring off against one of them, Alibaba, in India, Google’s largest growth market.

The Information published a solid look at mobile habits across India, courtesy of data from mobile startup Quettra. Some of the figures aren’t surprising. Facebook dominates: Indians love the social site and really love Facebook’s WhatsApp — it has 55 million usersmonthly hours spent, blowing away other messaging apps. Google, though, has a solid lead in utilities and video apps, thanks to YouTube.

A potentially troubling sign for the search giant is the race on mobile browsers.

Read more…

BlackBerry pulls out of Pakistan over government’s demands to access user data

The Next Web

BlackBerry has announced that it will no longer in operate in Pakistan after November 30, following a government notice which stated that the company would not be allowed to run its service in the country from December.

The Pakistan Telecommunications Authority (PTA) issued its notice to mobile carriers across the country in July, citing ‘security reasons’.

BlackBerry COO Marty Beard confirmed the move today. In a blog post, he explained:

“The truth is that the Pakistani government wanted the ability to monitor all BlackBerry Enterprise Service (BES) traffic in the country, including every BES e-mail and BES BBM message. But BlackBerry will not comply with that sort of directive….”

Read more…

After privacy ruling, Facebook now requires Belgium users to log in to view pages

The Verge

In response to a privacy ruling, Belgian Facebook users must now sign in to see any content. The change means that if you don’t have a Facebook account, you can’t view Belgian Facebook pages — including public profiles like those of local businesses.

The decision comes after a November court order saying Facebook has run afoul of European privacy law, which is much more stringent than in the US. Facebook limited access to its website rather than remove a tracking cookie, which can live in the user’s browser for up to two years. In the US, Facebook can place cookies like these without asking for permission, but in Europe, companies must get user permission to plant tracking software. Facebook members have consented to being tracked, and the company says the cookie is for security purposes — preventing the creation of fake accounts, account hijacking, and online theft.

Read more…

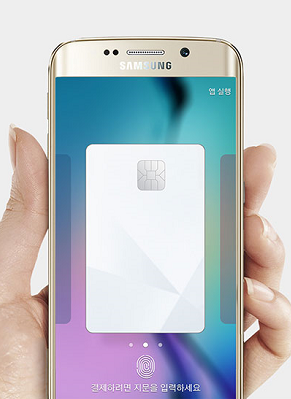

Congress investigates security of mobile payments

Biometric Update

The House Energy & Commerce Committee held a hearing Tuesday to preliminary review disruptive technologies in the mobile payments space, according to a report by Bank Info Security.

With testimonies from PayPal, Samsung Pay and the Merchant Customer Exchange, the hearing’s main takeaway was that while most mobile payments options offer stronger user authentication and convenience, they fail to provide the same legal and legislative protections as other methods.

Though the committee did not reveal any plans to take legislative action regarding this issue, it called on stakeholders to provide additional comments and concerns about mobile security over the next 30 days.

Read more…

ITU: 3.2B People Now Online Globally, Mobile Broadband Overtakes Home Internet Use

Tech Crunch

Overall, there are now 3.2 billion people online, but mobile networks continue to lead the way when it comes to connecting people for the next generation of communications: Mobile subscriptions are now at 7.1 billion globally, and more than 95% of the world’s population are now within reach of a mobile network signal, according to International Telecommunication Union, which today published its annual global survey charting progress across developed and emerging markets.

The Republic of Korea — a very early adopter both in fast, affordable broadband and next-generation mobile services — has held on to its spot as the most-connected place in the world when it comes to Internet connectivity and how well data services are adopted in the country, .